- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AXON

How Investors May Respond To Axon Enterprise (AXON) Analyst Optimism on New Technology and Sector Expansion

Reviewed by Sasha Jovanovic

- RBC Capital recently initiated coverage of Axon Enterprise with an Outperform rating, citing expectations for continued strong revenue growth fueled by new product innovations like TASER 10, Axon Body 4, and rising demand for its Platform Solutions, which include advancements in counter-drone technology and virtual reality.

- Institutional investors and recent customer agreements have highlighted Axon's expanding footprint beyond traditional law enforcement, underscoring the company's progress in emerging sectors such as AI-enabled solutions and drones, while maintaining momentum in new product development despite past stock underperformance.

- We'll examine how positive analyst coverage and innovation in technologies like counter-drone solutions could influence Axon's investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Axon Enterprise Investment Narrative Recap

To own Axon Enterprise as a shareholder, you need to believe in the future of tech-driven public safety and sustained product adoption, especially as agencies seek modern, cloud-based, and AI-enabled solutions. The recent analyst coverage could support bullish sentiment in the short term, but concerns around earnings quality, such as a Q3 net loss and margin compression, remain the key risk for Axon, with no material change to that outlook from this news.

Among recent announcements, Axon's Q4 2025 guidance of US$750 million to US$755 million revenue, supported by strong Platform Solutions momentum, closely ties to these themes. Innovations like counter-drone technology and expanded ecosystem offerings may serve as important near-term catalysts as customer demand continues to shift toward comprehensive public safety platforms.

Yet, as investor focus increases, there is growing concern over regulatory and privacy challenges that could restrict future growth in SaaS and analytics offerings...

Read the full narrative on Axon Enterprise (it's free!)

Axon Enterprise's outlook anticipates $4.6 billion in revenue and $476.0 million in earnings by 2028. This implies a 24.3% annual revenue growth rate and a $149.7 million increase in earnings from the current $326.3 million level.

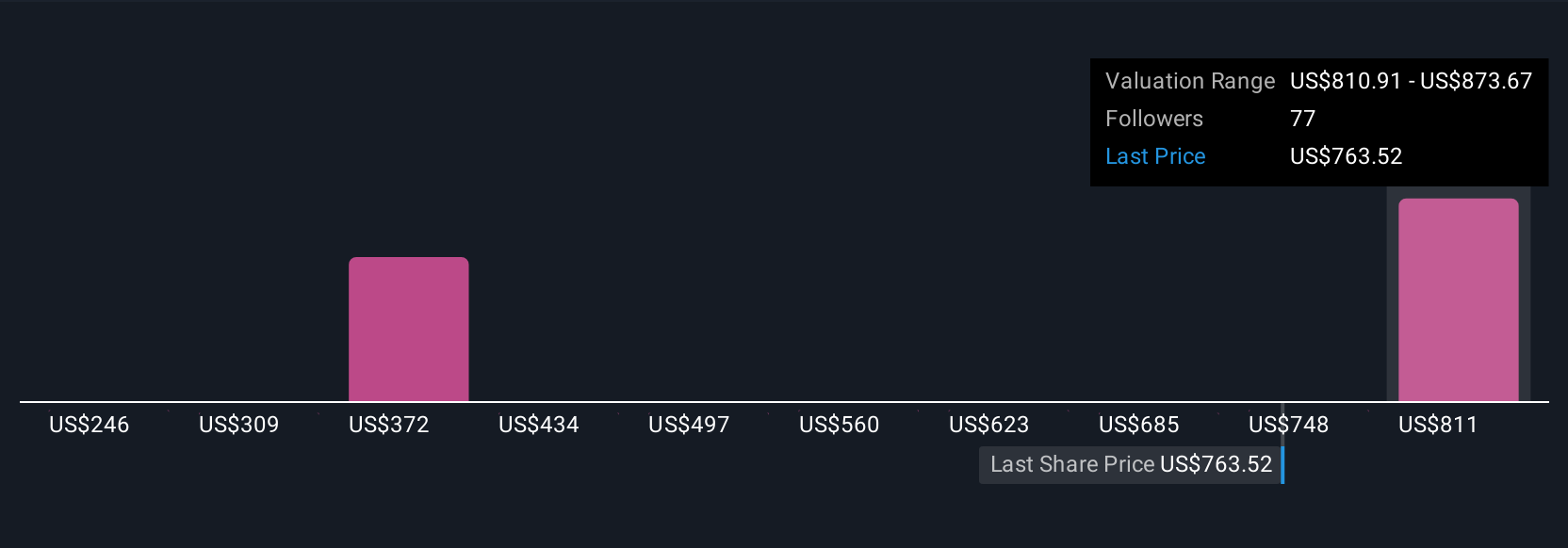

Uncover how Axon Enterprise's forecasts yield a $822.50 fair value, a 56% upside to its current price.

Exploring Other Perspectives

Nine Simply Wall St Community members estimate Axon's fair value to range from US$404,000 to US$835,000 per share, reflecting wide differences in views. With regulatory and privacy risks in focus, your outlook on adoption could shape how you interpret this spread, see more contrasting opinions from the community.

Explore 9 other fair value estimates on Axon Enterprise - why the stock might be worth as much as 58% more than the current price!

Build Your Own Axon Enterprise Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Axon Enterprise research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Axon Enterprise research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Axon Enterprise's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AXON

Axon Enterprise

Develops, manufactures, and sells conducted energy devices (CEDs) under the TASER brand in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success