- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:KTOS

Is Kratos Defense Still Attractive After a 26% Drop Amid New Government Contract Buzz?

Reviewed by Bailey Pemberton

- Wondering if Kratos Defense & Security Solutions is a bargain or overpriced right now? You are definitely not alone, as plenty of investors are eyeing this stock after its dramatic run.

- The share price has skyrocketed nearly 200% over the past year, but more recently it has pulled back, dropping 14% in the last week and over 26% across the past month. This may signal a potential shift in market sentiment or risk perception.

- Much of this volatility has coincided with news of government contracts and heightened investor attention on the defense sector, which has kept speculation swirling. Major headlines include ramped-up demand for advanced drone and satellite tech solutions, which Kratos is well positioned to deliver.

- When it comes to valuation, Kratos scores just 1 out of 6 on our undervalued checks, so it is not ticking many classic value boxes. However, as you will see, there are some approaches (and one especially interesting method at the end) that might change how you see its price.

Kratos Defense & Security Solutions scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

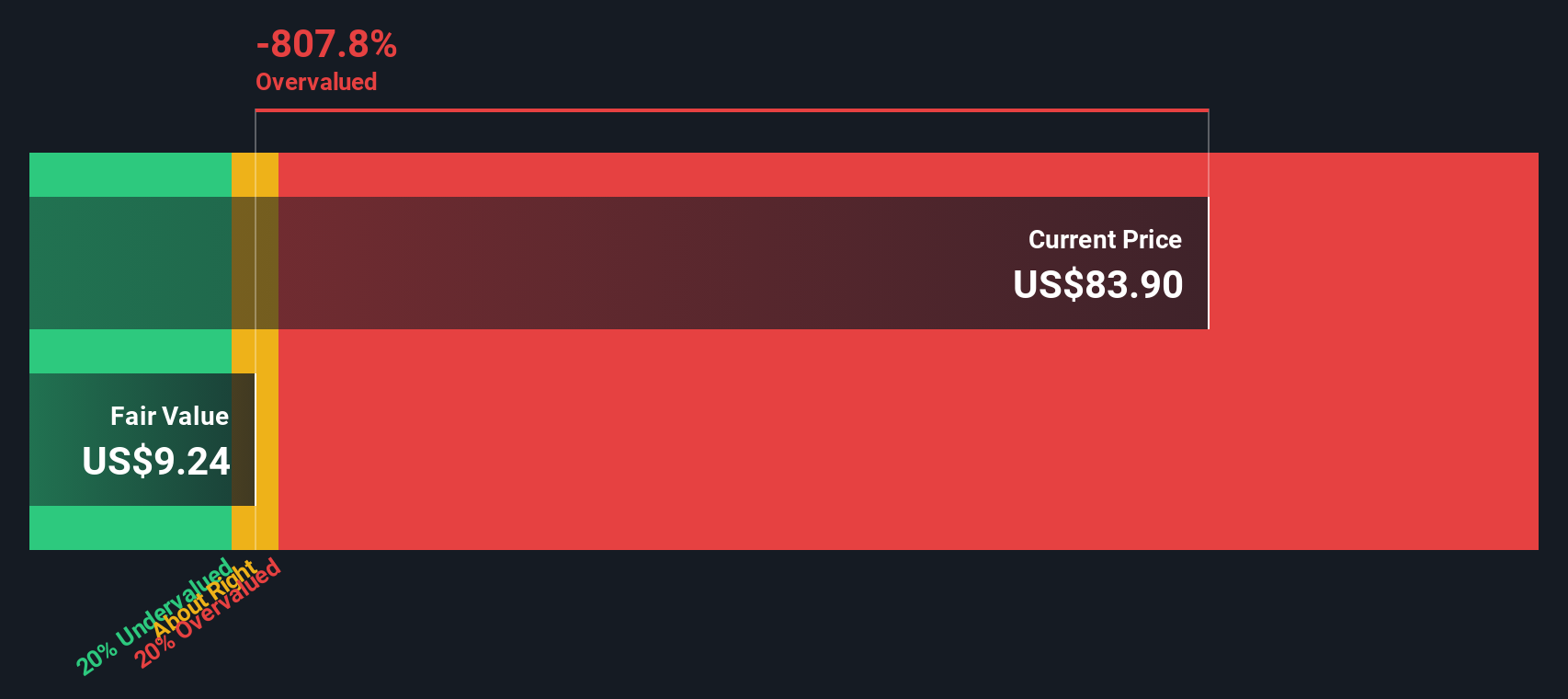

Approach 1: Kratos Defense & Security Solutions Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and then discounting them back to today's value. For Kratos Defense & Security Solutions, this method uses recent and projected free cash flow (FCF) data to build a forward-looking picture of value.

According to the latest information, Kratos's last twelve months' free cash flow stood at -$80.8 Million, indicating that the company is currently burning cash rather than producing it. However, analysts expect a turnaround, projecting positive free cash flow of $26.6 Million by the end of 2027. Longer-term estimates, extrapolated by Simply Wall St, suggest that free cash flow could increase to approximately $155.5 Million by 2035.

Taking all these estimates into account, the DCF model calculates an intrinsic value of $13.56 per share using a two-stage approach to address early volatility and later growth. Comparing this estimate to the current market price, the shares are trading around 474.3% above what the model considers fair value. This substantial gap implies that the market is pricing in very aggressive growth or future opportunities beyond what current cash flows would justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kratos Defense & Security Solutions may be overvalued by 474.3%. Discover 870 undervalued stocks or create your own screener to find better value opportunities.

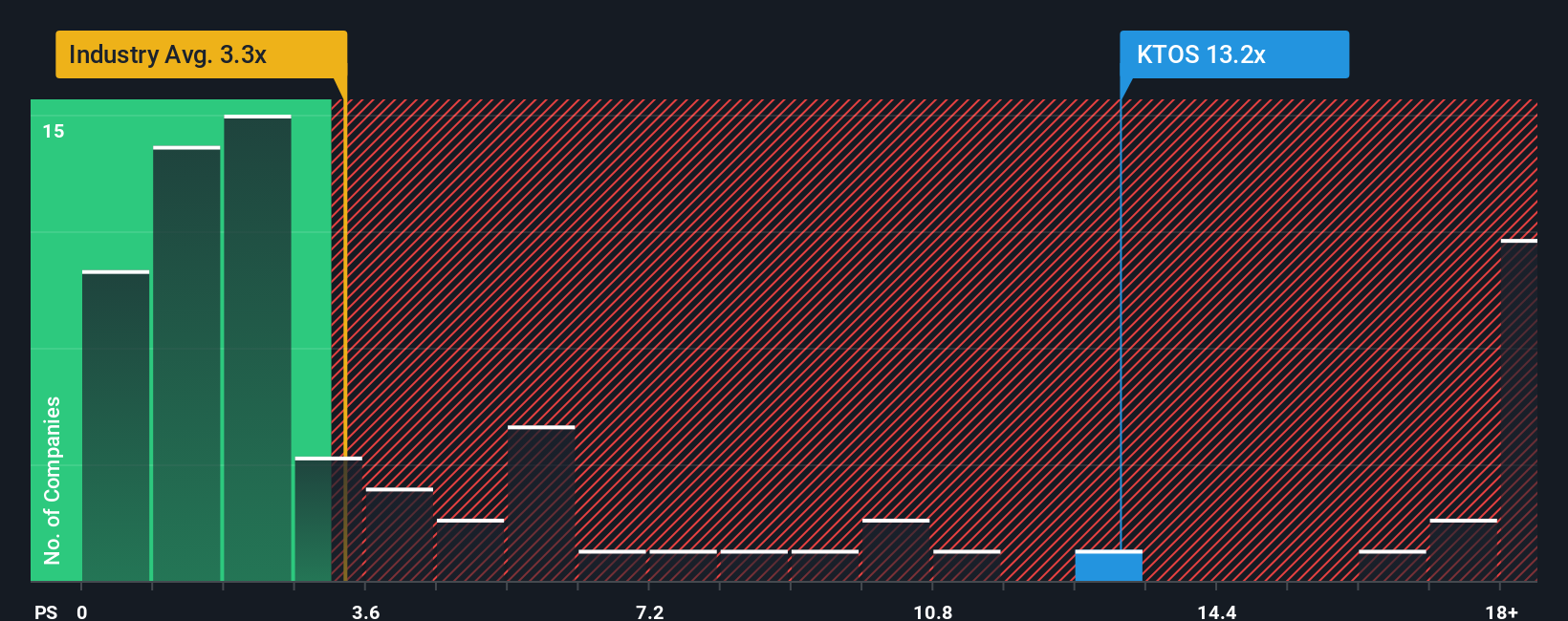

Approach 2: Kratos Defense & Security Solutions Price vs Sales

For many companies, especially those not consistently profitable, the Price-to-Sales (PS) ratio serves as a useful valuation yardstick. The PS ratio compares a company's stock price to its total revenues, providing a clearer picture when earnings fluctuate or are negative, as is currently the case with Kratos Defense & Security Solutions.

Investors often look at multiples like PS to gauge whether a stock is trading at a premium or discount to its revenue base. Higher growth rates and lower risks can justify higher PS ratios, while slower or more uncertain growth means a lower multiple is more reasonable. Kratos’s current PS ratio stands at 10.23x, sharply above both the Aerospace & Defense industry average of 2.98x and the peer group average of 3.55x. This suggests that investors are pricing in significant future growth or unique advantages.

Simply Wall St’s “Fair Ratio” adds a tailored perspective, accounting for Kratos’s growth potential, risk factors, profitability, industry dynamics, and market cap to determine what a justified PS ratio should be. For Kratos, the Fair Ratio is computed at 2.68x, well below both its current PS ratio and even its peer benchmarks. Since this proprietary metric captures more of the underlying company context than a basic industry comparison, it can give investors a more precise sense of value.

Comparing the Fair Ratio of 2.68x to Kratos’s actual PS ratio of 10.23x, the stock is trading substantially above what would be considered fair based on its fundamentals. This indicates a clear risk of overvaluation at today’s price.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1396 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kratos Defense & Security Solutions Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a concise story you develop about a company that connects what you believe about its business future to specific numbers, such as projected revenue, profits, and margins, resulting in a tailored fair value estimate for the stock.

Narratives make investing personal and powerful because they help you reframe your research so that analysis is more than just numbers on a page. By linking your view of Kratos Defense & Security Solutions’s prospects to a financial forecast, and then to a share price you consider fair, Narratives translate big ideas into actionable decisions: when the Narrative Fair Value is above today’s Price, it may be time to buy, and when it drops below, it may be time to reconsider.

Narratives on Simply Wall St are easy to access in the Community page, and they are dynamic. As new earnings, news, or industry events arrive, Narrative fair values and forecasts are instantly updated, keeping you in sync with what matters most. For example, the most optimistic Narrative for Kratos Defense & Security Solutions sees a fair value as high as $93 per share thanks to expanding unmanned systems and major contract wins, while the most cautious scenario estimates just $60 based on tightening margins and reliance on government spending. This demonstrates how diverse perspectives create different, yet data-driven, investment conclusions.

Do you think there's more to the story for Kratos Defense & Security Solutions? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kratos Defense & Security Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KTOS

Kratos Defense & Security Solutions

A technology company, provides technology, products, and system and software for the defense, national security, and commercial markets in the United States, other North America, the Asia Pacific, the Middle East, Europe, and Internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives