- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AVAV

Is AeroVironment’s 124% Surge Justified After New Defense Contracts?

Reviewed by Bailey Pemberton

- Wondering if AeroVironment is a smart buy or heading for turbulence? If you are curious about whether the recent buzz matches the stock’s true value, you are in good company.

- The stock grabbed attention with a 124.2% year-to-date gain, even after pulling back 7.9% over the last week and 10.5% over the past month.

- Recent headlines have focused on AeroVironment’s continued role in supplying advanced drone technology to defense clients, with new contracts fueling investor optimism. As drone and military tech remain in the spotlight globally, the company is front and center in the conversation.

- Despite the excitement, AeroVironment currently scores a 0 out of 6 on our valuation check. This means all six valuation measures suggest the stock is not currently undervalued. Next, we will break down what these approaches actually tell us, and later in the article, we will share an even smarter way to evaluate whether AeroVironment is really worth its price tag.

AeroVironment scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: AeroVironment Discounted Cash Flow (DCF) Analysis

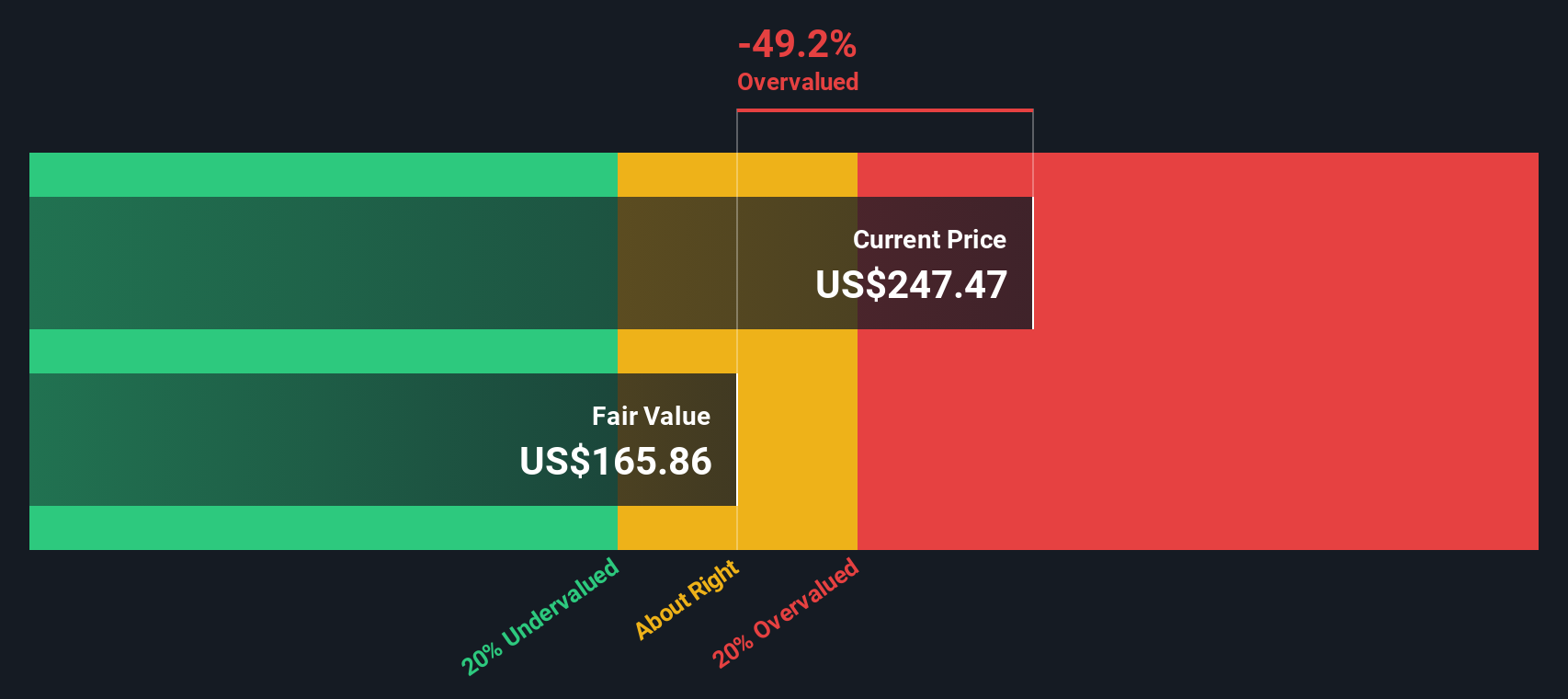

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. This approach aims to reveal what the business is really worth, based on how much cash it can generate over time.

For AeroVironment, the current Free Cash Flow (FCF) sits at -$193.8 million, reflecting recent investments or operational challenges. Analysts forecast future growth, with the company's FCF expected to reach $234.6 million in 2028. Looking further ahead, projections indicate steady annual increases, with estimates suggesting FCF could climb to around $600.9 million by 2035. These longer-term numbers are based on a mix of analyst forecasts for the next five years, with further growth extrapolated from industry trends.

Taking these projections into account, the DCF model calculates an intrinsic value of $185.62 per share for AeroVironment. When compared to the current market price, this valuation implies the stock is trading at an 88.9% premium to its calculated fair value. This signals it is substantially overvalued according to this approach.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AeroVironment may be overvalued by 88.9%. Discover 838 undervalued stocks or create your own screener to find better value opportunities.

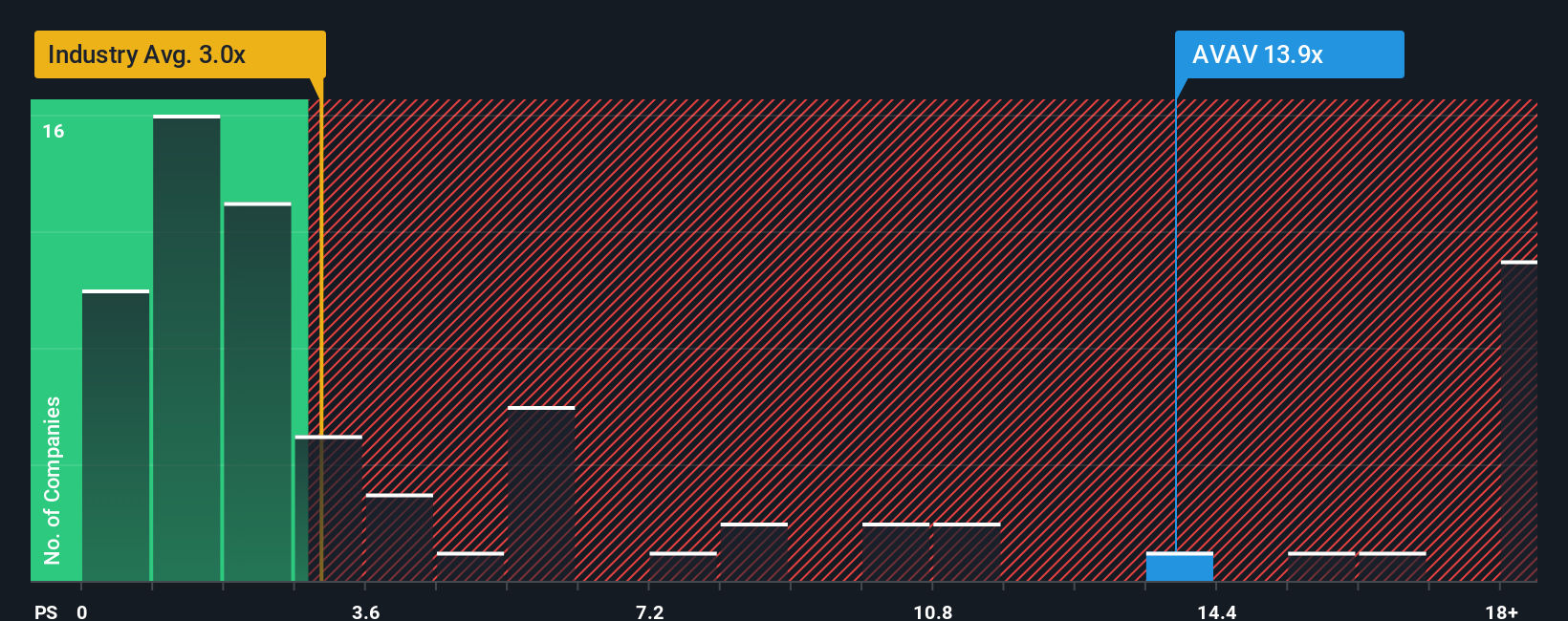

Approach 2: AeroVironment Price vs Sales

The price-to-sales (P/S) ratio is a popular metric for valuing companies, especially those in growth phases or with volatile earnings, as it focuses on revenue instead of profits. This makes it useful for assessing AeroVironment, given its investment-heavy growth and rapidly evolving financial profile.

Growth expectations and perceived risk play a big part in what makes a "normal" or "fair" P/S ratio for any stock. High-growth companies and those with expanding margins often trade at higher multiples, while riskier or more mature companies usually warrant lower ratios.

At present, AeroVironment trades at a P/S ratio of 16.1x. This is much higher than the aerospace and defense industry average of 3.2x and the peer group average of 6.7x. On the surface, that steep premium might look concerning.

Simply Wall St introduces a "Fair Ratio" for each company, blending expected growth, margins, risks, industry dynamics, and market cap to produce a more tailored benchmark. In AeroVironment’s case, the Fair Ratio stands at 6.0x, which reflects what a rational investor might pay for the stock’s sales given its specific circumstances.

Unlike basic industry or peer averages, the Fair Ratio is customized to capture the nuances that make AeroVironment unique, rather than painting every stock in the sector with the same brush.

Since AeroVironment's P/S ratio of 16.1x is well above the Fair Ratio of 6.0x, the stock appears significantly overvalued using this approach.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AeroVironment Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your personal story or perspective about a company, connecting your beliefs about AeroVironment's future, such as its earnings, revenues, and business direction, with a financial forecast and a fair value estimate.

Rather than just looking at static ratios or analyst targets, Narratives empower you to express exactly how and why you think the numbers will play out, linking the company’s story straight to a clear, dynamic valuation. On Simply Wall St’s Community page, millions of investors use this tool to quickly build their own case with just a few clicks, choosing growth assumptions, margins, or risk factors to reflect what they believe drives AeroVironment’s future.

This process makes it much easier to decide when to buy or sell by comparing your estimated Fair Value to the current market Price. As news, earnings, or events unfold, Narratives update automatically so your view always reflects the latest information.

For example, some investors using Narratives see AeroVironment's rapid global expansion, ambitious AI integration, and strong contract wins and set a Fair Value as high as $409 per share, while others, more concerned about competition, reliance on U.S. contracts, or margin pressures, calculate a much more conservative value of $225.

Do you think there's more to the story for AeroVironment? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAV

AeroVironment

Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives