- United States

- /

- Electrical

- /

- OTCPK:DCFC.Q

A Piece Of The Puzzle Missing From Tritium DCFC Limited's (NASDAQ:DCFC) Share Price

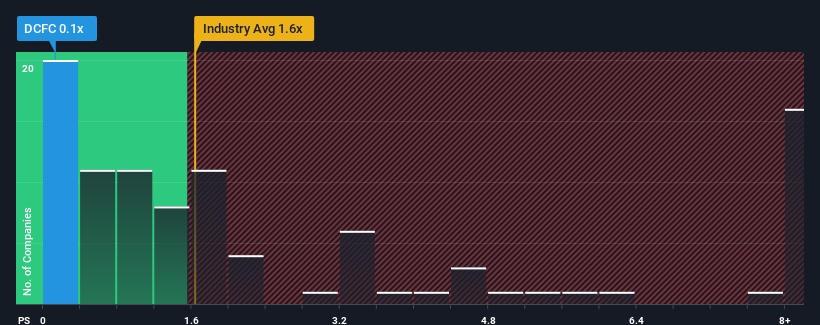

You may think that with a price-to-sales (or "P/S") ratio of 0.1x Tritium DCFC Limited (NASDAQ:DCFC) is a stock worth checking out, seeing as almost half of all the Electrical companies in the United States have P/S ratios greater than 1.6x and even P/S higher than 4x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Tritium DCFC

How Tritium DCFC Has Been Performing

Tritium DCFC certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tritium DCFC.Is There Any Revenue Growth Forecasted For Tritium DCFC?

In order to justify its P/S ratio, Tritium DCFC would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 115%. The strong recent performance means it was also able to grow revenue by 293% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 47% during the coming year according to the three analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 17%, which is noticeably less attractive.

In light of this, it's peculiar that Tritium DCFC's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Tritium DCFC's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

To us, it seems Tritium DCFC currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

Having said that, be aware Tritium DCFC is showing 6 warning signs in our investment analysis, and 2 of those are potentially serious.

If these risks are making you reconsider your opinion on Tritium DCFC, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Tritium DCFC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OTCPK:DCFC.Q

Tritium DCFC

Designs, manufactures, and supplies direct current chargers for electric vehicles in Australia and internationally.

Moderate and slightly overvalued.

Similar Companies

Market Insights

Community Narratives