- United States

- /

- Trade Distributors

- /

- NasdaqGS:DXPE

DXP Enterprises (DXPE): Assessing Valuation Following Record Q3 2025 Sales Surge in Pumping Solutions

Reviewed by Simply Wall St

DXP Enterprises (DXPE) just announced record sales for the third quarter of 2025, powered by impressive gains in its Innovative Pumping Solutions division. Strong demand in energy and water projects clearly drove these results, even as other areas showed slower performance.

See our latest analysis for DXP Enterprises.

Following these standout results, DXP Enterprises has seen its share price dip sharply in the past month. However, the 1-year total shareholder return stands at an impressive 21.95%. Looking further back, long-term investors have been well rewarded, with momentum remaining strong over the last three and five years.

If DXP’s surge has you thinking about other opportunities, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

But with shares pulling back despite record growth and the stock still trading below analyst targets, the big question is whether the recent dip signals a real buying opportunity or if the market already reflects DXP’s future potential.

Most Popular Narrative: 34.9% Undervalued

With DXP Enterprises closing at $88.90 and the most followed narrative placing fair value at $136.50, there is a notable gap that calls for deeper scrutiny. This difference sets the stage for a closer look at what is driving the optimism behind that higher price estimate.

DXP's ongoing investments in digital sales platforms and the launch of an e-commerce channel are enhancing sales efficiency and enabling higher-margin transactions. These initiatives could drive both revenue growth and margin expansion as more industrial buyers shift to online procurement.

Want to know which ambitious forecasts underpin that target price? The narrative’s core thesis revolves around a digital pivot, bigger margins, and surprising growth assumptions yet to be revealed. Get the inside story of the projections driving this compelling fair value. Some numbers might challenge what you expect from an industrial supplier.

Result: Fair Value of $136.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, DXP's gains still face risks from its heavy energy sector exposure and the possibility of rising labor costs, which could pressure margins going forward.

Find out about the key risks to this DXP Enterprises narrative.

Another View: Digging Into Market Multiples

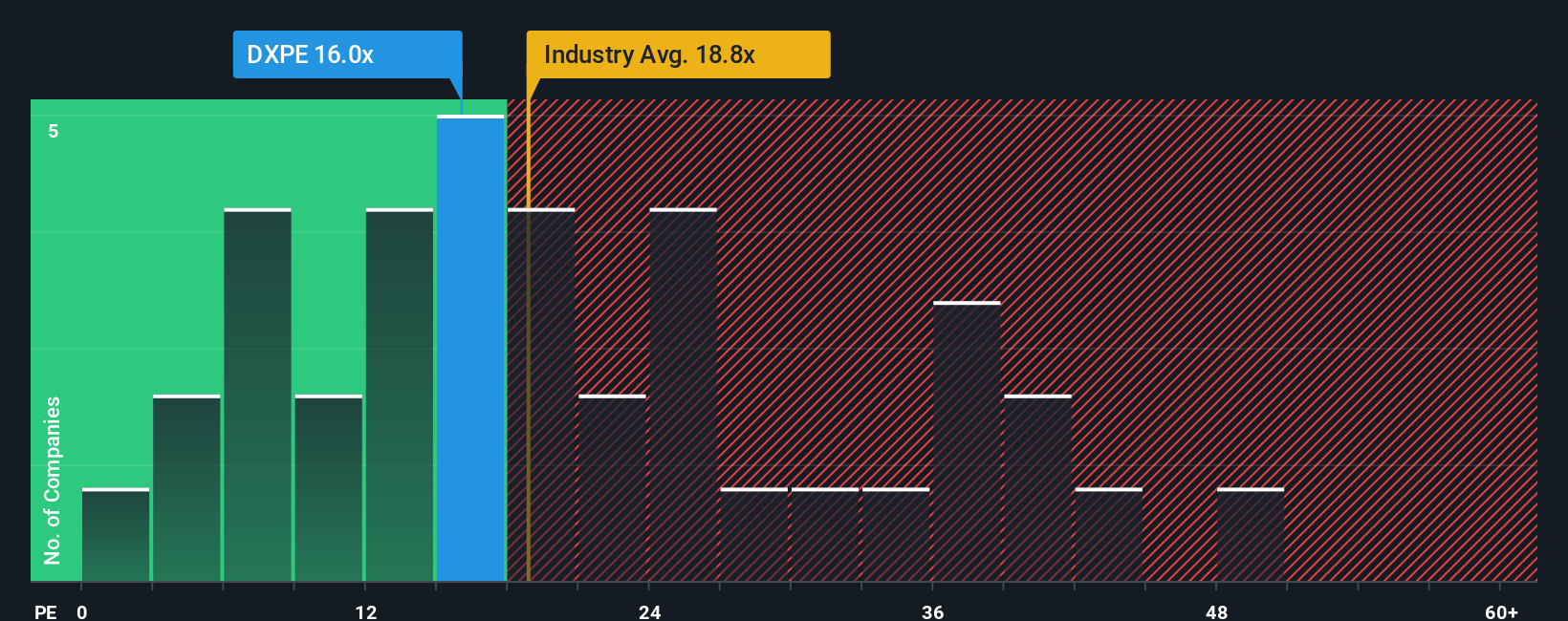

Looking from a different angle, the current market price values DXP Enterprises at a price-to-earnings ratio of 16, which is higher than direct peers averaging 13.7 but still below the industry’s 18.8 average. Interestingly, this remains well under the fair ratio of 26.5. This is a level the market could move toward if momentum builds. These gaps can mean either latent opportunity or unexpected downside, leaving investors to decide if the risk-reward is truly in their favor.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DXP Enterprises Narrative

If these perspectives don’t match your own or you want to dig deeper, you can quickly shape your own DXP Enterprises story and analysis in just a few minutes. Do it your way

A great starting point for your DXP Enterprises research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investing Ideas?

Ready to see what else is out there? Give your portfolio an upgrade and access new possibilities by using Simply Wall Street’s powerful stock screeners below.

- Uncover potential bargains and start building a stronger foundation by targeting value plays with these 921 undervalued stocks based on cash flows that could be flying under the radar.

- Tap into the next technological breakthrough by checking out these 26 AI penny stocks with massive potential in artificial intelligence and automation.

- Boost your cash flow with steady performers by reviewing these 15 dividend stocks with yields > 3% offering attractive yields and reliable income.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DXPE

DXP Enterprises

Engages in distributing maintenance, repair, and operating (MRO) products, equipment, and services in the United States, Canada, and internationally.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives