- United States

- /

- Electrical

- /

- NasdaqGS:PLPC

Preformed Line Products (PLPC) Earnings Growth Accelerates, Reinforcing Bullish Consistency Narratives

Reviewed by Simply Wall St

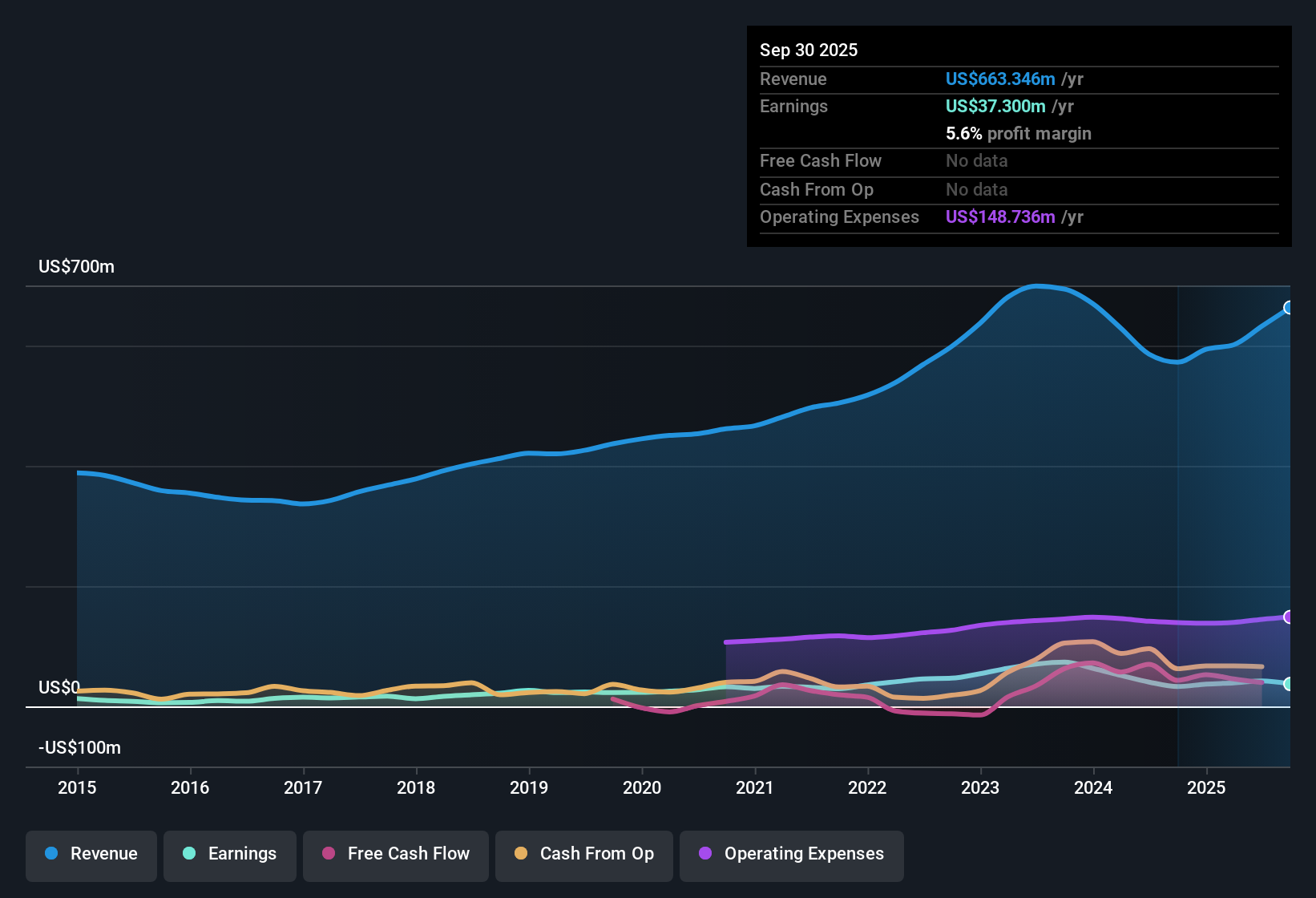

Preformed Line Products (PLPC) delivered 13.1% earnings growth over the past year, outpacing its own five-year average growth rate of 5.3% per year. Forward-looking estimates suggest earnings are set to grow by 12.46% per year and revenue by 6.1% annually. However, both are expected to trail the wider US market’s growth. Despite a net profit margin that has dipped slightly to 5.6%, investors will note the company's price-to-earnings ratio of 28.9x, which is below electrical industry and peer group averages, even as the share price trades at a premium to estimated fair value. Ultimately, Preformed Line Products is viewed as offering high quality and consistent earnings, while maintaining some attractive value traits relative to peers.

See our full analysis for Preformed Line Products.Next, we’ll set these earnings figures side by side with the most widely followed narratives to see which outlooks are confirmed and which might need a rethink.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Holds Near Recent Lows

- The net profit margin for Preformed Line Products stands at 5.6%, a slight dip from last year's 5.8%. This indicates that recent growth has not been driven by expanding margins.

- While the prevailing market view emphasizes benefits from high-quality earnings, the narrow margin highlights a tension for bullish investors seeking stronger operational leverage.

- Despite profit margins being stable, bullish claims of operational outperformance face a test because profit expansion is not coming from margin gains.

- Persistently modest margins could mean the company must maintain robust sales growth to keep pace with broader sector advances.

Valuation Undercuts Peers but Premium to DCF Fair Value

- At 28.9x price-to-earnings, PLPC shares trade below the US electrical industry average of 29.4x and well below the peer group average of 47.6x. However, the current price of $219.15 is notably above its DCF fair value of $181.86.

- The prevailing market view spotlights good value versus many comparables, but any bullish claims of a bargain are challenged by a share price premium above intrinsic DCF value.

- PLPC's multiples make it look appealing next to industry and peer averages, but the gap between the current share price and DCF fair value presses investors to consider whether they are paying up for consistency.

- This valuation stretch, despite a relative discount to peers, complicates the pure value case for long-term holders focused on intrinsic worth.

Sustained Growth Yet Trails Broader Market

- Earnings are forecast to grow by 12.46% per year versus 15.7% for the overall US market, with revenue projected at 6.1% annual growth compared to the market's 10.3%.

- The prevailing market view recognizes Preformed Line Products' durability, but the growth outlook underscores a key narrative challenge. Bulls may point to resilience, while skeptics could note that the company is not keeping up with wider market expansion.

- Growth rates above historical averages offer some reassurance for bullish observers, even as the company concedes ground to broader market pacesetters.

- For investors prioritizing relative momentum, the more modest forecasts signal that outperformance may be hard to sustain against the mainstream trend.

Even as margins and valuation ratios look appealing next to peers, PLPC's growth trajectory versus the market adds extra nuance for anyone eyeing long-term upside.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Preformed Line Products's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Preformed Line Products' premium to intrinsic value and below-market growth rates raise concerns about paying for consistency without the advantage of faster expansion.

If you’re searching for better value and market-beating potential, use these 831 undervalued stocks based on cash flows to find companies where the price tag appears more compelling than the growth outlook here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLPC

Preformed Line Products

Designs and manufactures products and systems that are used in the construction and maintenance of overhead, ground-mounted, and underground networks for the energy, telecommunication, cable, data communication, and other industries.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives