- United States

- /

- Electrical

- /

- NasdaqCM:BEEM

Revenues Not Telling The Story For Beam Global (NASDAQ:BEEM) After Shares Rise 26%

Beam Global (NASDAQ:BEEM) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 56% share price decline over the last year.

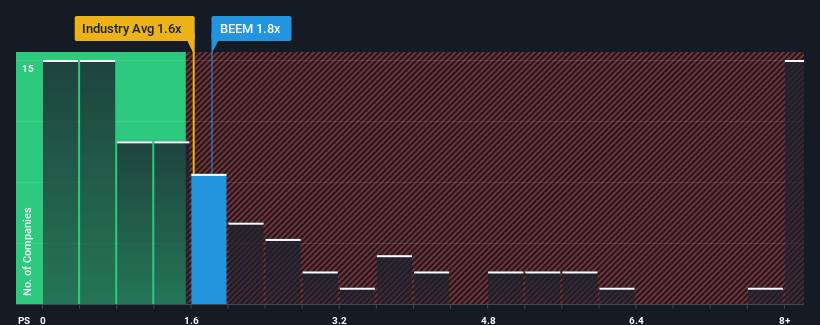

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Beam Global's P/S ratio of 1.8x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in the United States is also close to 1.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Beam Global

What Does Beam Global's Recent Performance Look Like?

Beam Global certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beam Global.How Is Beam Global's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Beam Global's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 214%. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 31% per year during the coming three years according to the seven analysts following the company. That's shaping up to be materially lower than the 68% per year growth forecast for the broader industry.

With this information, we find it interesting that Beam Global is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

Its shares have lifted substantially and now Beam Global's P/S is back within range of the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our look at the analysts forecasts of Beam Global's revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Beam Global that you need to be mindful of.

If these risks are making you reconsider your opinion on Beam Global, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Beam Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BEEM

Beam Global

A clean-technology innovation company, engages in the design, development, engineering, manufacture, and sale of renewably energized infrastructure products and battery solutions in the United States and Romania.

Moderate risk with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives