- United States

- /

- Trade Distributors

- /

- NasdaqGS:FTAI

FTAI Aviation (FTAI): Assessing Valuation Following Strong Q3 Results and Dividend Increase

Reviewed by Simply Wall St

FTAI Aviation (FTAI) announced a strong third-quarter performance, with revenue and net income both increasing compared to last year’s results. The company also raised its quarterly dividend, reinforcing management’s positive outlook for shareholders.

See our latest analysis for FTAI Aviation.

Despite some choppiness in recent weeks, FTAI Aviation’s momentum is still impressive. A 19% share price gain over the past 90 days and 12% year-to-date show investors are rewarding the company’s robust earnings and dividend hikes. With a 9% total return over the past year and a staggering 855% total return over three years, the longer-term trajectory has remained strikingly positive as management continues to build on these strong results.

If this kind of performance piques your curiosity, it might be time to broaden your search and discover fast growing stocks with high insider ownership

With such rapid growth and a soaring share price, the key question now is whether FTAI Aviation is still trading at a bargain or if the market has already priced in all of its future potential.

Most Popular Narrative: 27.1% Undervalued

FTAI Aviation’s most popular valuation narrative points to a fair value well above the last closing price, signaling that the share could offer meaningful upside if current expectations are realized. The calculation sets the stage for a deeper dive into the numbers and key assumptions fueling this optimistic outlook.

Significant operational leverage is expected from FTAI's ramp in vertical integration, as evidenced by recent acquisitions (e.g., Pacific Aerodynamic) and in-house repair/production capabilities. These moves are driving cost efficiencies, increased margin per shop visit, and expanded gross or EBITDA margins, all of which are likely to boost future EPS growth.

Curious what bold financial projections are woven into this forecast? The secret sauce blends eye-popping margin expansion and assumptions usually reserved for dominant market disruptors. Discover which aggressive numbers underpin the bullish case and why the market hasn’t fully caught on just yet.

Result: Fair Value of $222.60 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, factors like dependence on legacy engine platforms and ambitious international expansion could challenge FTAI’s long-term growth if industry dynamics shift unexpectedly.

Find out about the key risks to this FTAI Aviation narrative.

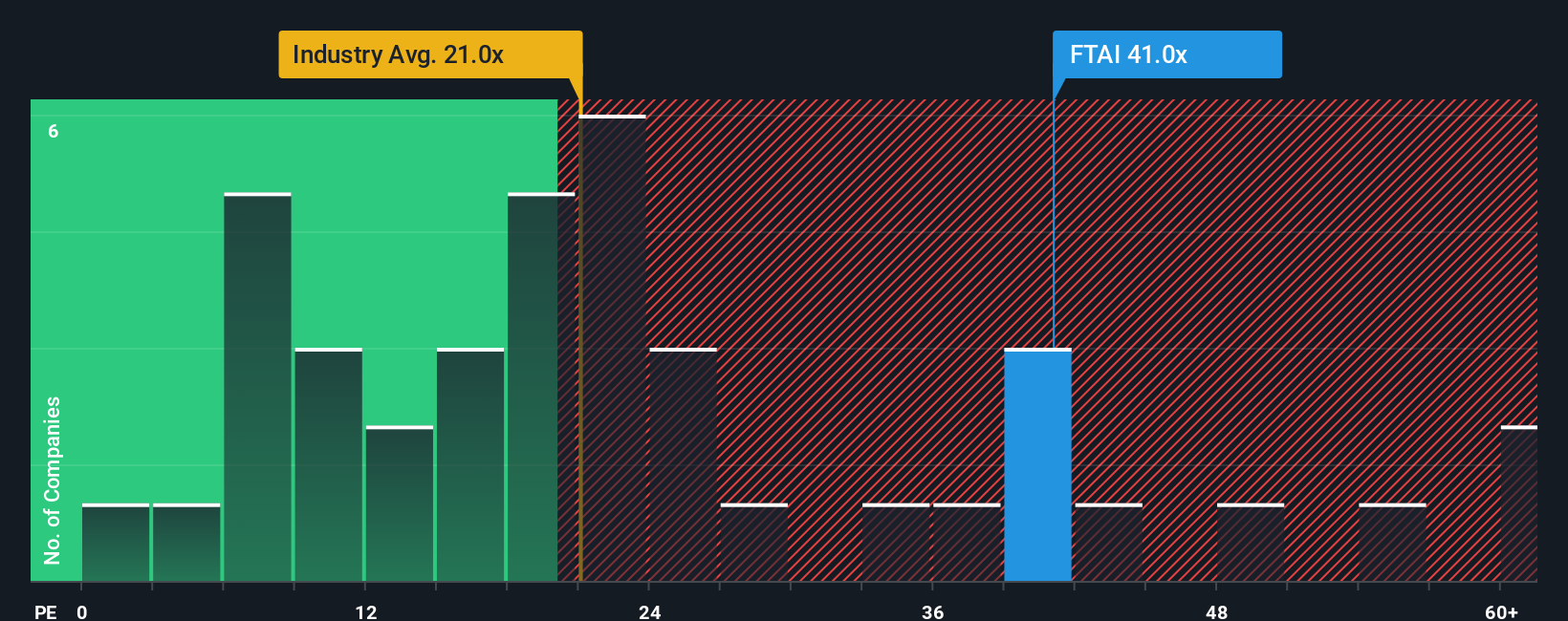

Another View: Shares Look Expensive by Market Standards

While the consensus suggests FTAI Aviation is undervalued based on projected growth, the current price-to-earnings ratio of 36.8x tells a different story. This is well above both the US Trade Distributors industry average of 21x and peer average of 19.4x. It also sits far from the fair ratio of 59x indicated by regression analysis. Such a gap highlights increased valuation risk if growth stumbles or sector sentiment turns. Is the market too optimistic, or could these elevated multiples signal longer-term opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out FTAI Aviation for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 860 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own FTAI Aviation Narrative

If you see the story differently or want to dive into the numbers yourself, you have the power to shape your own narrative in just a few minutes. Do it your way

A great starting point for your FTAI Aviation research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your advantage grows when you act early. Don’t let unique market opportunities slip by. These handpicked stock ideas could help you get ahead:

- Tap into the powerful momentum of innovation by reviewing these 860 undervalued stocks based on cash flows offering strong fundamentals and attractive valuations right now.

- Capture the income edge as you assess these 17 dividend stocks with yields > 3% that consistently deliver yields above 3%, fueling stable long-term growth.

- Spot future disruptors before the crowd by browsing these 24 AI penny stocks poised for breakthroughs in the rapidly expanding world of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTAI

FTAI Aviation

Owns, acquires, and sells aviation equipment for the transportation of goods and people worldwide.

High growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives