- United States

- /

- Industrials

- /

- NasdaqGS:IEP

Icahn Enterprises (IEP) Surges 13.4% After Strong Q3 Earnings and Asset Value Gains Has the Narrative Shifted?

Reviewed by Sasha Jovanovic

- Icahn Enterprises L.P. reported third-quarter 2025 results, posting US$281 million in net income and US$383 million in adjusted EBITDA, both rising sharply year-over-year and exceeding analyst expectations.

- An interesting development from the report is the significant US$567 million increase in indicative net asset value, primarily credited to strong gains in its investment positions and the energy segment.

- With adjusted EBITDA more than doubling year-over-year, we’ll examine how this shift influences Icahn Enterprises’ investment narrative.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Icahn Enterprises' Investment Narrative?

Anyone considering Icahn Enterprises today needs to weigh a fairly dramatic business turnaround against persistent, well-known risks. The third quarter’s sharp swing to US$281 million in net income and more than doubling of adjusted EBITDA did more than just beat expectations, it shifted some short-term catalysts front and center. Gains in investment positions and the energy segment, alongside a US$567 million jump in net asset value, clearly moved the dial, reflected in a substantial short-term price jump. But while this performance offers ammunition for a renewed bullish thesis, many underlying issues remain: high leverage, a sustained history of losses across nine months, sizable dividend obligations that aren’t fully covered by earnings, and recent management changes are far from resolved. The recent results might temper immediate bankruptcy and turnaround concerns, but the fundamental risk profile hasn’t vanished, and the long-term investment case still hinges on sustained profitability and improved balance sheet strength.

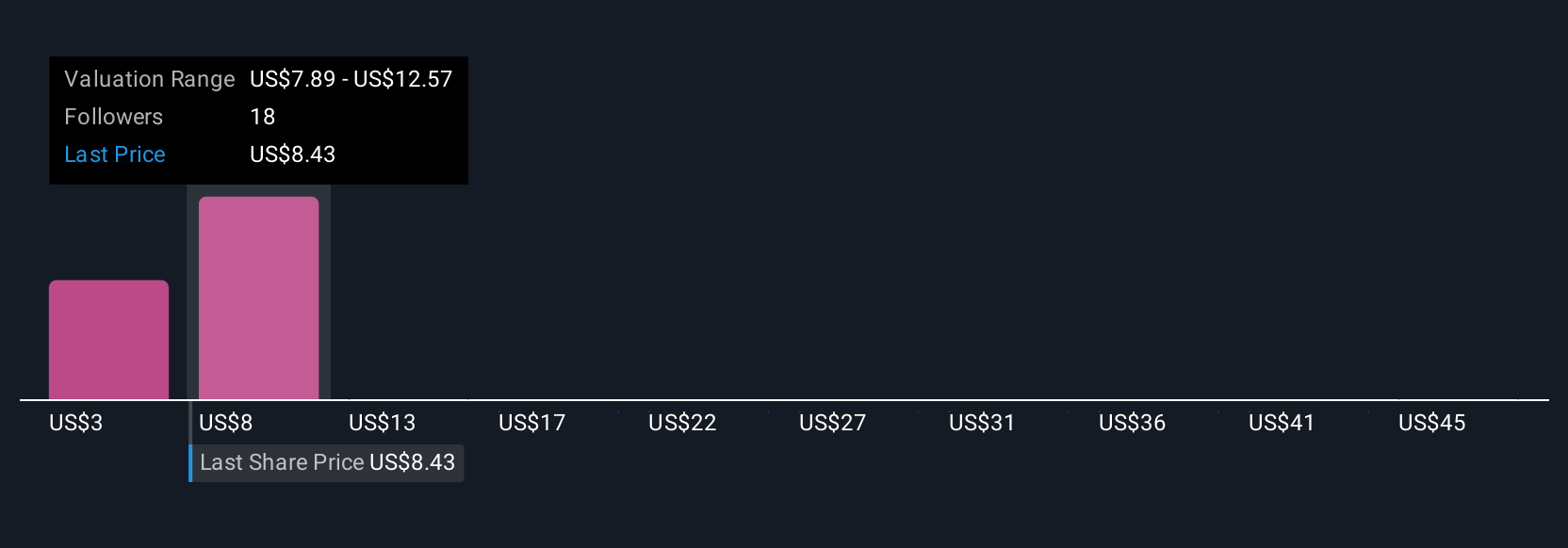

On the other side, the company’s high debt costs may remain a critical talking point for investors. Icahn Enterprises' shares are on the way up, but they could be overextended by 18%. Uncover the fair value now.Exploring Other Perspectives

Explore 8 other fair value estimates on Icahn Enterprises - why the stock might be worth over 7x more than the current price!

Build Your Own Icahn Enterprises Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Icahn Enterprises research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Icahn Enterprises research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Icahn Enterprises' overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IEP

Icahn Enterprises

Through its subsidiaries engages in the investment, energy, automotive, food packaging, real estate, home fashion and pharma in the United States and internationally.

Adequate balance sheet and fair value.

Market Insights

Community Narratives