- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AXON

Is Now The Time To Put Axon Enterprise (NASDAQ:AXON) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Axon Enterprise (NASDAQ:AXON). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

View our latest analysis for Axon Enterprise

Axon Enterprise's Improving Profits

In the last three years Axon Enterprise's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. Thus, it makes sense to focus on more recent growth rates, instead. In impressive fashion, Axon Enterprise's EPS grew from US$0.63 to US$1.86, over the previous 12 months. Year on year growth of 195% is certainly a sight to behold. The best case scenario? That the business has hit a true inflection point.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The music to the ears of Axon Enterprise shareholders is that EBIT margins have grown from -11% to 7.7% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

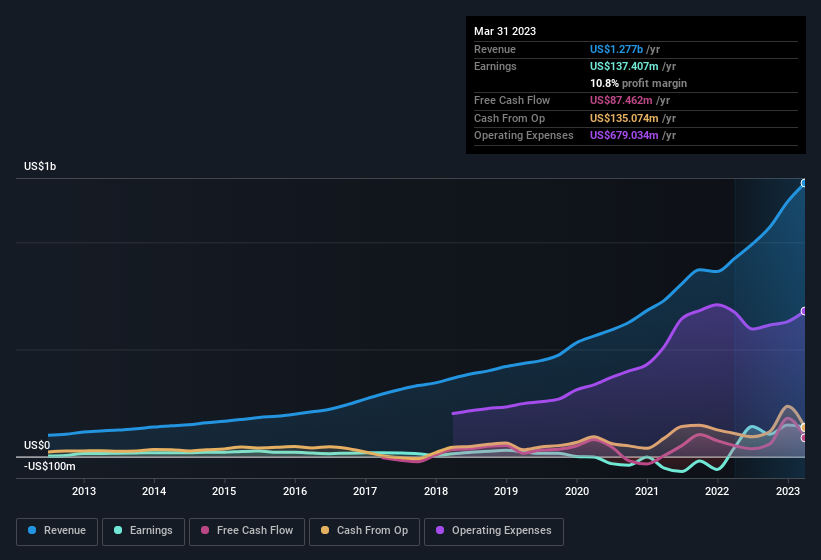

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Axon Enterprise.

Are Axon Enterprise Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The US$1.5m worth of shares that insiders sold during the last 12 months pales in comparison to the US$4.0m they spent on acquiring shares in the company. This bodes well for Axon Enterprise as it highlights the fact that those who are important to the company having a lot of faith in its future. We also note that it was the Independent Director, Hadi Partovi, who made the biggest single acquisition, paying US$2.0m for shares at about US$200 each.

Along with the insider buying, another encouraging sign for Axon Enterprise is that insiders, as a group, have a considerable shareholding. We note that their impressive stake in the company is worth US$926m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. The cherry on top is that the CEO, Rick Smith is paid comparatively modestly to CEOs at similar sized companies. For companies with market capitalisations over US$8.0b, like Axon Enterprise, the median CEO pay is around US$12m.

Axon Enterprise's CEO only received compensation totalling US$33k in the year to December 2022. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Axon Enterprise Worth Keeping An Eye On?

Axon Enterprise's earnings have taken off in quite an impressive fashion. What's more, insiders own a significant stake in the company and have been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Axon Enterprise deserves timely attention. We should say that we've discovered 2 warning signs for Axon Enterprise that you should be aware of before investing here.

The good news is that Axon Enterprise is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AXON

Axon Enterprise

Develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally.

High growth potential with excellent balance sheet.