- United States

- /

- Trade Distributors

- /

- NasdaqCM:CLWT

Do Euro Tech Holdings' (NASDAQ:CLWT) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Euro Tech Holdings (NASDAQ:CLWT). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Euro Tech Holdings

How Fast Is Euro Tech Holdings Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Impressively, Euro Tech Holdings has grown EPS by 34% per year, compound, in the last three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

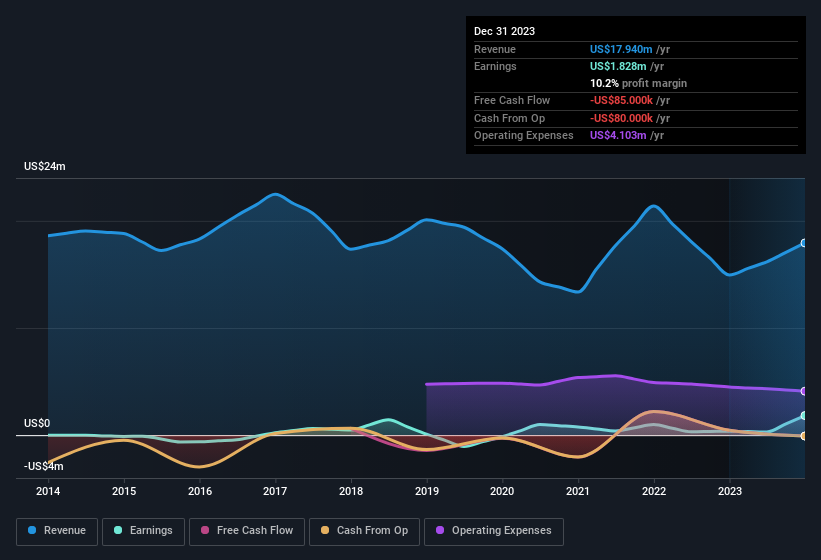

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. On the revenue front, Euro Tech Holdings has done well over the past year, growing revenue by 20% to US$18m but EBIT margin figures were less stellar, seeing a decline over the last 12 months. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Euro Tech Holdings is no giant, with a market capitalisation of US$11m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Euro Tech Holdings Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So as you can imagine, the fact that Euro Tech Holdings insiders own a significant number of shares certainly is appealing. Indeed, with a collective holding of 56%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Valued at only US$11m Euro Tech Holdings is really small for a listed company. So despite a large proportional holding, insiders only have US$6.4m worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

Should You Add Euro Tech Holdings To Your Watchlist?

For growth investors, Euro Tech Holdings' raw rate of earnings growth is a beacon in the night. This EPS growth rate is something the company should be proud of, and so it's no surprise that insiders are holding on to a considerable chunk of shares. The growth and insider confidence is looked upon well and so it's worthwhile to investigate further with a view to discern the stock's true value. We should say that we've discovered 2 warning signs for Euro Tech Holdings that you should be aware of before investing here.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in the US with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Euro Tech Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:CLWT

Euro Tech Holdings

Engages in the marketing and trading of water and wastewater related process control, analytical and testing instruments, disinfection equipment, and supplies and related automation systems in Hong Kong and in the People's Republic of China.

Flawless balance sheet and good value.

Market Insights

Community Narratives