- United States

- /

- Construction

- /

- OTCPK:ISUN.Q

Further Upside For iSun, Inc. (NASDAQ:ISUN) Shares Could Introduce Price Risks After 36% Bounce

Those holding iSun, Inc. (NASDAQ:ISUN) shares would be relieved that the share price has rebounded 36% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 74% share price drop in the last twelve months.

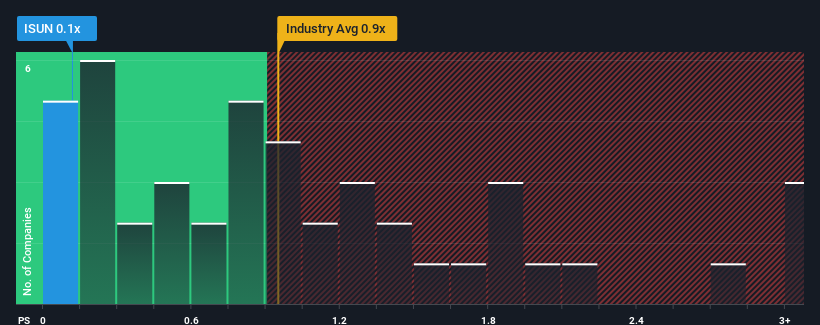

Even after such a large jump in price, it would still be understandable if you think iSun is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in the United States' Construction industry have P/S ratios above 0.9x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for iSun

What Does iSun's P/S Mean For Shareholders?

iSun certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think iSun's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For iSun?

In order to justify its P/S ratio, iSun would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 17% per year as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 7.9% each year growth forecast for the broader industry.

In light of this, it's peculiar that iSun's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From iSun's P/S?

iSun's stock price has surged recently, but its but its P/S still remains modest. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A look at iSun's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you settle on your opinion, we've discovered 3 warning signs for iSun (1 is concerning!) that you should be aware of.

If these risks are making you reconsider your opinion on iSun, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if iSun might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:ISUN.Q

iSun

A solar energy services and infrastructure deployment company, provides design, development, engineering, procurement, installation, storage, and electric vehicle infrastructure services for residential, commercial, industrial, and utility customers in the United States.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives