- United States

- /

- Trade Distributors

- /

- NasdaqGS:FAST

Will Max Tunnicliff's Appointment Shift Fastenal's (FAST) Digital Strategy and Supply Chain Focus?

Reviewed by Sasha Jovanovic

- Fastenal recently appointed Max Tunnicliff as Chief Financial Officer and Senior Executive Vice President, effective November 10, 2025, with the announcement highlighting his extensive multinational finance leadership experience from prior roles at Beko Europe and Whirlpool Corporation.

- This leadership change brings in expertise across financial reporting, audit, supply chain finance, and strategic planning, providing Fastenal with fresh perspective during a period of digital growth and supply chain evolution.

- We'll explore how Max Tunnicliff's multinational financial experience could influence Fastenal's ongoing digital expansion and supply chain diversification plans.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Fastenal Investment Narrative Recap

For someone considering Fastenal stock today, the big picture is about believing in the company’s ability to execute growth through digital expansion and efficient supply chain management, while managing cost pressures from tariffs and logistics. The appointment of Max Tunnicliff as Chief Financial Officer, with extensive multinational experience, brings relevant expertise to these priorities. The impact on near-term catalysts, particularly expansion of Fastenal’s digital footprint and supply chain diversification, is expected to be neutral, without materially shifting the most immediate risks, such as margin pressure from operating costs and tariffs.

Among recent announcements, Fastenal’s opening of a new distribution center in Magna, Utah, directly supports a key catalyst: enhancing operational efficiency and service reach. This move aligns with the company's focus on improving supply chain reliability and optimizing customer delivery, factors that are increasingly important as Fastenal seeks to boost its revenue share from digital channels and mitigate risks associated with tariffs and external disruptions.

Yet, despite these efforts, it is important to be aware that ongoing trade tensions and higher tariff costs could still materially affect Fastenal's supply chain resilience and profitability if...

Read the full narrative on Fastenal (it's free!)

Fastenal's narrative projects $9.9 billion in revenue and $1.6 billion in earnings by 2028. This requires 8.5% yearly revenue growth and a $0.4 billion increase in earnings from the current $1.2 billion.

Uncover how Fastenal's forecasts yield a $44.35 fair value, a 7% upside to its current price.

Exploring Other Perspectives

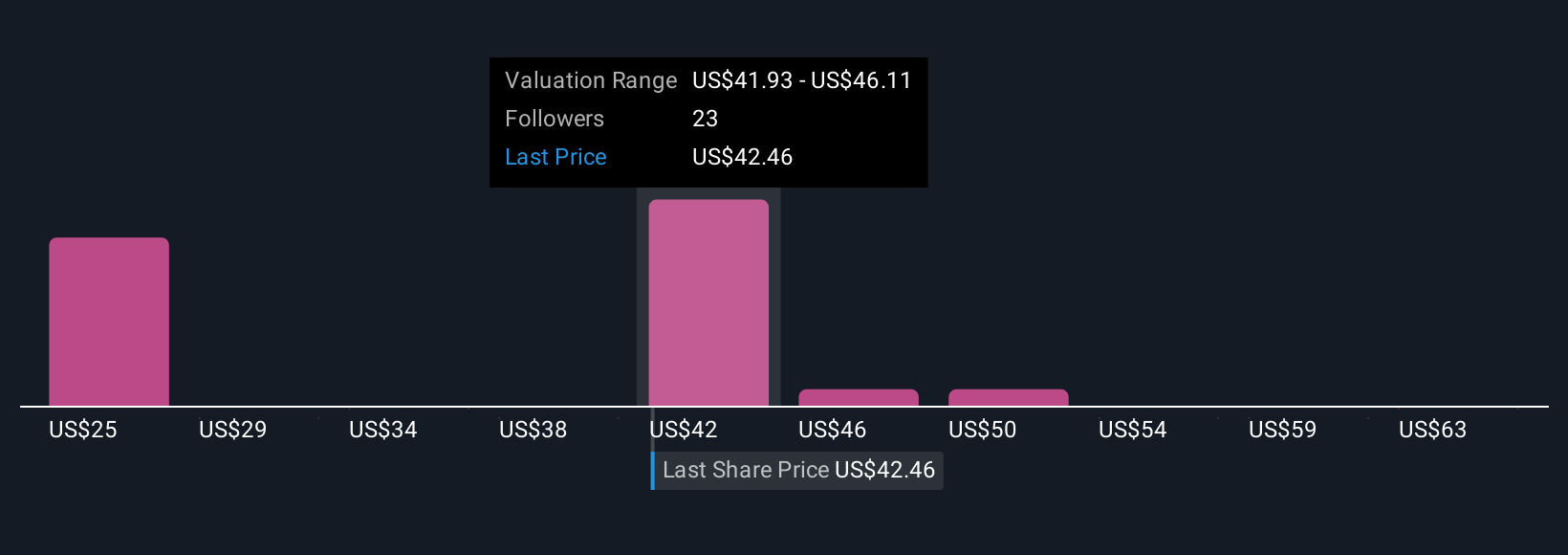

The Simply Wall St Community’s fair value estimates for Fastenal range from US$25.82 to US$67 across nine investor perspectives. While opinions vary, many remain focused on the company’s push to expand its digital footprint and the influence this could have on future competitiveness and margin resilience.

Explore 9 other fair value estimates on Fastenal - why the stock might be worth as much as 62% more than the current price!

Build Your Own Fastenal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fastenal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Fastenal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fastenal's overall financial health at a glance.

No Opportunity In Fastenal?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FAST

Fastenal

Engages in the wholesale distribution of industrial and construction supplies in the United States, Canada, Mexico, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives