- United States

- /

- Construction

- /

- NasdaqGS:MYRG

MYR Group (MYRG): Examining Valuation After Strong Quarterly Results and Rising Share Price

Reviewed by Simply Wall St

MYR Group (MYRG) has just wrapped up a quarter highlighted by steady revenue growth and a healthy increase in net income. Investors are analyzing whether the recent results offer more upside ahead for this specialty contracting company.

See our latest analysis for MYR Group.

MYR Group’s share price has climbed an impressive 49.93% so far this year, reaching $221.72 recently, as investor appetite grows in response to both solid fundamental results and broader optimism around infrastructure spending. With a robust one-year total shareholder return of 52.43% and a long-term gain of 327.37% over five years, the stock’s momentum is clearly building.

If MYR Group’s recent uptick has you considering what else is gaining traction, this could be the perfect time to discover fast growing stocks with high insider ownership

But with shares up nearly 50% this year and trading close to analyst price targets, does MYR Group still offer room to run? Or is the market already factoring in the company’s future growth potential?

Most Popular Narrative: 2.8% Undervalued

The narrative sets MYR Group’s fair value at $228 per share, slightly above the recent closing price of $221.72. Expect cautious optimism, as the estimate comes in just a bit higher than what the market is currently indicating.

Significant multi-year utility contracts (notably the new 5-year master service agreement with Xcel Energy and others in the Northeast/Midwest) are set to expand recurring revenues and improve backlog visibility. This is expected to support higher future revenue and greater earnings predictability. Sustained momentum in electrification, including grid upgrades, data center buildouts, and transportation, along with robust private and public sector investment, is expected to drive strong demand for MYR Group's infrastructure services. This would elevate the overall addressable market and support top-line growth.

Curious what’s really driving this upgrade? The valuation hinges on bold top-line momentum and a future earnings multiple that could shake up expectations. Which key projections fuel this price—are analysts betting big on margin expansion or steady contract wins? Find out what numbers underpin this narrative’s punchy fair value.

Result: Fair Value of $228 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shrinking renewables contributions and ongoing labor cost pressures could challenge MYR Group’s future growth story if market or project dynamics shift unexpectedly.

Find out about the key risks to this MYR Group narrative.

Another View: What Do Relative Valuations Suggest?

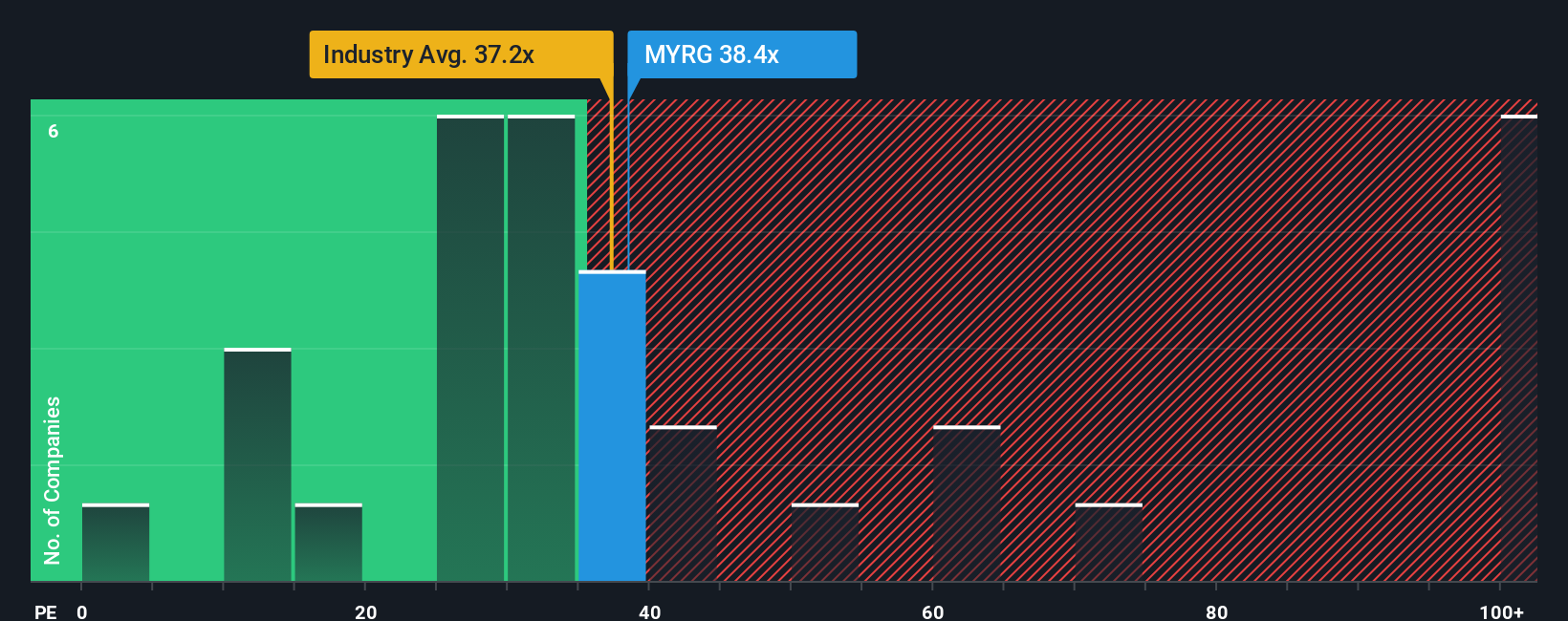

While the fair value narrative calls MYR Group slightly undervalued, a closer look at its price-to-earnings ratio tells a different story. At 35.2x, MYR Group trades much higher than its industry average of 32.5x, the peer average of 23.5x, and the fair ratio of 28.7x. This premium suggests that investors are betting on growth continuing without a pause. However, what could prompt a reset in expectations?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MYR Group Narrative

If you see things differently or want to dig into the numbers on your own, you can build and share your own MYR Group narrative in just a few minutes. Do it your way

A great starting point for your MYR Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Supercharge your research and spot stand-out opportunities by using the Simply Wall Street Screener. Don’t miss your chance to get ahead of the market trendsetters.

- Boost your portfolio by targeting potential future leaders. Start with these 27 AI penny stocks for a front-row seat to innovation in artificial intelligence.

- Strengthen your passive income strategy by finding top-yield picks with these 18 dividend stocks with yields > 3% that pay over 3% and shine for reliability.

- Uncover hidden gems that might be trading below their true worth by checking out these 908 undervalued stocks based on cash flows for access to value-driven opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MYRG

MYR Group

Through its subsidiaries, provides electrical construction services in the United States and Canada.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives