- United States

- /

- Trade Distributors

- /

- NasdaqGS:FTAI

FTAI Aviation (FTAI) Raises Dividend Again Is This Evidence of a Stronger Capital Allocation Vision?

Reviewed by Sasha Jovanovic

- FTAI Aviation Ltd. recently reported its third quarter 2025 results, showing revenues rising to US$667.06 million and net income reaching US$117.72 million, alongside an increased quarterly dividend to US$0.35 per share.

- The increase in net income and dividend points to the company’s ongoing focus on rewarding shareholders and its confidence in continued financial strength.

- We’ll explore how FTAI Aviation’s higher earnings and raised dividend reinforce and potentially shift the investment narrative for the business.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

FTAI Aviation Investment Narrative Recap

To be a shareholder in FTAI Aviation, you need to believe in the durability of demand for mid-life aircraft engines and the company's success in expanding its capital-light model. The latest results, featuring higher revenues and a growing dividend, affirm the ongoing momentum of FTAI’s core business, but do not fundamentally shift the main near-term catalyst, sustained maintenance demand, or address the most important risk: exposure to shifts in propulsion technology and evolving engine platforms.

Of the recent announcements, the increase of the ordinary dividend to US$0.35 per share stands out. This upward move in shareholder returns underlines management’s confidence in current cash flows, but also raises the stakes for FTAI to deliver on recurring revenue growth and maintain robust margins if industry demand fluctuates.

By contrast, investors should also be mindful of the risk that rapid adoption of new engine technologies could reduce demand for FTAI’s core platforms...

Read the full narrative on FTAI Aviation (it's free!)

FTAI Aviation's narrative projects $3.7 billion revenue and $1.1 billion earnings by 2028. This requires 19.8% yearly revenue growth and a $683.5 million earnings increase from $416.5 million currently.

Uncover how FTAI Aviation's forecasts yield a $222.60 fair value, a 36% upside to its current price.

Exploring Other Perspectives

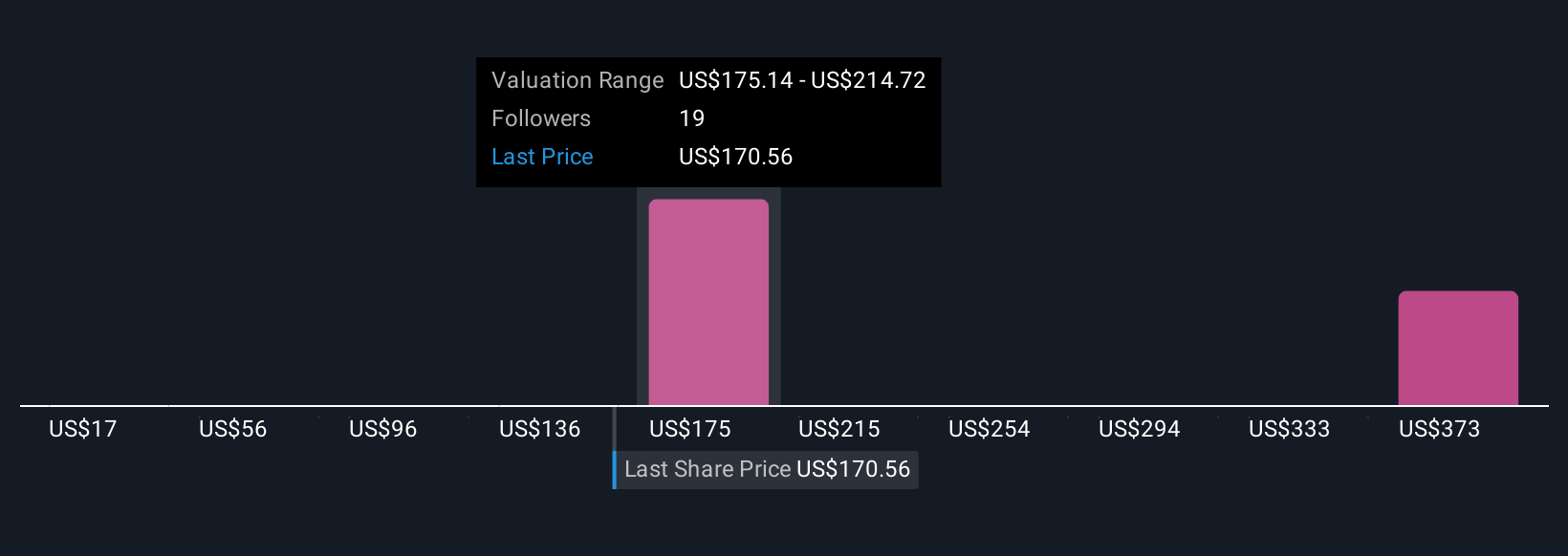

Simply Wall St Community members provided fair value estimates for FTAI ranging from US$16.83 up to US$222.60, across three perspectives. While opinions vary, the central catalyst remains global airline reliance on mid-life engines for fleet stability, which could support earnings through different market cycles.

Explore 3 other fair value estimates on FTAI Aviation - why the stock might be worth less than half the current price!

Build Your Own FTAI Aviation Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your FTAI Aviation research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free FTAI Aviation research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate FTAI Aviation's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTAI

FTAI Aviation

Owns, acquires, and sells aviation equipment for the transportation of goods and people worldwide.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives