- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:DRS

Leonardo DRS (DRS): Valuation Insights Following Strong Q3 Results and Leadership Changes

Reviewed by Simply Wall St

Leonardo DRS (DRS) just shared its third-quarter results, showing solid growth in both sales and net income, and raised its revenue forecast for the year. These updates came as the company also unveiled leadership changes.

See our latest analysis for Leonardo DRS.

While Leonardo DRS is making headlines for its strong quarterly results and executive shake-up, the past month’s share price return of -17.7% suggests some investors are recalibrating expectations after a strong run earlier this year. Despite this recent dip, its year-to-date share price return of 9.9% points to underlying confidence in the company’s longer-term growth story. Meanwhile, the total shareholder return over the last twelve months is nearly flat, hinting that the real payoff for shareholders may still be ahead if the company delivers on its guidance and new strategic moves.

Given the sector’s rapid pace of change, this could be a good moment to see what other aerospace and defense names are gaining momentum. See the full list for free.

The question for investors now is whether Leonardo DRS’s recent pullback signals an undervalued opportunity, or if the current share price and forecasts already reflect the company’s growth and strategic strengths.

Most Popular Narrative: 25.9% Undervalued

Leonardo DRS's prevailing narrative points to a fair value markedly above its last close, setting the stage for a debate about just how much growth the company can deliver in the next few years.

The company's strategic alignment with national priorities, including investments in naval modernization, next-generation air and missile defense (such as the Golden Dome initiative), and counter-UAS capabilities, positions it for premium contract awards and program expansions. This is expected to benefit both revenue and net margins over the next several years.

Want to know which bold forecasts drive this valuation? The narrative hinges on a combination of profitability inflections and aggressive assumptions on future contract wins. How do these projections stack up against market reality? The next click reveals the financial expectations and strategic bets behind the headline fair value.

Result: Fair Value of $48 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent raw material supply constraints and intense competition for key defense contracts could present challenges for Leonardo DRS's growth path and future earnings potential.

Find out about the key risks to this Leonardo DRS narrative.

Another View: Sizing Up the Valuation

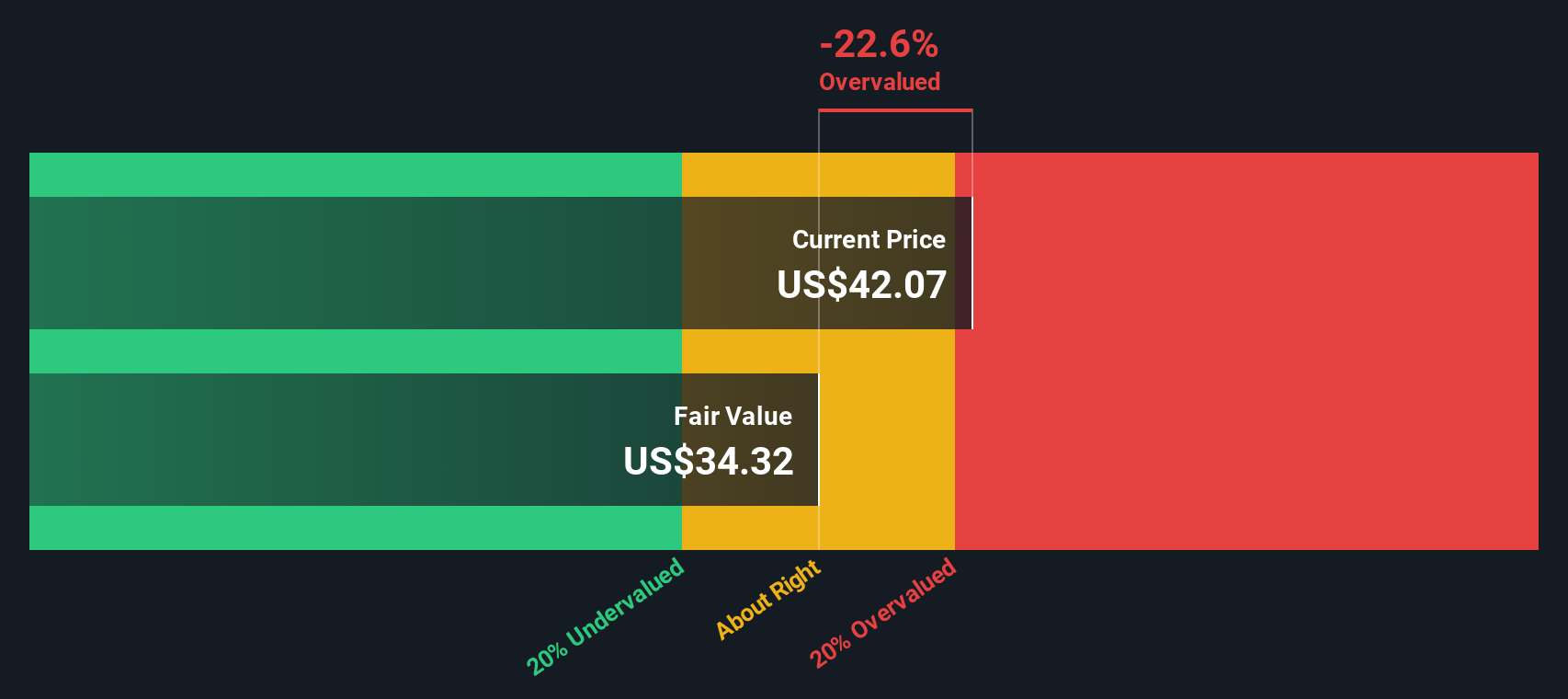

While many analysts see upside based on earnings growth and target prices, our DCF model paints a more cautious picture. According to the SWS DCF model, Leonardo DRS currently trades above its estimated fair value. This more conservative outlook raises questions about whether the market is pricing in even higher growth or if certain risks are being overlooked.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Leonardo DRS for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 858 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Leonardo DRS Narrative

If you see things differently or want to draw your own conclusions, you can build a custom narrative using the data in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Leonardo DRS.

Looking for More Smart Investment Ideas?

Don't let other opportunities pass you by while the market keeps moving. Use Simply Wall Street’s powerful screener to uncover standout stocks and fresh investment angles right now.

- Capture long-term value by targeting these 858 undervalued stocks based on cash flows that the market has overlooked. These may offer strong fundamentals at compelling prices.

- Start building a portfolio of tomorrow’s innovation giants by selecting these 25 AI penny stocks. These are positioned to harness artificial intelligence trends before the crowd catches on.

- Get ahead of market shifts and secure stable income with these 15 dividend stocks with yields > 3% by focusing on companies consistently paying reliable yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DRS

Leonardo DRS

Provides defense electronic products and systems, and military support services worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives