- United States

- /

- Trade Distributors

- /

- NasdaqCM:BGLC

BioNexus Gene Lab Corp. (NASDAQ:BGLC) Stocks Shoot Up 234% But Its P/S Still Looks Reasonable

Despite an already strong run, BioNexus Gene Lab Corp. (NASDAQ:BGLC) shares have been powering on, with a gain of 234% in the last thirty days. But the last month did very little to improve the 85% share price decline over the last year.

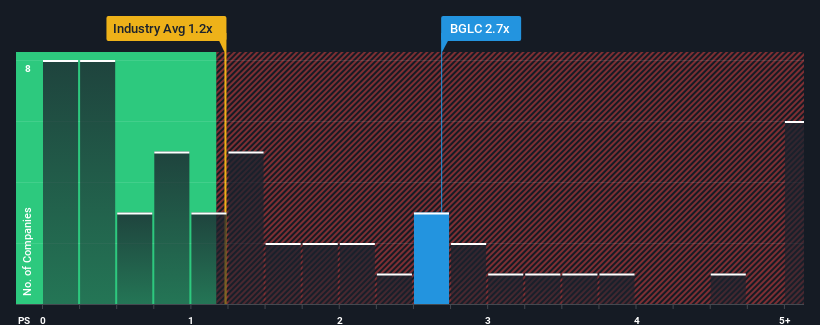

Following the firm bounce in price, given close to half the companies operating in the United States' Trade Distributors industry have price-to-sales ratios (or "P/S") below 1.2x, you may consider BioNexus Gene Lab as a stock to potentially avoid with its 2.7x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for BioNexus Gene Lab

What Does BioNexus Gene Lab's Recent Performance Look Like?

As an illustration, revenue has deteriorated at BioNexus Gene Lab over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be quite nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on BioNexus Gene Lab will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as high as BioNexus Gene Lab's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 8.8% decrease to the company's top line. Even so, admirably revenue has lifted 41% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Comparing that to the industry, which is only predicted to deliver 5.1% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why BioNexus Gene Lab's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

BioNexus Gene Lab shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of BioNexus Gene Lab revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Plus, you should also learn about these 4 warning signs we've spotted with BioNexus Gene Lab (including 2 which are a bit concerning).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if BioNexus Gene Lab might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BGLC

BioNexus Gene Lab

Through its subsidiaries, focuses on the sale of chemical raw materials for the manufacture of industrial, medical, appliance, aero, automotive, mechanical, and electronic products in Malaysia, Indonesia, Vietnam, and other countries in Southeast Asia.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives