- United States

- /

- Machinery

- /

- NasdaqGM:EML

Eastern (EML) Margin Squeeze Challenges Bullish Profitability Narratives After Earnings Release

Reviewed by Simply Wall St

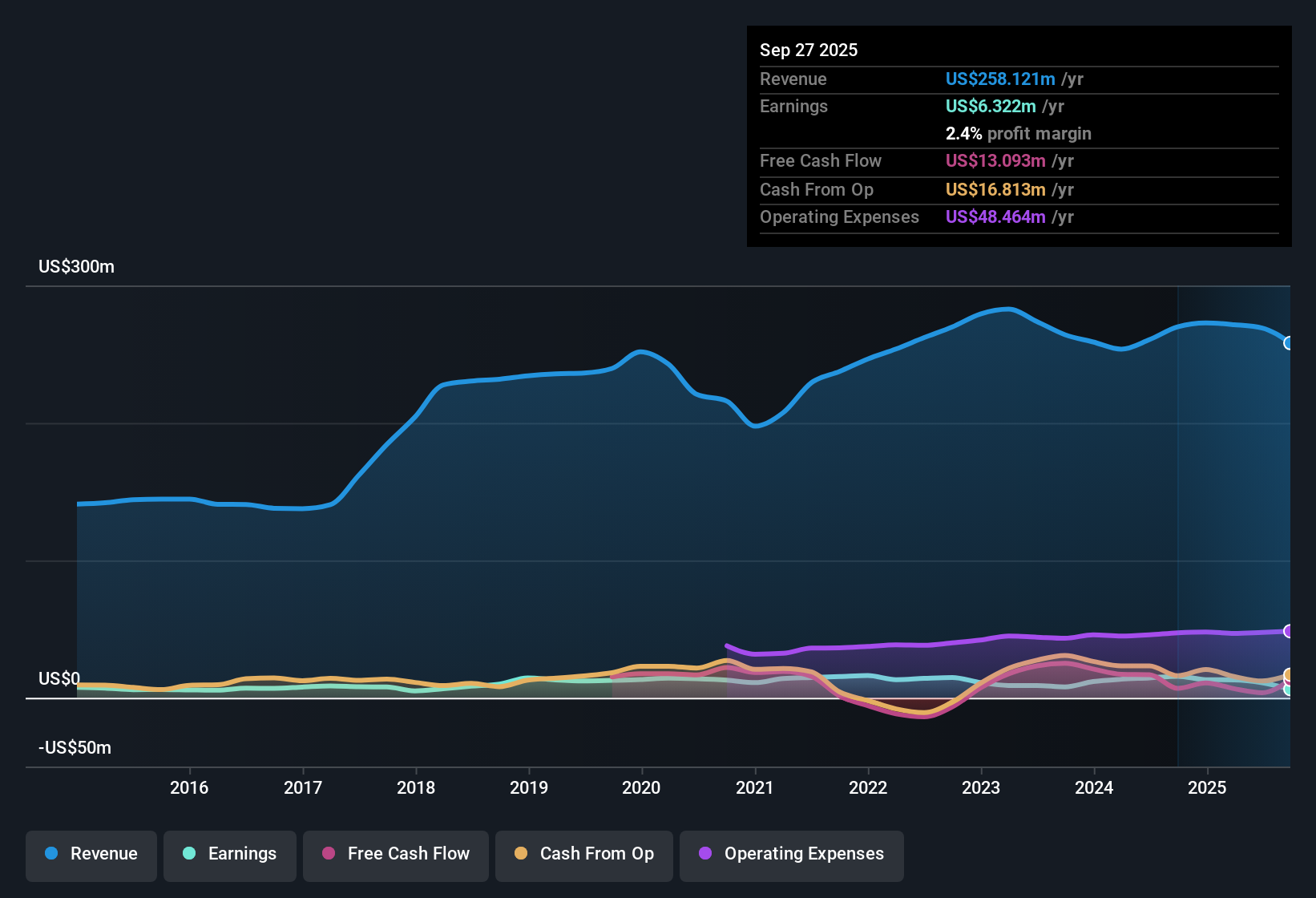

Eastern (EML) posted a net profit margin of 4.1%, down from 5.2% last year, highlighting a contraction in profitability. Over the past five years, the company’s earnings have shrunk by an average of 2.6% annually, and the most recent period brought negative earnings growth. Despite these trends, Eastern stands out for its high-quality earnings and an attractive valuation, but tempered investor optimism with ongoing stagnant revenue and earnings prospects.

See our full analysis for Eastern.Now, let’s see how the headline numbers measure up against the current narratives. Some assumptions will be confirmed, while others might get called into question.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margin Shrink Tightens Value Argument

- The net profit margin narrowed to 4.1% from 5.2%, reinforcing that Eastern’s core profitability is under pressure. This change contradicts expectations that profitability would remain steady, despite assertions of high-quality earnings.

- While the company remains recognized for its high-quality earnings, the continued margin contraction challenges the optimistic case that strong fundamentals alone can offset ongoing declines.

- The 1.1 percentage point drop directly tests the bullish argument that profitability would stabilize due to quality controls and cost discipline.

- Bulls often cite high-quality earnings as a reason for confidence. However, the ongoing squeeze on margins supports those who argue that declining profitability can eventually erode even solid underlying business models.

Persistent Earnings Decay

- Average annual earnings have decreased by 2.6% over the last five years, and the most recent period saw negative earnings growth. This trend stands out even in a choppy market environment.

- Analysis of this downward trajectory shows that the narrative suggesting Eastern’s earnings quality makes it resilient now faces direct headwinds from multi-year declines.

- Rather than weathering volatile markets with steady results, the business has seen its earnings shrink by more than two percent annually.

- The negative growth in the latest period highlights how historical pressures have not reversed, which is significant given investor hopes for eventual improvement.

Deep Valuation Discount to Peers

- Eastern’s price-to-earnings ratio of 11.5x represents a substantial discount compared to the US Machinery industry’s average of 23.5x and its closest peers at 22.3x, positioning the stock as a clear value play on a relative basis.

- The attractive P/E ratio and ongoing dividend yield present a compelling scenario: even without growth expectations, the valuation provides a cushion for investors willing to prioritize current value over growth.

- Despite lagging earnings momentum, the large gap in multiples could benefit patient investors if fundamentals stabilize or improve.

- This discount may also reduce downside risk, even as stagnant revenue and profit risks remain a central concern for value-focused buyers.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Eastern's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Eastern’s persistent earnings decline and ongoing margin contraction highlight its inability to deliver stable and reliable growth for investors.

If you want stocks with consistent, worry-free performance instead, check out stable growth stocks screener (2074 results) and focus on companies that actually grow earnings and revenues year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastern might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:EML

Eastern

Designs, manufactures, and sells engineered solutions to industrial markets in the United States and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives