- United States

- /

- Machinery

- /

- NasdaqGS:NDSN

Nordson (NDSN) Valuation: Examining Upside Potential After Recent Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for Nordson.

Nordson’s share price has quietly trended upward this year, recently notching a 13% gain year-to-date. Its 10.9% 90-day share price return suggests renewed momentum may be building after a period of slower movement. Looking longer term, the one-year total shareholder return remains negative, but three- and five-year figures are solidly positive, hinting that patient investors have still fared well overall.

If you’re weighing where momentum might turn next in the market, this is the perfect moment to broaden your perspective and discover fast growing stocks with high insider ownership

But with shares near recent highs and analysts’ targets only modestly higher, investors are left wondering if Nordson is undervalued at these levels or if the market has already accounted for its future growth potential.

Most Popular Narrative: 9.5% Undervalued

Nordson’s most popular narrative prices the company meaningfully above its recent close, suggesting a stronger outlook than the current market mood. The gap between consensus fair value and last price has widened, prompting a closer look at what is driving this narrative optimism.

Demand for advanced technology solutions is accelerating, especially in semiconductor packaging and electronics assembly, as customers ramp capacity for AI, cloud, and advanced consumer devices. Nordson's exposure to the back end of these markets and its ongoing new product launches are expected to drive sustained revenue growth and market share gains.

Want to know what is lifting Nordson’s fair value far above the current share price? The secret is aggressive profit projections, bigger margins, and a bold future earnings estimate. Will those numbers pan out or rattle expectations? Read on as the numbers fueling this target could surprise even seasoned investors.

Result: Fair Value of $256.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in polymer processing or a slower-than-expected recovery in key segments could put pressure on Nordson’s growth narrative and valuation outlook.

Find out about the key risks to this Nordson narrative.

Another View: Market Ratios Echo Caution

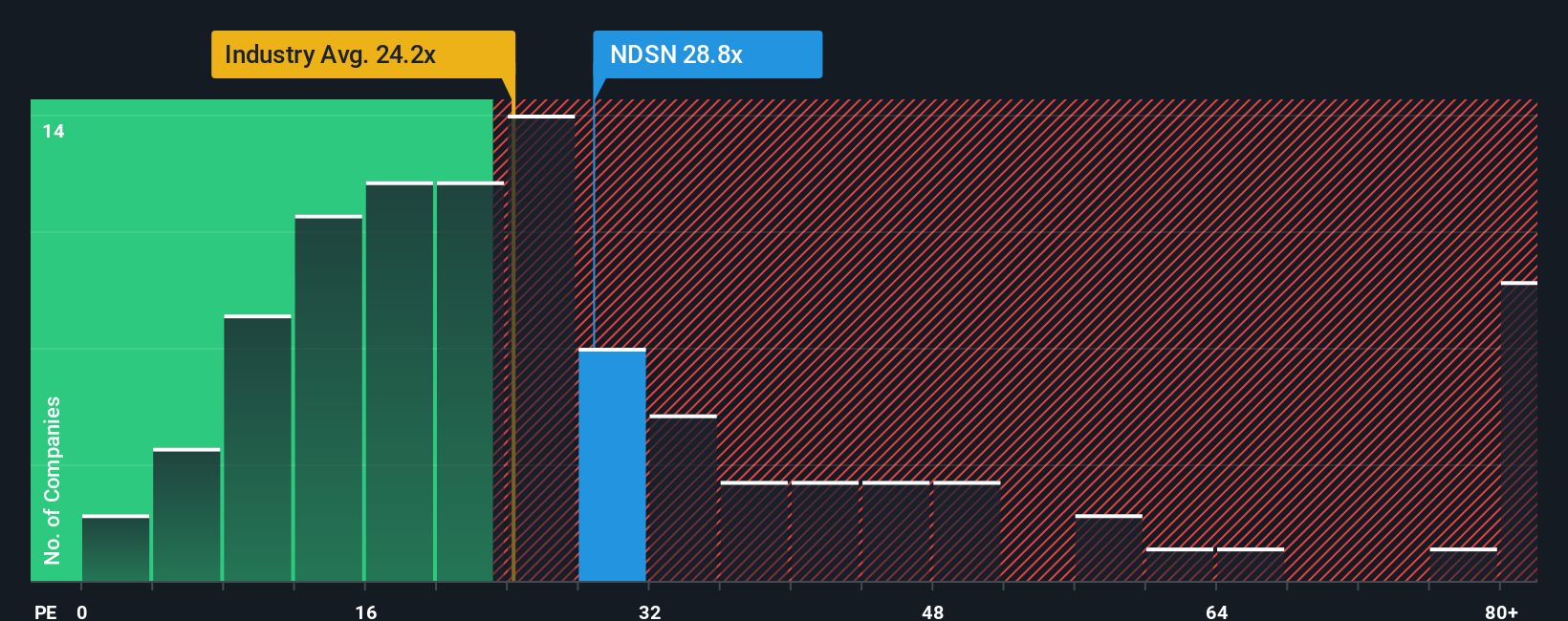

Looking at valuation from another perspective, Nordson’s price-to-earnings ratio stands at 28.6x, noticeably higher than both its industry average of 24x and the fair ratio of 24.6x that the market could move toward. This premium suggests investors are paying up for optimism, increasing valuation risk if expectations waver. Could this gap signal a brewing price correction?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nordson Narrative

If you see things differently, or enjoy diving into the numbers firsthand, you can craft a personal narrative using your own research in just a few minutes. Do it your way

A great starting point for your Nordson research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Right now, powerful screeners make it simple to spot compelling stocks based on real performance, growth, and innovation trends.

- Unlock the potential of high-yielding opportunities and boost your returns through these 22 dividend stocks with yields > 3% with yields greater than 3%.

- Position your portfolio at the heart of rapid innovation by tapping into transformative companies with these 26 AI penny stocks.

- Enhance your strategy by zeroing in on under-the-radar value with these 833 undervalued stocks based on cash flows rooted in cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDSN

Nordson

Nordson Corporation engineers, manufactures, and markets products and systems to dispense, apply, and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives