- United States

- /

- Construction

- /

- NasdaqCM:LMB

Why Has Limbach Holdings (LMB) Shifted Three-Quarters of Revenue to Recurring Services?

Reviewed by Sasha Jovanovic

- Limbach Holdings, Inc. recently reported strong third quarter 2025 results, with sales rising to US$184.58 million and net income increasing to US$8.79 million, while also reaffirming its full-year revenue guidance.

- An important insight is that the company’s focus on expanding owner-direct relationships and integrating the Pioneer Power acquisition has shifted over three-quarters of its revenue to recurring service contracts, supporting operational momentum and margin growth initiatives.

- We'll assess how the substantial year-over-year revenue growth and higher-margin service focus impact Limbach's future investment outlook.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Limbach Holdings Investment Narrative Recap

Being a shareholder in Limbach Holdings means believing in the company’s transition toward recurring Owner Direct Relationship (ODR) service contracts to drive more predictable and higher-margin growth. The recent reaffirmation of full-year revenue guidance, alongside robust Q3 results, supports the main short-term catalyst of sustained ODR expansion, while the biggest risk, seamless integration and margin improvement from the Pioneer Power acquisition, remains present but was not materially altered by the news.

The company’s announcement of over 76% of revenue now coming from ODR contracts, following the integration of Pioneer Power, stands out as most relevant. This reinforces the focus on service-driven earnings growth, even as the acquisition brings near-term margin dilution risk if synergies aren’t effectively realized.

In contrast, investors should be aware of timing and replenishment risks in the ODR backlog, especially if shortfalls persist and...

Read the full narrative on Limbach Holdings (it's free!)

Limbach Holdings' narrative projects $922.5 million revenue and $70.5 million earnings by 2028. This requires 18.6% yearly revenue growth and a $35.2 million earnings increase from $35.3 million today.

Uncover how Limbach Holdings' forecasts yield a $137.25 fair value, a 75% upside to its current price.

Exploring Other Perspectives

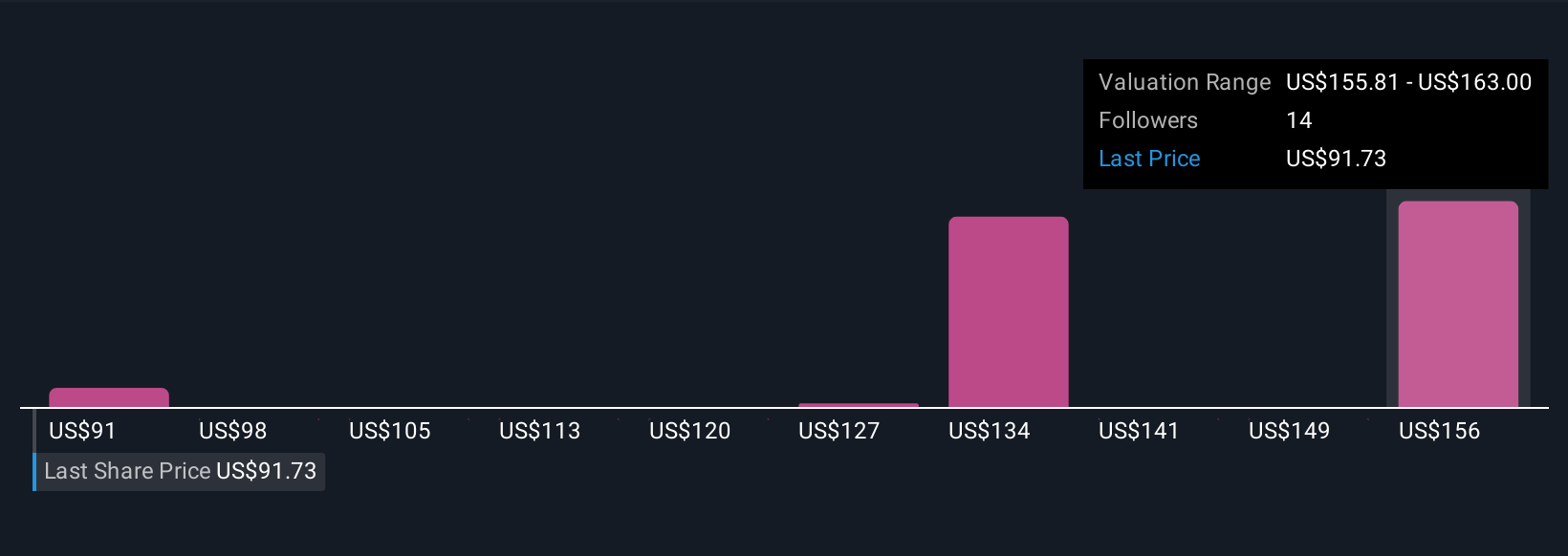

Fair value estimates for Limbach Holdings from seven Simply Wall St Community members range from US$91.10 to US$163 per share. While views differ, the focus on recurring ODR contracts remains a key catalyst shaping future growth and margin resilience, consider several viewpoints before forming your outlook.

Explore 7 other fair value estimates on Limbach Holdings - why the stock might be worth just $91.10!

Build Your Own Limbach Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Limbach Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Limbach Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Limbach Holdings' overall financial health at a glance.

No Opportunity In Limbach Holdings?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:LMB

Limbach Holdings

Operates as a building systems solution company in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives