- United States

- /

- Machinery

- /

- NasdaqGS:FELE

Franklin Electric (FELE): Assessing Valuation After $125M Debt Issuance and Strong Q2 Results

Reviewed by Kshitija Bhandaru

Franklin Electric (FELE) just completed a $125 million senior notes issuance to refinance existing debt and finance its working capital. This move strengthens the company’s overall financial flexibility for the years ahead.

See our latest analysis for Franklin Electric.

The recent $125 million debt raise comes right after Franklin Electric beat expectations with strong second quarter results, suggesting disciplined growth and strengthened finances. While the share price has been mostly treading water this year, the five-year total shareholder return stands at a solid 61%, highlighting meaningful long-term value creation even as near-term momentum cools.

If you’re curious about discovering what other fast-growing companies with high insider ownership are doing right now, it could be the perfect time to explore fast growing stocks with high insider ownership.

With analyst targets pointing higher and recent results showing resilience, is Franklin Electric's current valuation leaving room for upside, or has the market already priced in all the anticipated growth?

Most Popular Narrative: 10.8% Undervalued

Franklin Electric’s narrative fair value stands at $108, compared to a last close price of $96.32. This suggests notable upside potential if forecasted improvements in growth and margins materialize.

Strategic recent acquisitions, such as Barnes and PumpEng, are being integrated ahead of plan. This has led to faster-than-expected cross-selling opportunities and regional manufacturing expansion (for example, foundry capacity), which enables operational efficiencies and diversifies revenue streams. These factors create upside for both revenue and margins.

Curious what’s fueling this valuation leap? The narrative is built on a bold set of future profit and growth assumptions that deviate from today’s market mood. Want to know which transformative moves and financial projections drive analyst consensus? You’ll need to dig deeper to see the exact forces shaping this price target.

Result: Fair Value of $108 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, reliance on cyclical markets and ongoing margin pressures from acquisitions could disrupt the company’s projected growth if industry conditions shift unexpectedly.

Find out about the key risks to this Franklin Electric narrative.

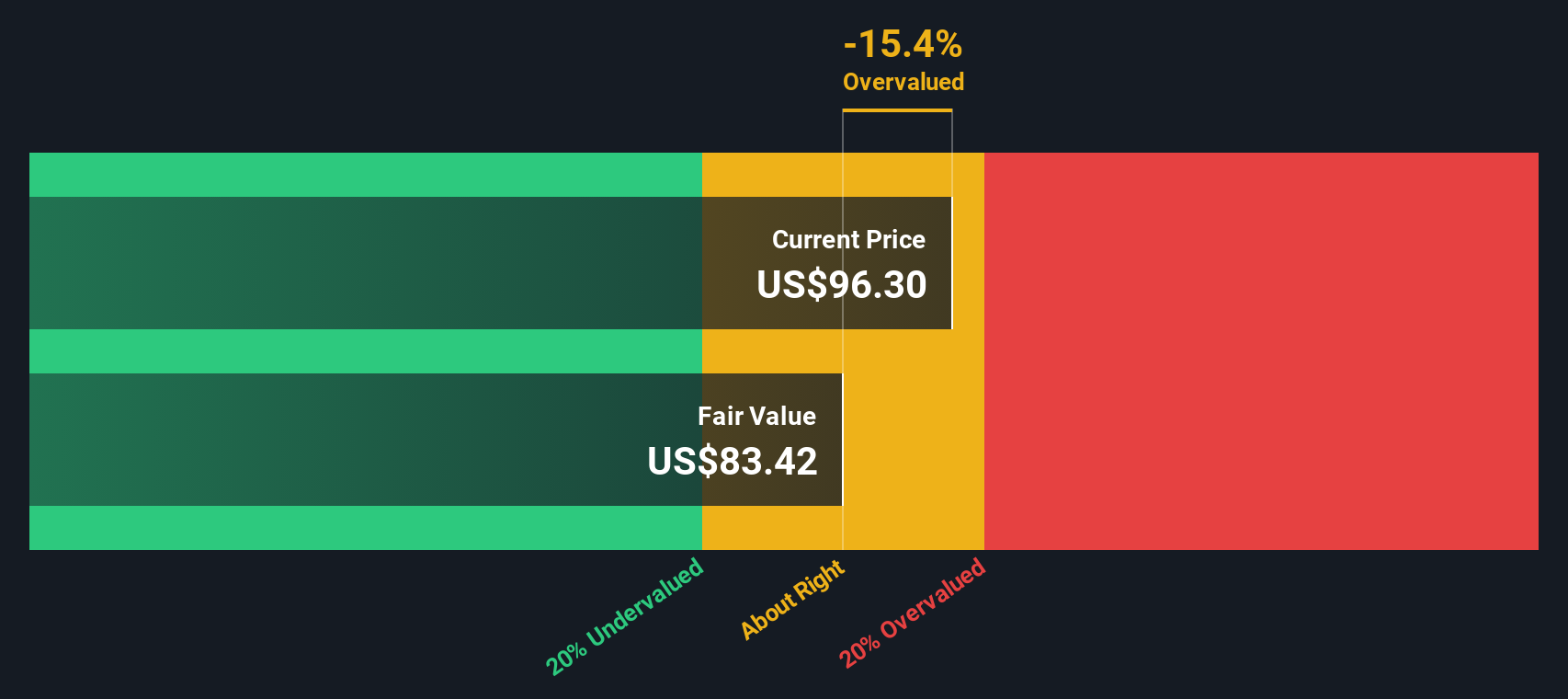

Another View: Discounted Cash Flow Signals a Different Story

While the analyst price target points to upside, our SWS DCF model places Franklin Electric’s fair value at $84.05 per share, which is below the recent trading price of $96.32. This suggests the stock may actually be overvalued based on projected future cash flows. So, which view carries more weight for investors right now?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Franklin Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Franklin Electric Narrative

If you want a different perspective or trust your own research process, you can build a custom narrative in just a few minutes. Do it your way.

A great starting point for your Franklin Electric research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit themselves to just one opportunity. Use the Simply Wall Street screener to seize your edge and uncover stocks other investors are missing out on.

- Unlock the potential for strong passive income when you tap into these 19 dividend stocks with yields > 3% yielding over 3%.

- Capitalize on tomorrow’s tech leaps by spotting innovators within these 24 AI penny stocks who are set to shape the artificial intelligence landscape.

- Ride the momentum of market mispricings by jumping on these 893 undervalued stocks based on cash flows that are based on powerful cash flow metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FELE

Franklin Electric

Designs, manufactures, and distributes water and fuel pumping systems in the United States, Canada, Latin America, Europe, the Middle East, Africa, and the Asia Pacific.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives