- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AVAV

How the Pentagon Drone Deal Impacts AeroVironment Stock Amid Record 2025 Gains

Reviewed by Bailey Pemberton

If you have been eyeing AeroVironment stock lately, you are not alone; chances are, you are asking yourself the same thing as many investors: what should I actually do with these shares, especially after such an incredible run? AeroVironment has been a standout in the aerospace and defense sector, not only capturing headlines with its cutting-edge technologies, but also capturing returns that make even seasoned investors pause.

Let’s talk about those numbers. Over just the last week, the stock recorded a 4.7% gain. Zoom out to the past month and you are looking at a remarkable 58.8% increase. The year-to-date chart is even more dramatic, with the stock up 150.7%. Over the longer term, the returns are just as striking: 82.1% over one year and a jaw-dropping 423.1% over the past five years. A series of market developments, including growing demand for unmanned aerial vehicles and shifting geopolitical priorities, have fueled optimism about AeroVironment’s long-term potential and helped to reshape how investors judge the company’s risk and growth profile.

But here is where the conversation gets interesting. When we turn to standard valuation checks, AeroVironment scores a 0 out of 6 for being undervalued. In other words, by these traditional measures, none suggest the stock is trading below its intrinsic worth. So how do we square that lack of “value” stamp with the stock’s runaway performance? That is exactly what we will dive into next, starting with a breakdown of common valuation approaches and building toward a smarter way to evaluate a high-flyer like AeroVironment.

AeroVironment scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: AeroVironment Discounted Cash Flow (DCF) Analysis

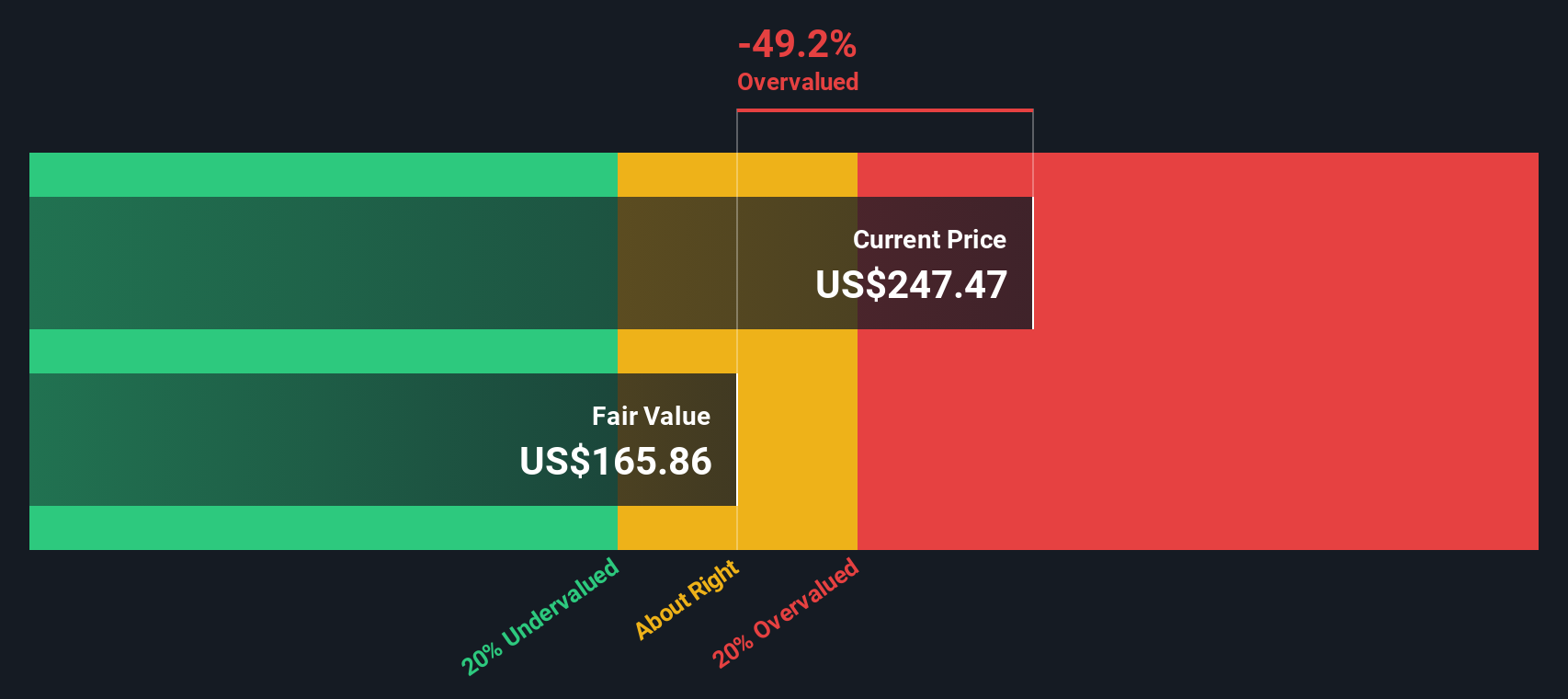

A Discounted Cash Flow (DCF) model estimates what a company is worth today based on projections of how much cash it will generate in the future, adjusted for the value of money over time. For AeroVironment, this approach uses two stages of cash flow: examining analyst estimates for the next few years and extrapolating future performance beyond that using realistic growth rates.

Looking at the latest numbers, AeroVironment's last twelve months of Free Cash Flow (FCF) stands at negative $193.8 million, reflecting recent investments and growth spending. Analyst forecasts predict the FCF will rise significantly, reaching $234.6 million by 2028. Extended projections, which stretch out to 2035 and incorporate expected industry trends, also suggest steady growth in AeroVironment's cash generation capacity over the next decade.

Based on these cash flow projections, the DCF model calculates an estimated intrinsic value of $171.77 per share. With the DCF-implied discount showing the stock is trading at 128.4 percent above its intrinsic value, this suggests AeroVironment is currently priced well above what its future cash flows would justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests AeroVironment may be overvalued by 128.4%. Find undervalued stocks or create your own screener to find better value opportunities.

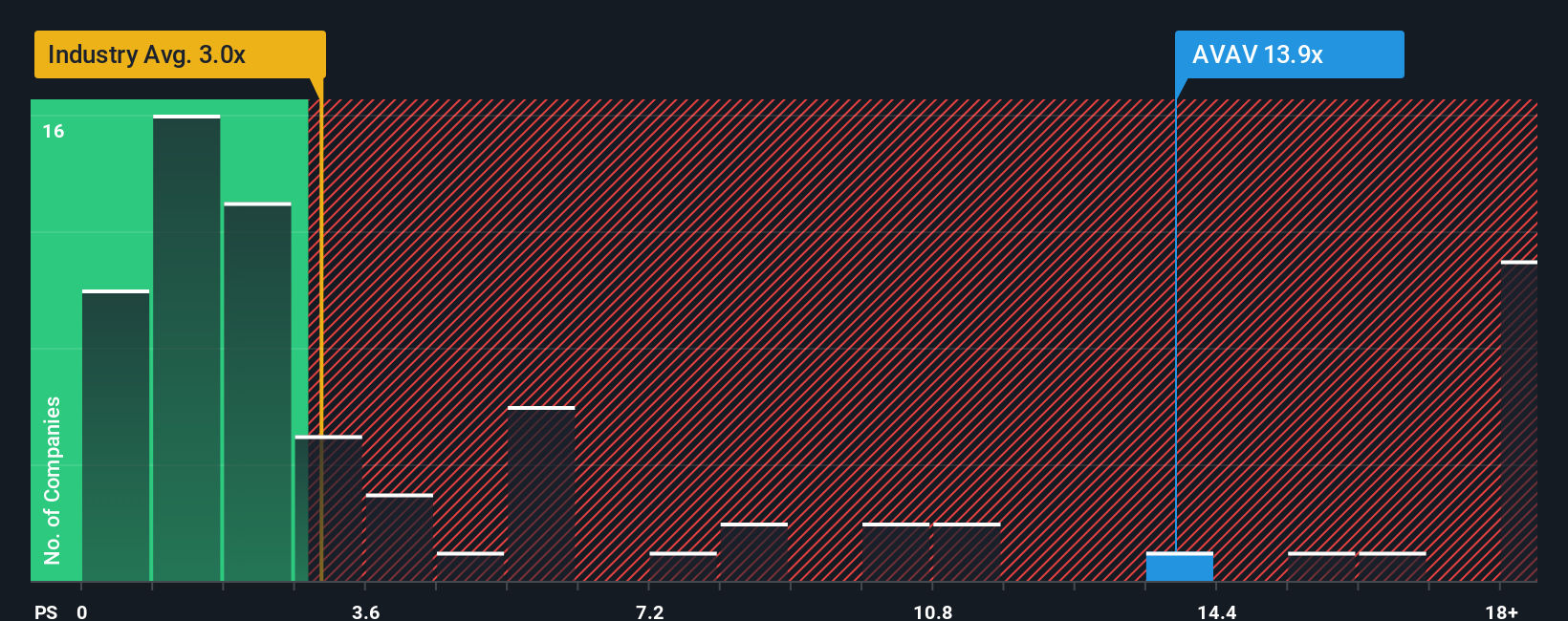

Approach 2: AeroVironment Price vs Sales (P/S)

For many companies in the growth phase, especially those that may not yet be consistently profitable, the Price-to-Sales (P/S) ratio is a helpful way to gauge valuation. This multiple lets investors judge how much they are paying for each dollar of sales, which is particularly relevant for AeroVironment, as its business is rapidly expanding and reinvesting for future growth.

Growth expectations and risk are fundamental drivers of what a “normal” or “fair” P/S ratio should be. Fast-growing or lower-risk companies generally command higher multiples because investors are willing to pay more today for anticipated future expansion. If growth slows or risks rise, a lower multiple is typical.

Right now, AeroVironment's P/S ratio stands at 17.96x. For context, the average P/S among U.S. Aerospace & Defense peers is around 7.43x. The broader industry average is even lower at 3.25x. Clearly, AeroVironment is trading well above these benchmarks, signaling high expectations from the market.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio for AeroVironment is calculated at 5.80x. Unlike plain comparisons to peers or industry averages, the Fair Ratio adjusts for company-specific factors such as revenue growth, profit margins, size, and risks. This means it more accurately reflects what investors should reasonably pay for AeroVironment's unique profile.

Comparing AeroVironment's current 17.96x P/S ratio to its 5.80x Fair Ratio, the stock is trading far above what would be considered fair based on its fundamentals and outlook. This suggests that the shares are overvalued even when accounting for growth potential and industry context.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your AeroVironment Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story—a personal point of view that connects what you know about a company to a financial forecast and, ultimately, to a fair value for the stock. Simply Wall St makes it easy for anyone to build and explore Narratives within the Community page, so you can anchor your investment decisions to more than just numbers. Narratives help you decide when to buy or sell by comparing your fair value (derived from your own assumptions about future revenue, margins, and risks) to the current share price. They also continue to evolve as new news or earnings updates become available.

For AeroVironment, for example, some investors set a bullish Narrative, believing breakthrough contracts and global military demand will drive a fair value as high as $335 per share. Others, more cautious about government budgets or competition, set their fair value closer to $225 per share. Narratives give investors a dynamic and transparent way to weigh the upside, the risks, and the path between, making investment decisions smarter and more personalized than ever.

Do you think there's more to the story for AeroVironment? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAV

AeroVironment

Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives