- United States

- /

- Electrical

- /

- NasdaqGS:NXT

Nextracker (NXT): Evaluating Valuation After New Solar Tech Launch and Strong Quarterly Results

Reviewed by Simply Wall St

Nextracker (NXT) recently introduced its NX Earth Truss foundation solution in Australia, targeting the complexities of large-scale solar projects. This launch, backed by an ARENA grant, highlights how product innovation and global expansion can drive investor attention.

See our latest analysis for Nextracker.

Nextracker's impressive product rollout and a string of earnings beats have caught the market’s attention, but the real story has been its momentum: shares have soared with a 26.4% 1-month share price return, and the year-to-date share price return stands at an eye-catching 164.9%. With so much excitement building, it’s clear investors see strong growth potential, not just a short-term boost.

Curious what other tech-focused companies could be next? See the full list for free with our high growth tech and AI stocks screener: See the full list for free.

Given the soaring share price and standout results, investors may wonder if there is genuine value left in Nextracker, or if all that future growth is already reflected in the current stock price.

Most Popular Narrative: 6% Overvalued

Compared to its most recent closing price of $104.63, the narrative projects a fair value of $98.65. This implies the market is pricing in even higher expectations than consensus forecasts suggest. This gap sets the tone for a compelling valuation debate, especially for investors who focus on future growth projections.

Nextracker's global expansion of R&D facilities in the U.S., Brazil, and India, along with the partnership with UC Berkeley for solar technology research, is expected to reinforce its commitment to innovation and position the company as a leader in solar technology, impacting long-term revenue and growth.

How does a company known for serious innovation justify a lofty valuation? The crux of this story lies in massively ambitious growth and margin forecasts, backed by market dominance bets and a bold expansion playbook. Which wild financial assumptions are holding up this price? The full narrative reveals the numbers that power this premium pricing.

Result: Fair Value of $98.65 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing tariff uncertainties and heavy dependence on the U.S. market could quickly shift Nextracker's growth outlook and valuation story.

Find out about the key risks to this Nextracker narrative.

Another View: Value Looks Different by Multiples

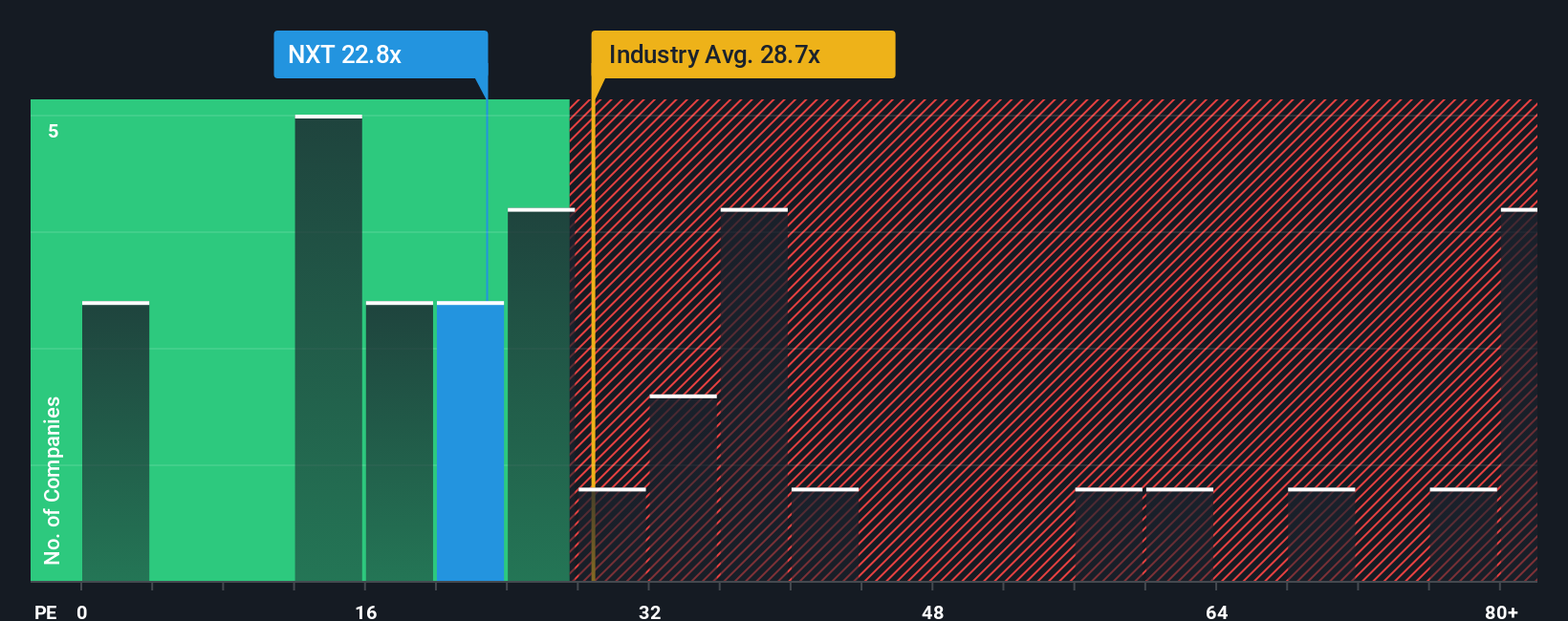

Taking a step back from narrative-based fair value, let’s look at Nextracker’s price-to-earnings ratio. At 26.9x, it is noticeably cheaper than both the Electrical industry average (29.9x) and peer average (38x). It also sits below the fair ratio of 34.2x, suggesting investors may be underestimating Nextracker’s potential.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nextracker Narrative

If you want to test your own perspective or reach your own conclusions, you can quickly build a personalized analysis using our platform. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Nextracker.

Looking for more investment ideas?

Don’t let your next best investment pass you by. Take action with our powerful screener and seize opportunities in markets you might be missing.

- Boost your portfolio’s potential by targeting high-yield opportunities. Check out these 16 dividend stocks with yields > 3% with strong payouts and above-average yields.

- Power up your growth strategy by pursuing innovation in artificial intelligence through these 25 AI penny stocks pushing boundaries in machine learning and automation.

- Secure great value by finding hidden gems undervalued by the market. See these 875 undervalued stocks based on cash flows that could be the catalyst for your next big win.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nextracker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXT

Nextracker

Provides solar tracker technologies and solutions for utility-scale and distributed generation solar applications in the United States and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives