- United States

- /

- Trade Distributors

- /

- NasdaqCM:BYU

There May Be Underlying Issues With The Quality Of BAIYU Holdings' (NASDAQ:BYU) Earnings

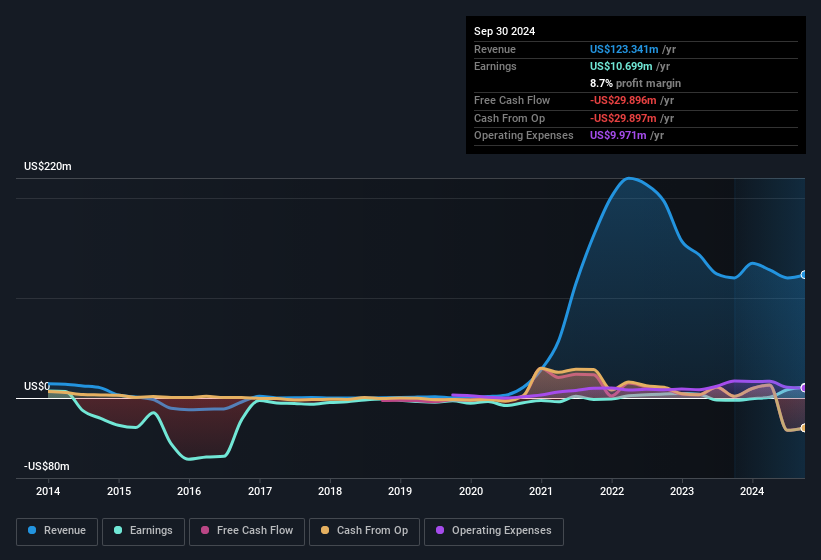

Last week's profit announcement from BAIYU Holdings, Inc. (NASDAQ:BYU) was underwhelming for investors, despite headline numbers being robust. We think that the market might be paying attention to some underlying factors that they find to be concerning.

View our latest analysis for BAIYU Holdings

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, BAIYU Holdings increased the number of shares on issue by 1,113% over the last twelve months by issuing new shares. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out BAIYU Holdings' historical EPS growth by clicking on this link.

A Look At The Impact Of BAIYU Holdings' Dilution On Its Earnings Per Share (EPS)

Three years ago, BAIYU Holdings lost money. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. And so, you can see quite clearly that dilution is having a rather significant impact on shareholders.

If BAIYU Holdings' EPS can grow over time then that drastically improves the chances of the share price moving in the same direction. However, if its profit increases while its earnings per share stay flat (or even fall) then shareholders might not see much benefit. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of BAIYU Holdings.

Our Take On BAIYU Holdings' Profit Performance

BAIYU Holdings issued shares during the year, and that means its EPS performance lags its net income growth. As a result, we think it may well be the case that BAIYU Holdings' underlying earnings power is lower than its statutory profit. On the bright side, the company showed enough improvement to book a profit this year, after losing money last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Keep in mind, when it comes to analysing a stock it's worth noting the risks involved. For example, we've discovered 3 warning signs that you should run your eye over to get a better picture of BAIYU Holdings.

Today we've zoomed in on a single data point to better understand the nature of BAIYU Holdings' profit. But there is always more to discover if you are capable of focussing your mind on minutiae. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks with significant insider holdings to be useful.

Valuation is complex, but we're here to simplify it.

Discover if BAIYU Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BYU

BAIYU Holdings

Engages in commodities trading and supply chain service businesses in the People’s Republic of China.

Adequate balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success