- United States

- /

- Trade Distributors

- /

- NasdaqGS:DSGR

Distribution Solutions Group (DSGR) Returns to Profitability, Challenging Concerns Over Earnings Quality

Reviewed by Simply Wall St

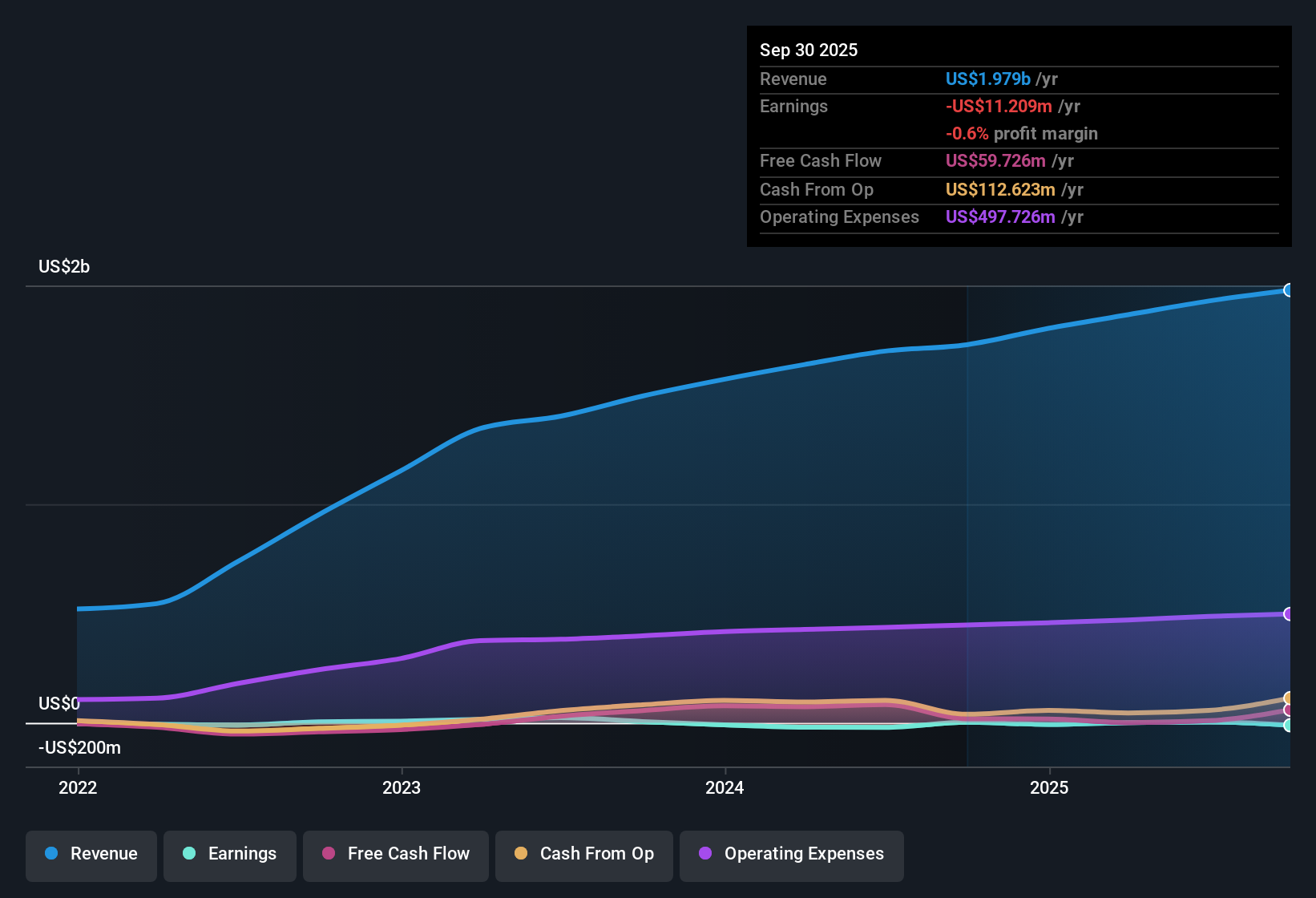

Distribution Solutions Group (DSGR) has shifted into profitability over the past year and now stands out for its forecasted 27.6% annual earnings growth, well ahead of the overall US market. Analysts expect this earnings strength to continue at an annual rate above 20% for at least the next three years. However, revenue growth of 4.1% per year is seen as lagging broader market trends. Investors are likely to weigh these gains in profitability and future growth projections against the company’s recent history of a $15.5 million one-off loss and ongoing concerns about financial quality. Valuation is currently seen as attractive both relative to peers and versus estimated fair value.

See our full analysis for Distribution Solutions Group.Now, let’s see how these headline figures stand up against the dominant market narratives and where they might differ.

See what the community is saying about Distribution Solutions Group

Margin Expansion Hinges on 3.3 Point Gain

- Analysts expect DSGR’s profit margins to rise from 0.2% today to 3.5% in three years, implying much stronger earnings power if achieved.

- According to analysts' consensus view, executing digital transformation and strategic acquisitions is seen as critical to pushing these margins higher.

- The shift includes upgraded CRM and analytics platforms, with the aim of boosting sales productivity and unlocking untapped EBITDA margin gains.

- Consensus narrative highlights, however, that integration of new acquisitions and realizing cost savings remains a source of execution risk for sustained margin improvement.

- Analysts say that margin expansion is the main lever for future profitability, but success depends on turning planned synergies into real-world gains.

Acquisition Integration Risk Still Looms

- Despite plans to drive long-term profitability through recent acquisitions like Source Atlantic and ConRes, the company faces material risk that delays or challenges in integration could slow or reduce margin improvement.

- Consensus narrative points out that bears remain concerned about ongoing execution hurdles:

- Delays in capturing expected cost savings and operational challenges from integrating these new businesses could keep expenses elevated and affect net earnings growth.

- Bears also argue that lagging improvements in salesforce productivity or unforeseen setbacks could stall planned EBITDA margin expansion across business units.

Valuation Versus Peers and DCF Fair Value

- DSGR trades at a 0.7x Price-To-Sales ratio, which is below both its peer average of 0.9x and the broader distributor industry at 1.1x. The company is also trading 11% below its DCF fair value of $31.29 per share, with analysts targeting a further 38.5 price target, nearly 38% higher than today’s price of $27.87.

- Analysts' consensus view is that the current valuation provides a perceived opportunity, but this case relies on the company realizing ambitious margin growth and fully capturing acquisition synergies.

- Given industry trends toward consolidation and digital transformation, the valuation gap with both DCF fair value and analyst targets reflects optimism about DSGR’s positioning if integration and margin goals are achieved.

- If acquisition and digital strategy risks materialize, however, these relative discounts may persist or widen, restraining share price upside despite the favorable metrics.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Distribution Solutions Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the figures? Share your insights and shape your own narrative in just a couple of minutes: Do it your way.

A great starting point for your Distribution Solutions Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite strong earnings forecasts, Distribution Solutions Group faces real hurdles integrating acquisitions and consistently growing sales. As a result, future margin gains are far from certain.

If you want to focus on steadier, more reliable growth stories, use stable growth stocks screener (2108 results) to zero in on companies that consistently deliver revenue and earnings expansion year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DSGR

Distribution Solutions Group

A specialty distribution company, provides value-added distribution solutions to the maintenance, repair and operations (MRO), original equipment manufacturer, and industrial technology markets.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives