- United States

- /

- Electrical

- /

- NasdaqCM:BEEM

Positive Sentiment Still Eludes Beam Global (NASDAQ:BEEM) Following 43% Share Price Slump

Beam Global (NASDAQ:BEEM) shares have had a horrible month, losing 43% after a relatively good period beforehand. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 59% loss during that time.

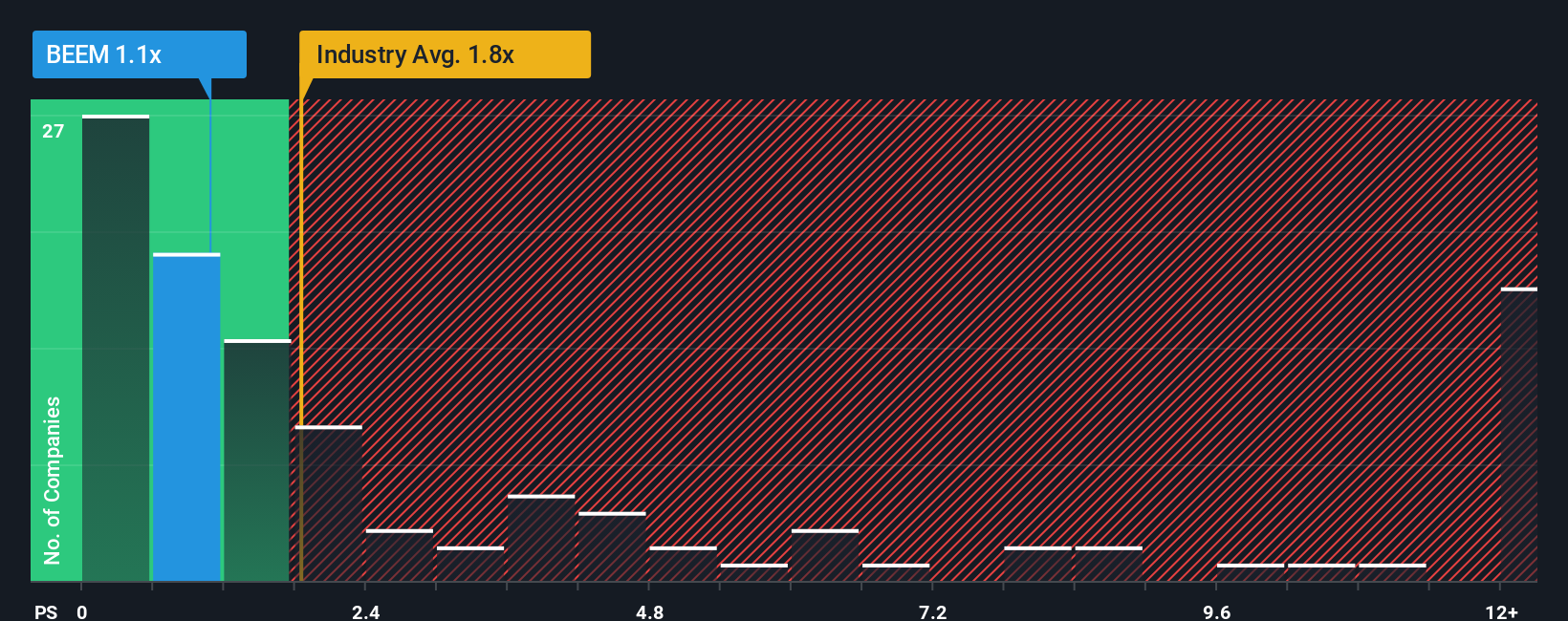

After such a large drop in price, Beam Global may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.1x, since almost half of all companies in the Electrical industry in the United States have P/S ratios greater than 1.8x and even P/S higher than 6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Beam Global

How Has Beam Global Performed Recently?

Beam Global hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Beam Global will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Beam Global?

Beam Global's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 55%. Even so, admirably revenue has lifted 57% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 21% per year over the next three years. With the industry only predicted to deliver 17% per year, the company is positioned for a stronger revenue result.

In light of this, it's peculiar that Beam Global's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What Does Beam Global's P/S Mean For Investors?

Beam Global's recently weak share price has pulled its P/S back below other Electrical companies. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

To us, it seems Beam Global currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. There could be some major risk factors that are placing downward pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

You should always think about risks. Case in point, we've spotted 5 warning signs for Beam Global you should be aware of, and 1 of them is a bit unpleasant.

If you're unsure about the strength of Beam Global's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Beam Global might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BEEM

Beam Global

A clean-technology innovation company, engages in the design, development, engineering, manufacture, and sale of renewably energized infrastructure products and battery solutions in the United States and Romania.

Moderate risk with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives