- United States

- /

- Electrical

- /

- NasdaqCM:EOSE

How Recent Government Support Impacts Eos Energy Valuation After 413% Share Price Surge

Reviewed by Bailey Pemberton

- Wondering if Eos Energy Enterprises is a smart buy right now? You are not alone, especially with big gains and a lot of debate about the stock's real worth.

- After skyrocketing 413.1% over the last year and surging 132.9% year-to-date, the stock's been on a wild ride, though it recently dipped 15.3% in the past week.

- Some of these moves came after major headlines. News about new government support for grid-scale batteries and Eos securing large financing deals have fueled optimism, while updates on regulations and technical milestones have kept risk perceptions shifting. Investors are watching closely to see if these catalysts can turn momentum into lasting value.

- Right now, Eos Energy Enterprises scores a 0 out of 6 on our valuation checks, with none of the standard metrics marking it as undervalued so far. But there is more to valuation than just these numbers. Let's explore how different methods stack up, and later, reveal an even better way to get the full picture.

Eos Energy Enterprises scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Eos Energy Enterprises Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to their value today. This approach focuses on whether the company is likely to generate enough future profits to justify its current price.

For Eos Energy Enterprises, the latest reported Free Cash Flow (FCF) is -$268.3 Million, reflecting ongoing investments and negative cash generation as the company continues to grow. Analysts forecast that by the end of 2029, annual FCF could reach $273.6 Million, with projections indicating a steady path upwards over the next decade. It is worth noting that analyst estimates extend five years, and further projections beyond that point are based on reasonable extrapolations.

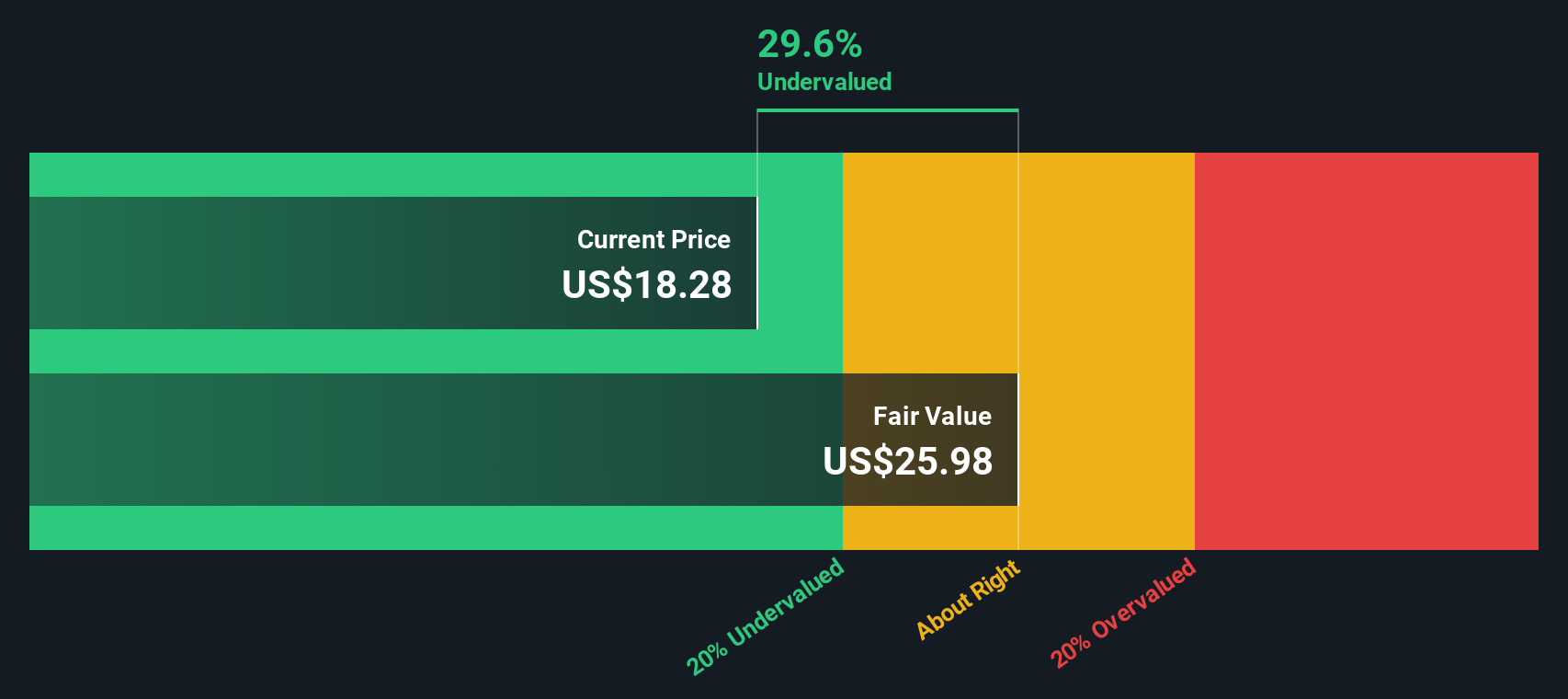

Based on these cash flow projections using the DCF model, the estimated intrinsic value per share is $12.21. Compared to the current market price, this suggests that the stock is about 5.5% overvalued, which is very close to fair value by most standards.

Result: ABOUT RIGHT

Eos Energy Enterprises is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Eos Energy Enterprises Price vs Book

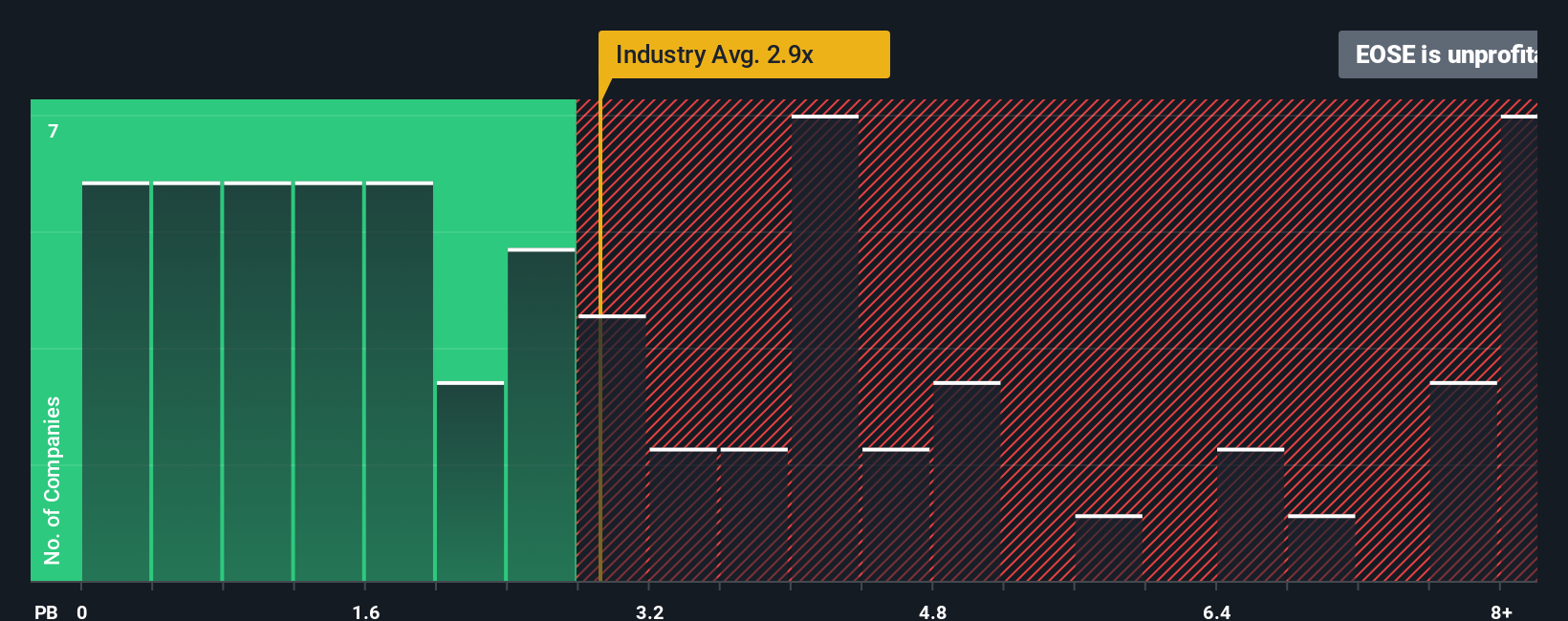

Price-to-Book (P/B) ratio is a widely used valuation tool for companies in industries where assets play a crucial role and profitability is not yet stable or consistent. It is especially relevant for asset-heavy or growth-stage firms, as it helps investors gauge how much they are paying compared to what the company is worth on paper.

Market optimism, company-specific risk, and future growth expectations all affect what investors consider a “normal” or “fair” P/B ratio. If a company is growing quickly or has a robust competitive advantage, investors may accept a higher ratio. Conversely, higher risks or inconsistent results can warrant a discount.

Currently, Eos Energy Enterprises trades at a P/B ratio of -1.60x. For context, the Electrical industry average P/B stands at 2.20x, while the peer average is 3.36x. This means the stock is well below these typical benchmarks. The negative value signals that the company's book value is negative, which is often a red flag and indicates ongoing losses or write-downs.

To move beyond simple comparisons, Simply Wall St introduces the “Fair Ratio.” This proprietary metric determines what multiple is truly reasonable by analyzing factors like expected growth, competitive risks, profit margins, industry norms, and company size. It makes side-by-side comparisons far more meaningful. Rather than just relying on peers or industry averages, it uses a holistic approach tailored to Eos Energy Enterprises’ unique circumstances.

Comparing Eos's actual P/B ratio to the Fair Ratio ultimately reveals whether the current share price is justified. In this case, the stock’s negative P/B ratio highlights fundamental challenges, but without a positive book value, traditional fairness judgments are less relevant. However, the gap between market value and book value suggests caution, but does not indicate the stock is clearly overvalued or undervalued by this approach.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1423 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Eos Energy Enterprises Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personalized story about a company that connects your outlook, such as your assumptions for future revenue, earnings, and margins, to a tailored financial forecast and fair value estimation.

Narratives go beyond the numbers, allowing you to reflect your perspective or “thesis” about Eos Energy Enterprises in a structured, step-by-step way. On Simply Wall St’s popular Community page, you can easily build, share, and compare Narratives. This approach is already used by millions of investors to clarify their buy or sell decisions.

With Narratives, you see how your expectations feed directly into a projected fair value, which can then be instantly compared to the current market price to help guide your investment timing. Narratives update dynamically as new information, such as news or earnings, becomes available. This ensures your view stays relevant and anchored in real data.

For example, some Eos Energy Enterprises Narratives are more optimistic, expecting revenue growth near 180% per year and a fair value over $15 per share, while the most bearish assume much slower progress with fair value closer to $5. This powerful tool helps you align your decisions with your own convictions, using data-driven forecasts and a story that makes sense to you.

Do you think there's more to the story for Eos Energy Enterprises? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eos Energy Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:EOSE

Eos Energy Enterprises

Designs, develops, manufactures, and markets energy storage solutions for utility-scale, microgrid, and commercial and industrial applications in the United States.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives