- United States

- /

- Electrical

- /

- NasdaqGS:ENVX

Could Insider Buying at Enovix (ENVX) Shift Perceptions on Management’s Confidence Amid Ongoing Losses?

Reviewed by Sasha Jovanovic

- Enovix Corporation recently reported its third quarter and nine-month earnings for 2025, with sales rising to US$7.99 million for the quarter and continued net losses totaling US$53.71 million over the same period.

- Recent insider buying by a company executive has drawn attention, reflecting management's apparent confidence in the business despite ongoing financial losses.

- We'll examine how increased revenues and recent insider buying may shape Enovix's investment narrative going forward.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Enovix Investment Narrative Recap

To own Enovix stock, you need to believe in its ability to ramp up high-volume battery production for smartphones and secure major customer qualifications, while managing ongoing financial losses. The latest earnings report shows revenues rising but net losses widening, which does not materially alter the near-term catalyst: achieving successful high-volume production and qualification. The main risk, delays in this process or failure to achieve profitable scale, remains front and center for any prospective investor.

Among recent company actions, the July launch of the AI-1TM platform for next-gen smartphones stands out. These initial sample shipments to a leading OEM align with Enovix’s central catalyst, as securing commercial contracts for these batteries is critical to translating new technology into substantial revenue growth in 2025 and beyond.

However, investors should be mindful that while the latest sales uptick is promising, the risk of cash flow strain from high-capital expenditures if demand does not ramp as expected is still...

Read the full narrative on Enovix (it's free!)

Enovix's narrative projects $460.3 million in revenue and $48.3 million in earnings by 2028. This requires a 171.2% yearly revenue growth and a $270.5 million earnings increase from current earnings of -$222.2 million.

Uncover how Enovix's forecasts yield a $28.80 fair value, a 154% upside to its current price.

Exploring Other Perspectives

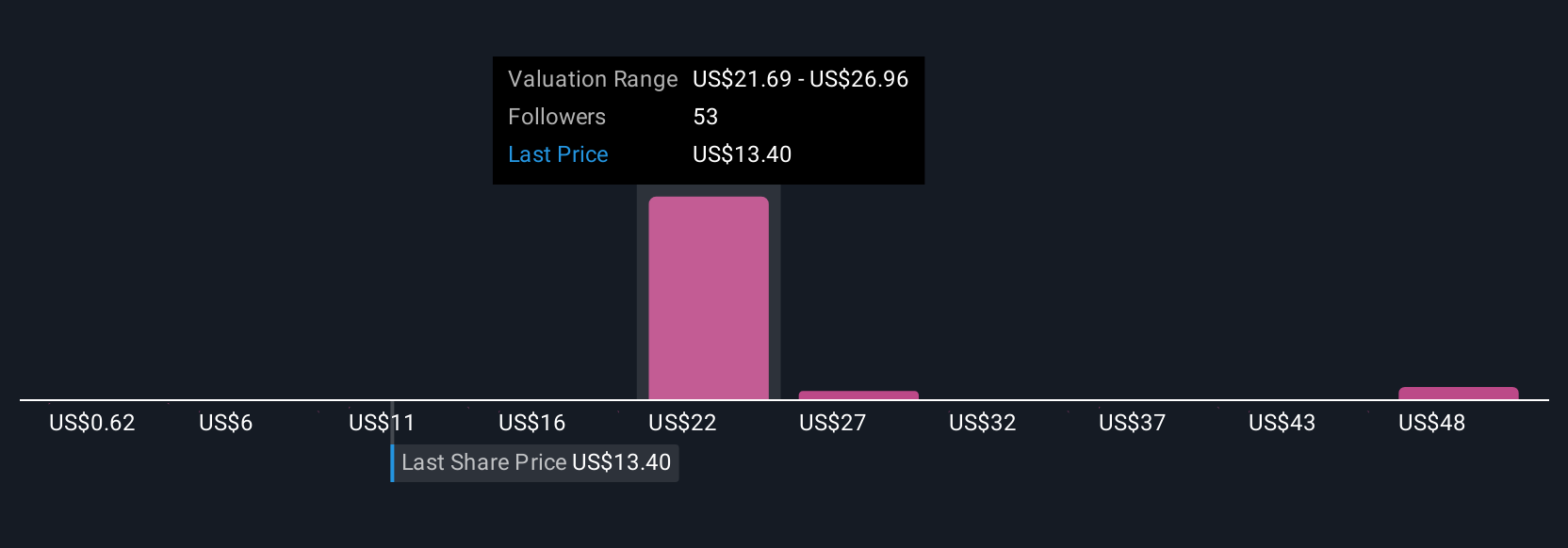

Eight community contributors estimate Enovix's fair value between US$0.81 and US$46.01. With high spending required to scale manufacturing, future company performance could see wide outcomes, so check multiple viewpoints.

Explore 8 other fair value estimates on Enovix - why the stock might be worth less than half the current price!

Build Your Own Enovix Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enovix research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Enovix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enovix's overall financial health at a glance.

Want Some Alternatives?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 38 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enovix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ENVX

Enovix

Designs, develops, and manufactures lithium-ion battery cells in the United States and internationally.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives