- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:DRS

Does Leonardo DRS' CEO Transition and Revenue Guidance Signal Strategic Confidence in DRS?

Reviewed by Sasha Jovanovic

- On October 29, 2025, Leonardo DRS, Inc. announced the retirement of longtime CEO and Chairman William J. Lynn, naming John Baylouny as his successor and Frances Fragos Townsend as the new Board Chair, effective January 1, 2026.

- This leadership transition was accompanied by a slight increase in full-year revenue guidance and a reaffirmed dividend, highlighting both management continuity and confidence in the company's ongoing business performance.

- We'll explore how this major executive change, together with updated revenue guidance, shapes the current investment narrative for Leonardo DRS.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

Leonardo DRS Investment Narrative Recap

To own shares of Leonardo DRS, I’d have to believe in its ability to capitalize on sustained defense sector demand, secure major U.S. and allied contracts, and innovate in high-value platforms like advanced sensing and network computing. The CEO and board transition, announced for January 2026, appears well-managed and does not materially affect the most pressing catalyst, growing defense budgets and contract wins, or the main risk, which remains potential federal budget volatility and contract concentration in large programs.

Among the recent announcements, the reaffirmed dividend of $0.09 per share, declared alongside the executive changes, stands out for reinforcing management’s confidence and commitment to returning value to shareholders. This signal of stability aligns closely with the ongoing short-term catalyst of robust government and defense contract momentum, as the company seeks to leverage its advanced technology in future awards and expand its backlog.

But while leadership stability is reassuring, investors should also be alert to the effects of future shifts in government spending priorities...

Read the full narrative on Leonardo DRS (it's free!)

Leonardo DRS' narrative projects $4.1 billion revenue and $351.1 million earnings by 2028. This requires 6.6% yearly revenue growth and a $101.1 million earnings increase from $250.0 million.

Uncover how Leonardo DRS' forecasts yield a $49.00 fair value, a 22% upside to its current price.

Exploring Other Perspectives

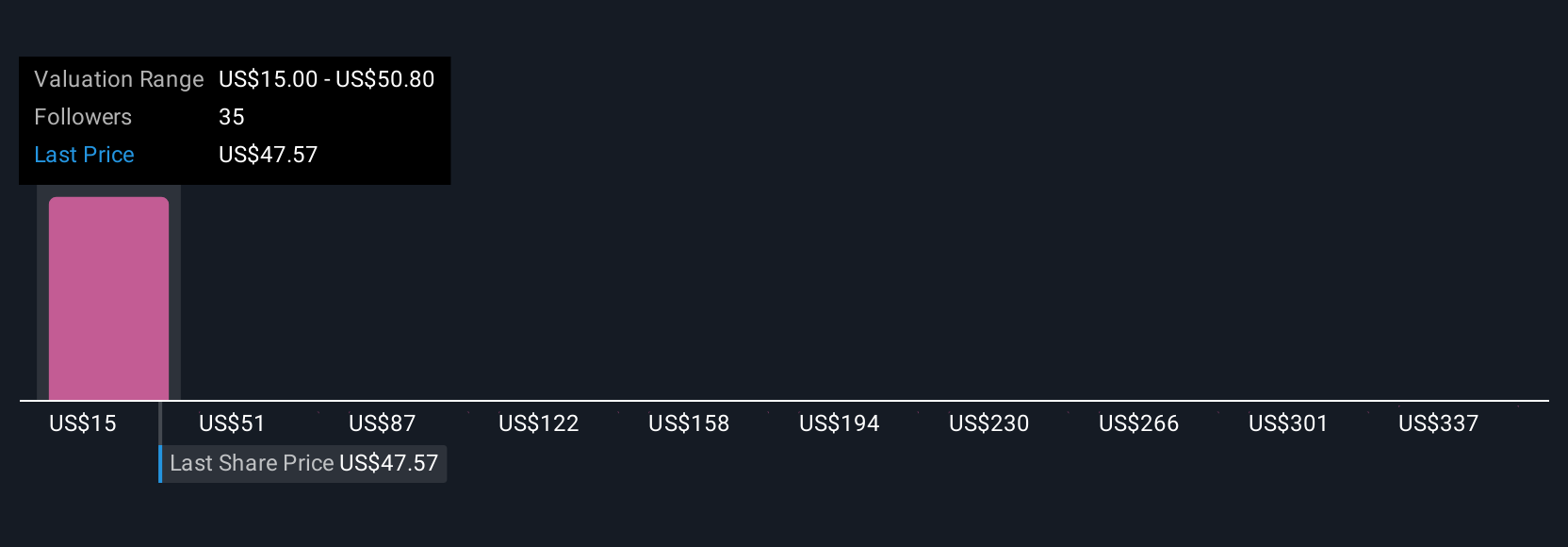

Fair value estimates from the Simply Wall St Community range from US$15 to US$372.97 across 8 contributors, highlighting widely different outlooks. Federal contract concentration remains a key risk that could impact future revenue and backlog, reminding you to weigh multiple opinions before making decisions.

Explore 8 other fair value estimates on Leonardo DRS - why the stock might be worth less than half the current price!

Build Your Own Leonardo DRS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Leonardo DRS research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Leonardo DRS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Leonardo DRS' overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DRS

Leonardo DRS

Provides defense electronic products and systems, and military support services worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives