- United States

- /

- Machinery

- /

- NasdaqGS:NDSN

Is Nordson’s Recent Automation Push Reflected in Its Current Share Price?

Reviewed by Bailey Pemberton

- Wondering if Nordson is really worth its current price tag? You are not alone, as investors keep asking whether the stock is undervalued or just fairly priced in today’s market.

- Despite climbing 12.4% year to date, Nordson shares have dipped 2.1% over the past week and are down 7.7% for the year, raising fresh questions about risk and growth potential.

- Recent headlines have put the spotlight on Nordson’s plans to expand its automation solutions through strategic partnerships, fueling both optimism among shareholders and uncertainty as the industry faces supply chain pressures. News of ongoing acquisitions and technology investments has also stirred conversations about how these moves might shape the company’s long-term value.

- Nordson currently lands a 1 out of 6 on our valuation checks, suggesting the case for it being undervalued is far from straightforward. Let’s break down the main valuation approaches next. There may even be a better way to see if this price truly reflects Nordson’s future.

Nordson scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Nordson Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a valuation method that estimates a company’s intrinsic value by projecting its future cash flows and then discounting those figures back to today’s dollars. This approach helps investors determine whether a company’s current market price reflects its long-term earning power.

For Nordson, the most recent Free Cash Flow stands at $557 million. Analyst forecasts and data extrapolations suggest this number is likely to grow gradually, with projected Free Cash Flow reaching around $821 million by 2035. Notably, analyst estimates cover the next several years. Projections beyond that, up to 10 years out, are calculated based on moderate growth expectations from Simply Wall St's model.

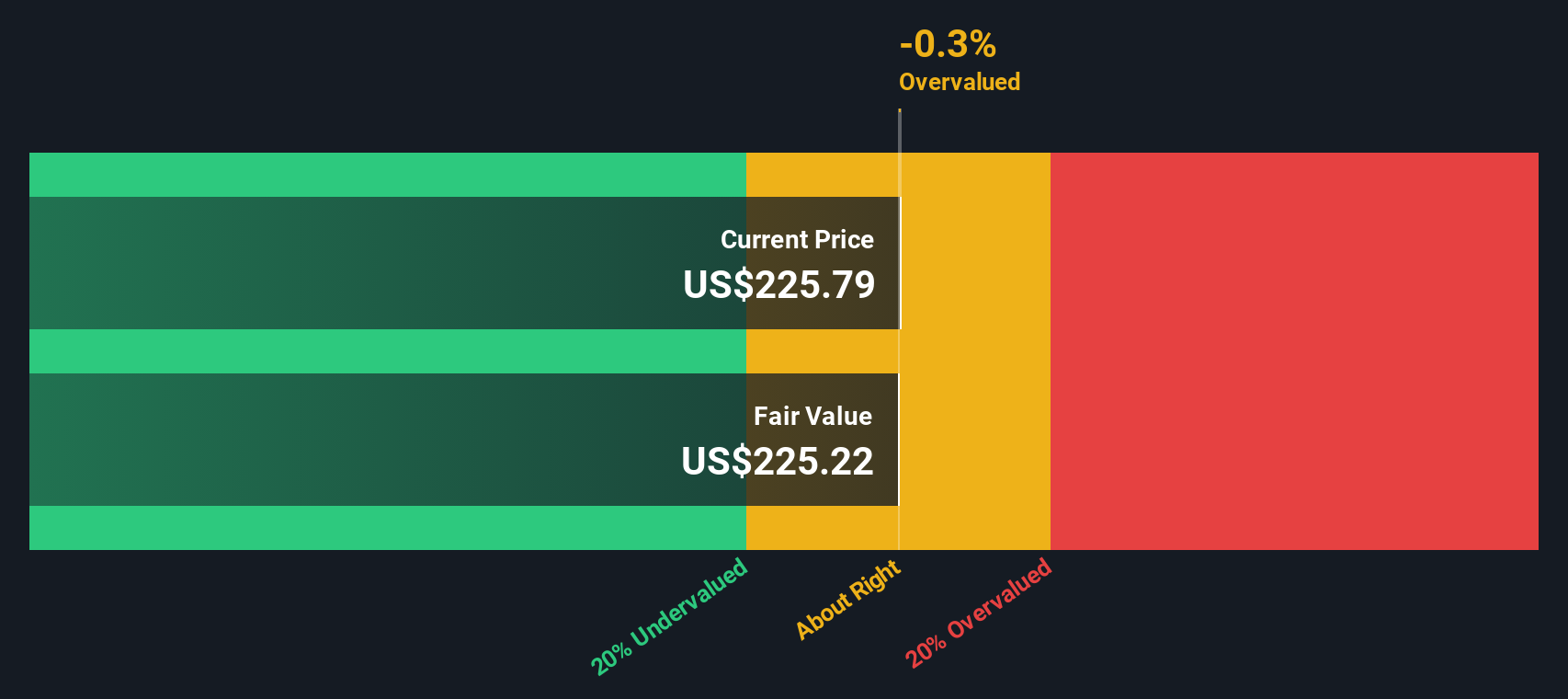

Using this sequence of future cash flows and applying the DCF methodology, Nordson's estimated intrinsic value is $204.42 per share. Compared to the current share price, this represents a 12.7% premium, indicating the stock is currently trading above its intrinsic worth.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Nordson may be overvalued by 12.7%. Discover 840 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Nordson Price vs Earnings

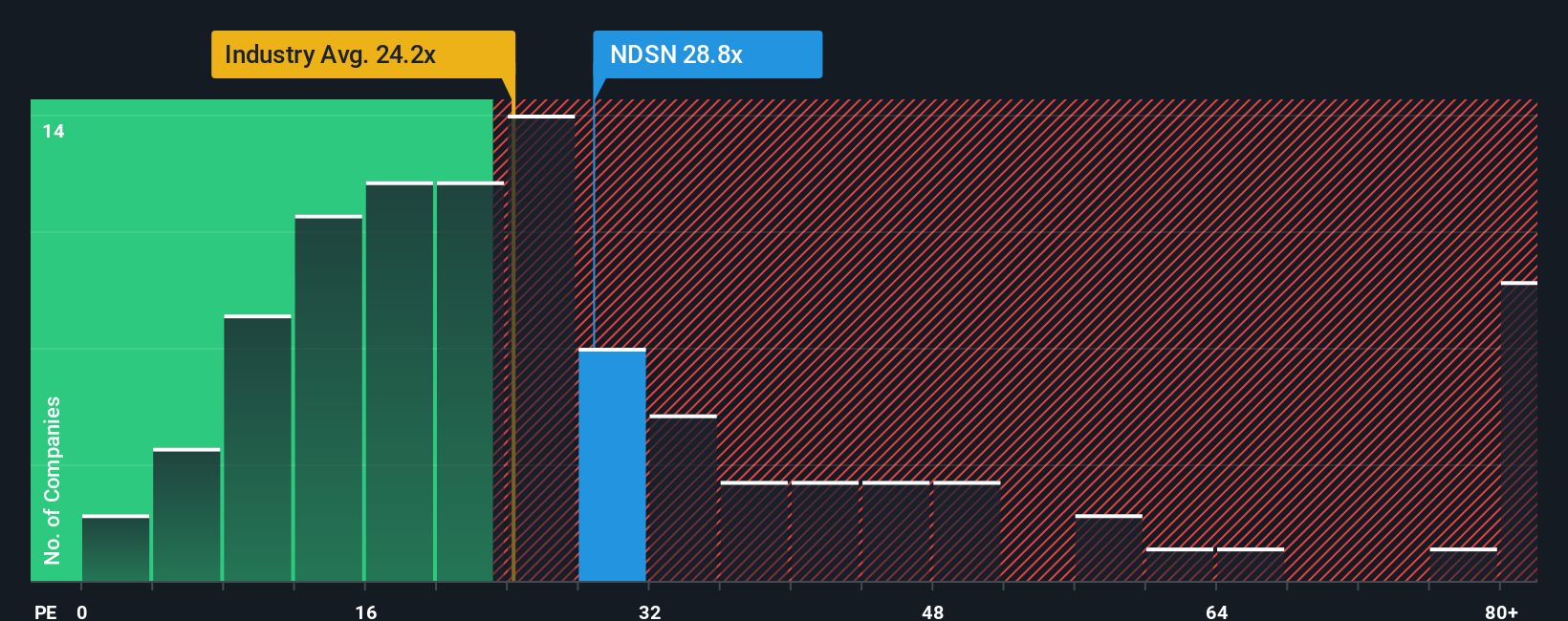

The Price-to-Earnings (PE) ratio is a widely used measure to evaluate profitable companies, as it shows how much investors are willing to pay for each dollar of a company’s earnings. For companies with a track record of generating consistent profits, the PE ratio offers a practical view of how the market perceives their current performance and future outlook.

Higher PE ratios typically reflect strong growth expectations and lower risk, while a lower ratio may suggest limited growth prospects or elevated risk. However, “normal” ratios can vary depending on factors like industry dynamics, earnings stability, and market sentiment.

Turning to Nordson, its current PE ratio stands at 28.4x. In comparison, the average PE for its industry peers in the Machinery sector is 23.5x, while direct peers post an even higher average of 32.3x. However, relying solely on these benchmarks can overlook important company-specific qualities. That is where Simply Wall St's proprietary Fair Ratio comes in. For Nordson, the Fair Ratio is 24.8x. This measure accounts not just for industry and market cap, but also for company growth, profit margins, and risk, offering a more nuanced and forward-looking benchmark than industry or peer comparisons alone.

Comparing the Fair Ratio of 24.8x to Nordson’s actual PE of 28.4x, the stock appears somewhat pricey on earnings, trading well above what would be considered fair based on its fundamentals and outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1409 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Nordson Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. Instead of relying only on numbers, Narratives let you tell your story behind a stock—your perspective on Nordson's future revenue, earnings, and margins—and connect that story to a detailed forecast and fair value calculation.

This approach makes your investment thinking personal and actionable because it ties the company's future prospects to a clear financial forecast, helping turn your assumptions and research into a fair value estimate you can actually use. Narratives are easy to access on Simply Wall St’s Community page, where millions of investors share their own stories and outlooks, making it simple for anyone to compare different viewpoints.

By comparing your Narrative fair value to today’s market price, you can see when Nordson might be a buy or a sell according to what matters most to you, rather than just industry averages. Best of all, Narratives are dynamic. They immediately reflect new earnings releases or breaking news, so your view of the stock stays relevant and up to date.

For example, some investors currently believe Nordson’s medical segment growth will drive shares as high as $285, while others are more cautious with a target of just $224. This shows how different Narratives capture the real diversity of investor expectations.

Do you think there's more to the story for Nordson? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordson might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NDSN

Nordson

Nordson Corporation engineers, manufactures, and markets products and systems to dispense, apply, and control adhesives, coatings, polymers, sealants, biomaterials, and other fluids.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives