- United States

- /

- Machinery

- /

- NasdaqGS:PCAR

The Bull Case For PACCAR (PCAR) Could Change Following Third Quarter Revenue and Earnings Declines

Reviewed by Sasha Jovanovic

- PACCAR Inc reported earnings for the third quarter and first nine months of 2025, revealing declines in both sales and net income compared to the prior year, with third quarter sales at US$6,106.5 million and net income at US$590 million.

- A reduction in basic and diluted earnings per share from continuing operations reflects ongoing pressures on profitability amid challenging market conditions.

- We'll examine how the year-over-year revenue and earnings declines may impact PACCAR's investment outlook and margin expectations.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

PACCAR Investment Narrative Recap

Owning PACCAR means believing in its ability to weather industry cycles and capitalize on long-term freight demand and fleet modernization, despite margin pressures and market headwinds. The recent declines in revenue and earnings highlight the immediate risk of prolonged weakness in truck orders and weaker market demand, which could weigh on short-term performance; however, this development does not materially alter the critical longer-term catalyst of anticipated pre-buying ahead of 2027 emissions standards.

Among recent announcements, the company’s quarterly cash dividend of US$0.33 per share, declared in September, stands out for its consistency, even amidst a challenging operating environment. While the dividend reflects management’s confidence in the underlying business, future payouts may be scrutinized more closely if earnings pressures persist and cash flow trends remain subdued.

By contrast, investors should look more closely at the risk that continued overcapacity in the truckload sector may put further pressure on...

Read the full narrative on PACCAR (it's free!)

PACCAR's outlook projects $32.1 billion in revenue and $4.2 billion in earnings by 2028. This scenario assumes 1.1% annual revenue growth and a $1.1 billion increase in earnings from the current $3.1 billion.

Uncover how PACCAR's forecasts yield a $107.00 fair value, a 9% upside to its current price.

Exploring Other Perspectives

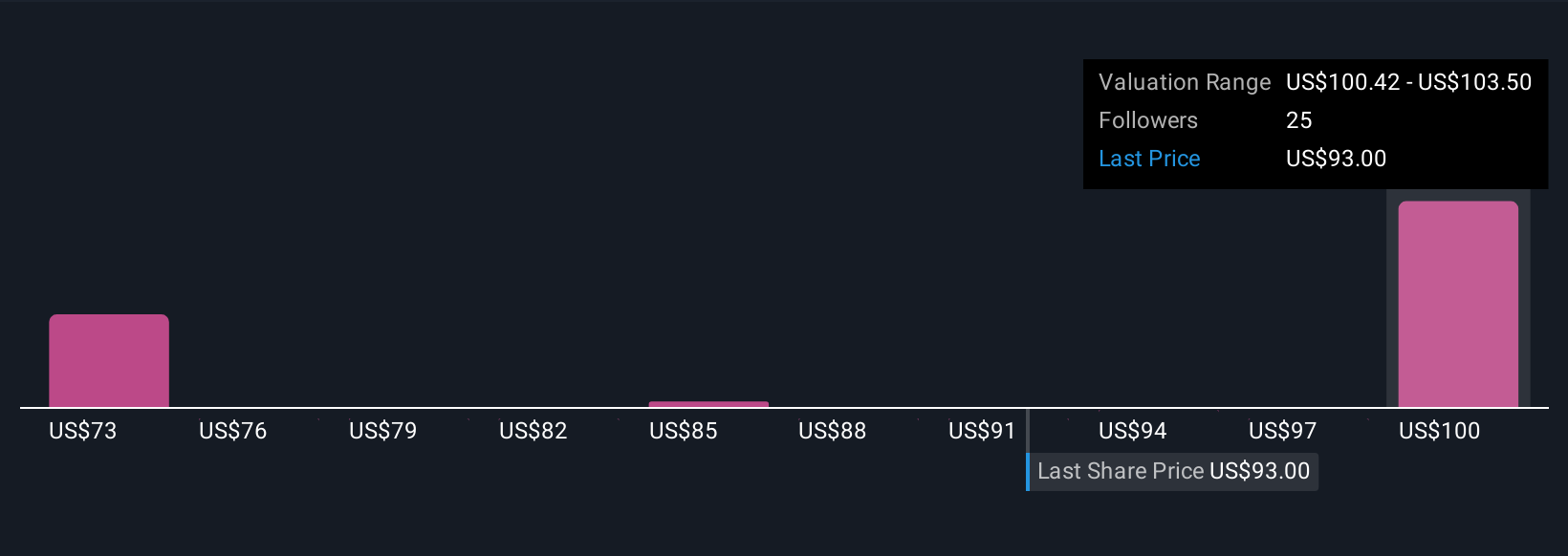

Four fair value estimates from the Simply Wall St Community place PACCAR’s valuation between US$86 and US$119.78 per share, showing a broad spectrum of individual outlooks. With continued pressure on order volumes and margins, these differing views highlight how a single catalyst or risk can shape performance assumptions, explore more opinions to see how investor thinking varies.

Explore 4 other fair value estimates on PACCAR - why the stock might be worth as much as 22% more than the current price!

Build Your Own PACCAR Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PACCAR research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free PACCAR research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PACCAR's overall financial health at a glance.

Seeking Other Investments?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCAR

PACCAR

Designs, manufactures, and distributes light, medium, and heavy-duty commercial trucks in the United States, Canada, Europe, Mexico, South America, Australia, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives