- United States

- /

- Trade Distributors

- /

- NasdaqCM:CLWT

Risks To Shareholder Returns Are Elevated At These Prices For Euro Tech Holdings Company Limited (NASDAQ:CLWT)

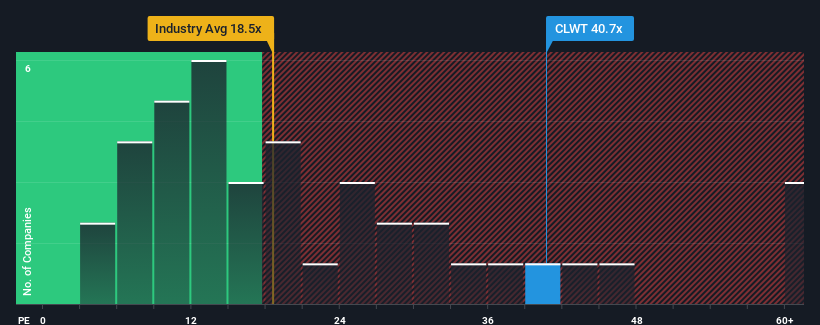

With a price-to-earnings (or "P/E") ratio of 40.7x Euro Tech Holdings Company Limited (NASDAQ:CLWT) may be sending very bearish signals at the moment, given that almost half of all companies in the United States have P/E ratios under 17x and even P/E's lower than 9x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Euro Tech Holdings has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Euro Tech Holdings

How Is Euro Tech Holdings' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as steep as Euro Tech Holdings' is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered an exceptional 29% gain to the company's bottom line. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 70% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 11% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's alarming that Euro Tech Holdings' P/E sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Euro Tech Holdings' P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Euro Tech Holdings revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Euro Tech Holdings that you should be aware of.

Of course, you might also be able to find a better stock than Euro Tech Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Euro Tech Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CLWT

Euro Tech Holdings

Engages in the marketing and trading of water and wastewater related process control, analytical and testing instruments, disinfection equipment, and supplies and related automation systems in Hong Kong and in the People's Republic of China.

Flawless balance sheet and good value.

Market Insights

Community Narratives