- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:MRCY

Mercury Systems (MRCY): Losses Deepen as Profit Growth Forecasts Test Turnaround Narrative

Reviewed by Simply Wall St

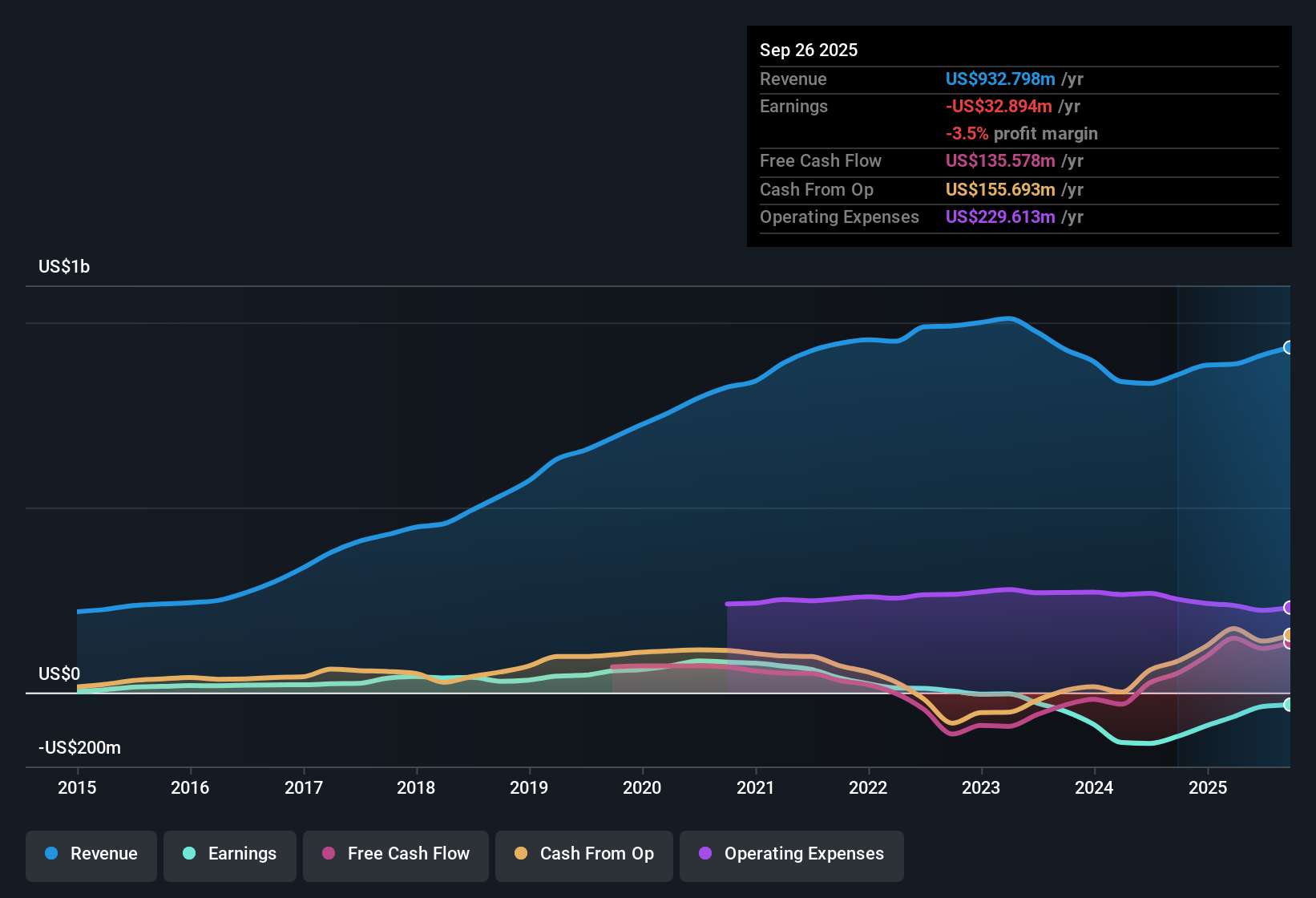

Mercury Systems (MRCY) reported continued unprofitability, with losses expanding at an average rate of 73.9% per year over the last five years. Despite the lack of net income, the company’s earnings are expected to grow by 102.49% annually, and profitability is projected within the next three years. This pace of profit growth is anticipated to exceed that of the broader market. The stock is currently priced at $78.13, which sits above its estimated fair value of $59.15. Its Price-to-Sales ratio of 5.1x appears favorable relative to peers, but is less attractive than the Aerospace & Defense industry average. Investors now face the crosscurrents of swift earnings forecasts and a still-widening loss profile as they consider Mercury Systems’ path forward.

See our full analysis for Mercury Systems.The next section will break down how Mercury Systems’ latest numbers measure up to the prevailing narratives, highlighting where the data supports or challenges investor expectations.

See what the community is saying about Mercury Systems

Margins Poised for Turnaround by 2028

- Analysts model a shift from today’s -4.2% profit margin to a positive 4.1% in three years, with consensus expecting net earnings to swing from a loss of $37.9 million to a $44.5 million gain. This substantial turnaround is based on new contracts and efficiency efforts.

- According to the analysts' consensus view, operational enhancements and investment in R&D are expected to steadily expand margins as legacy, low-margin backlog is completed.

- Margin expansion is attributed to higher-quality contracts and the company's growing role in defense digitization, which is seen as a core advantage supporting future profitability.

- However, the continued execution of older, low-margin contracts through FY26 is anticipated to temporarily constrain earnings growth until the business mix fully transitions to higher-value orders.

- Consensus narrative notes that, despite a challenging starting point, Mercury’s margin trajectory is a test case for defense suppliers navigating structural backlog constraints while targeting long-term profit improvement.

See how analysts weigh Mercury’s turnaround prospects in the full consensus narrative. 📊 Read the full Mercury Systems Consensus Narrative.

Backlog Quality Strengthens Revenue Visibility

- Bookings momentum tied to global defense modernization programs, especially radar and sensor upgrades, is increasing backlog quality and supporting stable projected revenue growth of 6.7% per year, even as US market peers expect 10.5% annual growth.

- As the consensus narrative highlights, Mercury's advances in embedded processing and open-architecture solutions are leading to a greater proportion of contracts that generate recurring, high-margin revenue.

- Expanded penetration into programs requiring secure, high-performance products should allow Mercury to withstand budget fluctuations better than firms dependent on one-off hardware sales.

- Still, the narrative calls out execution and integration risks. If transitions away from legacy programs or the ramp-up of next-generation orders are delayed, backlog improvements could take longer to materially impact earnings.

Stock Trades Above DCF Value Despite Peer Discount

- Mercury’s $78.13 share price stands well above its DCF fair value of $59.15. Its 5.1x Price-to-Sales ratio sits between the peer group (12.8x) and industry (3.1x) benchmarks, creating crosscurrents in valuation for investors.

- Consensus narrative underscores a key investor debate: while valuation looks favorable versus select peers, justifying the current price depends on believing in the swift recovery to $44.5 million in earnings and sustainable double-digit margin expansion.

- Analyst price targets cluster around $82.25, only modestly above today’s price. This signals the market sees much of the turnaround already priced in.

- Success hinges on Mercury’s ability to transition from high loss expansion toward margin capture. If progress stalls or sector multiples compress, the premium to DCF fair value could come under pressure.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Mercury Systems on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique angle on the results? In just minutes, you can craft your own perspective and shape the investment story. Do it your way

A great starting point for your Mercury Systems research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Mercury Systems’ widening losses and the premium over fair value raise concerns about reliance on a swift turnaround that has yet to materialize.

If you’re seeking stocks with stronger value credentials and less debate around price, check out these 836 undervalued stocks based on cash flows to find companies that are attractively priced by the market right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRCY

Mercury Systems

A technology company, manufactures and sells components, products, modules, and subsystems for defense prime contractors, original equipment manufacturers, government, and commercial aerospace companies.

Adequate balance sheet with moderate growth potential.

Market Insights

Community Narratives