- United States

- /

- Trade Distributors

- /

- NasdaqGS:FAST

A Look at Fastenal’s (FAST) Valuation Following CFO Appointment and Analyst Confidence

Reviewed by Simply Wall St

Fastenal (FAST) has named Max Tunnicliff as its new Chief Financial Officer and Senior Executive Vice President, effective November 10, 2025. Tunnicliff's extensive experience at Beko Europe and Whirlpool Corporation reflects the company's focus on strengthening its leadership.

See our latest analysis for Fastenal.

Fastenal’s recent leadership moves have coincided with renewed investor attention, but momentum has cooled since the summer. The stock’s 1-year total shareholder return sits at just 0.1%, even as the year-to-date share price return remains a solid 16.3%. The company continues to showcase long-term strength, with an impressive 3-year total shareholder return of 72.5% and a 5-year figure of 93.5% that highlights sustained value creation.

If you’re looking for more companies with a track record of both growth and strong leadership, now's an excellent moment to expand your search and discover fast growing stocks with high insider ownership

Given Fastenal's recent leadership changes and its consistent long-term performance, investors are left to wonder whether the current share price is an attractive entry point or if the market has already accounted for future growth.

Most Popular Narrative: 6.8% Undervalued

Fastenal’s most widely tracked narrative places its fair value target at $44.35, a modest premium to the current price of $41.35. This suggests limited near-term upside but a constructive outlook given strong operating trends.

Fastenal aims to increase its digital footprint to represent 66-68% of sales, up from 61%, potentially boosting revenue by optimizing purchasing and operational efficiency.

What are analysts betting on for Fastenal’s next chapter? The valuation hinges on a future growth formula powered by accelerated revenue, rising margins, and ambitious digital expansion. But which of these levers has the biggest impact on the share price? Click through to uncover the projections and learn why this valuation stands out from the crowd.

Result: Fair Value of $44.35 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing trade tensions and higher costs within Fastenal’s supply chain could present challenges to margins and put pressure on the optimistic outlook for future growth.

Find out about the key risks to this Fastenal narrative.

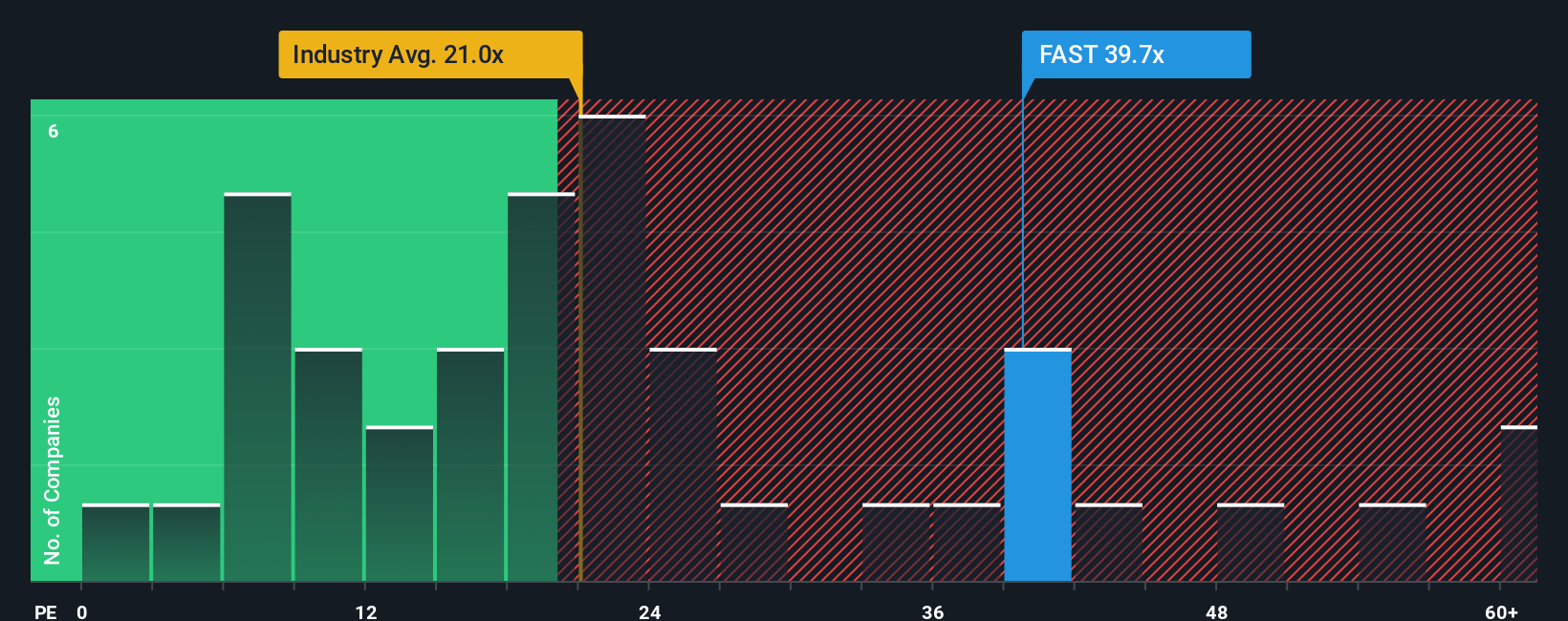

Another View: Market Multiples Paint a Different Picture

Looking at valuation from another angle, Fastenal's price-to-earnings ratio is 38.7x, almost double the industry average of 19.7x and well above the fair ratio of 26.2x that the market could gravitate toward. This elevated gap suggests investors are paying a significant premium, raising the stakes if growth expectations falter. Is this optimism justifiable or a risk worth considering?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fastenal Narrative

Readers who want to dig deeper or offer a different perspective can use our tools to form a unique view of Fastenal in just a few minutes, so Do it your way

A great starting point for your Fastenal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Take the next step and grow your portfolio with unique opportunities you might not have considered. Don’t miss out on strategies other investors rely on.

- Capture the potential of tiny companies with huge upside by scanning these 3578 penny stocks with strong financials that are poised for financial breakthroughs and strong fundamentals.

- Power up your passive income by checking out these 16 dividend stocks with yields > 3% with consistent yields above 3% for steady returns you can count on.

- Get a head start in the future of medicine by targeting these 32 healthcare AI stocks that are transforming patient care and driving innovation across the healthcare sector.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FAST

Fastenal

Engages in the wholesale distribution of industrial and construction supplies in the United States, Canada, Mexico, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives