- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AVAV

The Price Is Right For AeroVironment, Inc. (NASDAQ:AVAV) Even After Diving 27%

AeroVironment, Inc. (NASDAQ:AVAV) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 41%, which is great even in a bull market.

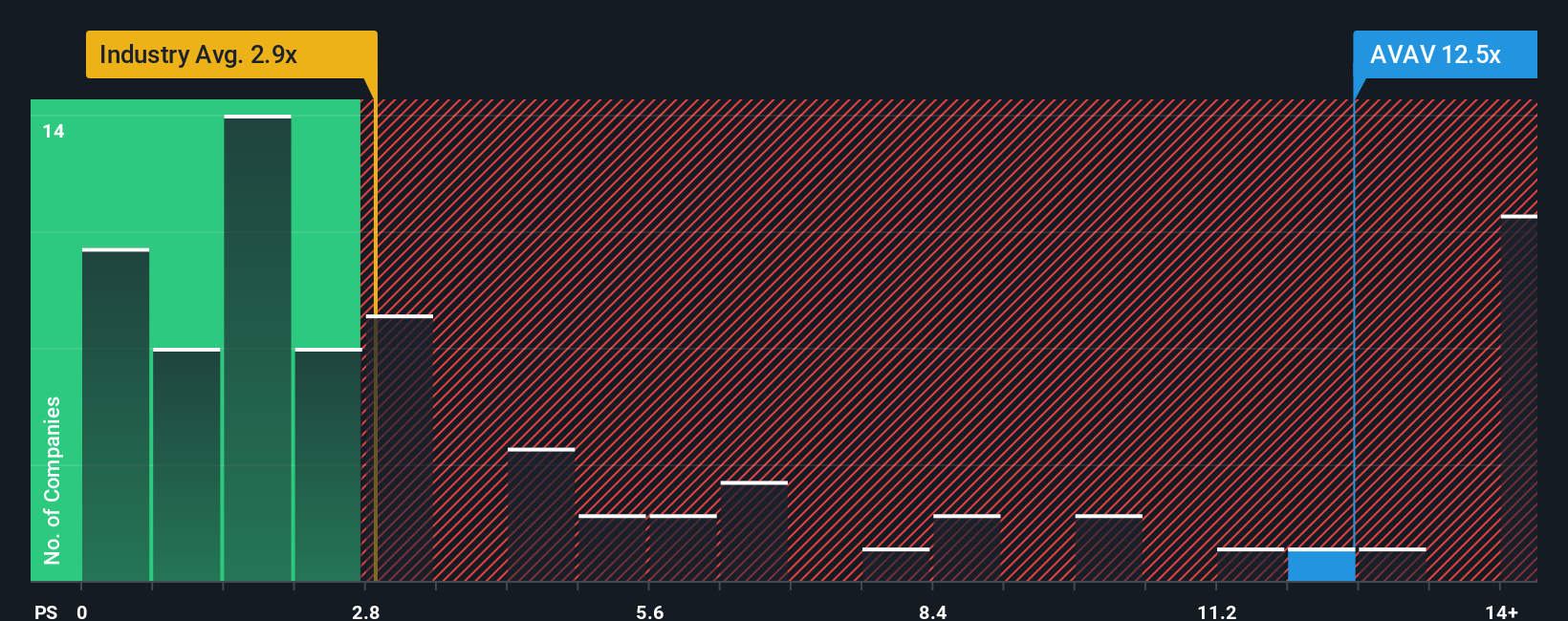

Although its price has dipped substantially, given around half the companies in the United States' Aerospace & Defense industry have price-to-sales ratios (or "P/S") below 2.9x, you may still consider AeroVironment as a stock to avoid entirely with its 12.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for AeroVironment

How Has AeroVironment Performed Recently?

With revenue growth that's superior to most other companies of late, AeroVironment has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think AeroVironment's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For AeroVironment?

In order to justify its P/S ratio, AeroVironment would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 44% gain to the company's top line. Pleasingly, revenue has also lifted 140% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 92% during the coming year according to the analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 9.7%, which is noticeably less attractive.

With this information, we can see why AeroVironment is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On AeroVironment's P/S

Even after such a strong price drop, AeroVironment's P/S still exceeds the industry median significantly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that AeroVironment maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Aerospace & Defense industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 2 warning signs for AeroVironment (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AVAV

AeroVironment

Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives