- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:AVAV

AeroVironment (AVAV): Assessing Valuation After Strategic Move to Standardize AV_Halo Command With OpenJAUS Collaboration

Reviewed by Simply Wall St

AeroVironment (AVAV) just announced a new collaboration with OpenJAUS to integrate the JAUS standard into its AV_Halo Command platform. This move provides streamlined and unified control to uncrewed systems across manufacturers, making it easier for defense operators to manage complex platforms.

See our latest analysis for AeroVironment.

After integrating the JAUS standard with AV_Halo Command, AeroVironment continues to build momentum, fresh off a $95.9 million Army contract for its LRKI missile program and several successful live-fire technology demonstrations. The stock's upward run is clear. Its share price return is up 133% year-to-date and 39% over the past 90 days, while the total shareholder return stands at 66% in the past year and a massive 336% over three years. This signals strong long-term confidence and rapid recent acceleration.

With growth and innovation top of mind for many investors, now could be a great time to explore the full landscape of defense and aerospace leaders with our See the full list for free.

But with AVAV riding a wave of contract wins and rapid innovation, is its impressive share price growth justified by fundamentals, or has the market already factored in all future momentum, potentially leaving little room for further upside?

Most Popular Narrative: 10.7% Undervalued

With AeroVironment’s most followed narrative assigning a fair value of $409 per share, compared to the latest close at $365.08, the market may be underappreciating the potential pinned on long-term growth drivers. Attention now turns to the assumptions and vision underlying this valuation.

The company’s strategic focus on developing modular, interoperable, and software-defined platforms, including the newly launched AV Halo open software ecosystem, directly aligns with the accelerating adoption of AI-powered autonomy and network-centric warfare. This approach could enable future premium pricing, increased service revenues, and gross margin expansion as these high-value platforms are deployed at scale.

Want to see what’s fueling this bullish view? The narrative is built on bold leaps in future revenue, margin expansion and enormous projected earnings growth. Find out the real numbers and the high-stakes assumptions behind this eye-catching fair value.

Result: Fair Value of $409 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on U.S. defense contracts and intense competition could quickly challenge AeroVironment’s growth narrative if market conditions change.

Find out about the key risks to this AeroVironment narrative.

Another View: Multiples Suggest Caution

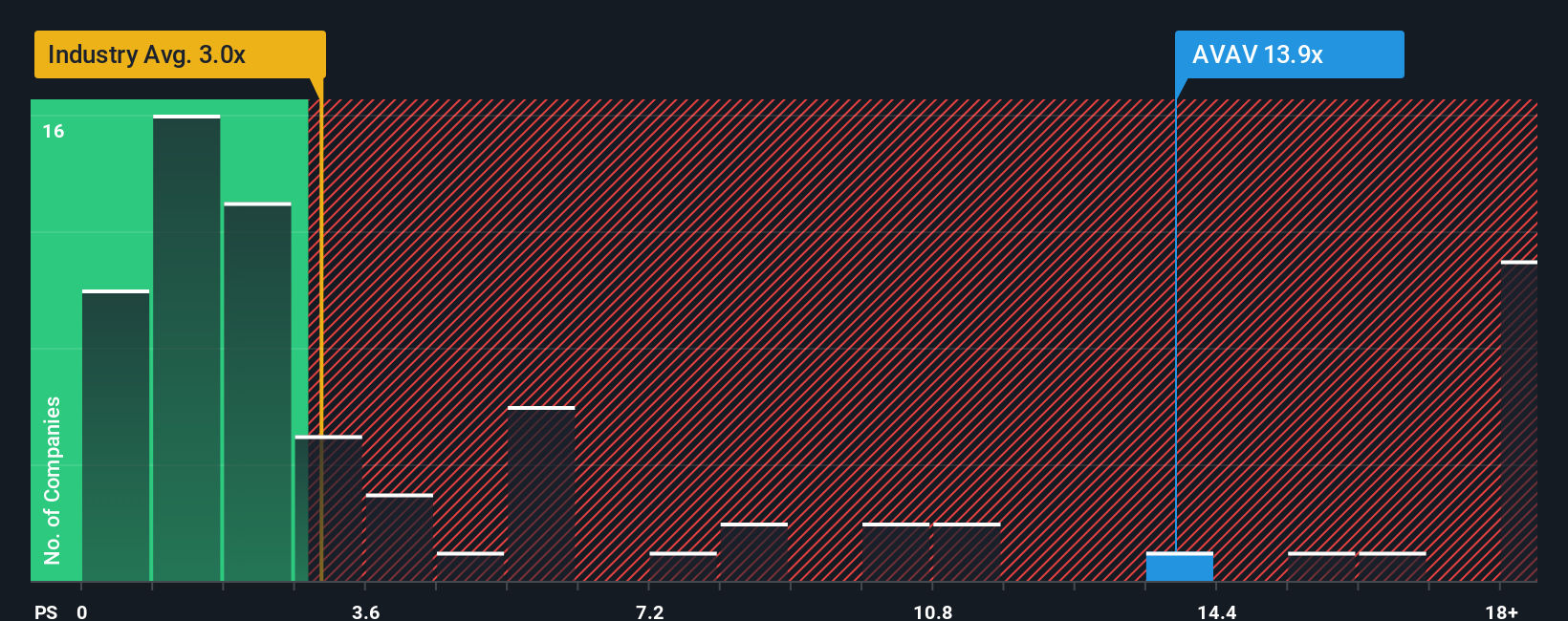

While the fair value narrative points to undervaluation, our market multiples tell a different story altogether. AeroVironment’s price-to-sales ratio is a lofty 16.7x, far higher than the 3.1x industry average, the 7.1x peer average, and the 6x fair ratio we would expect the market to move toward. This wide premium means investors may be buying into a lot of optimism. Is there more risk lurking here than first meets the eye?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AeroVironment Narrative

If you have a different perspective or want to test your own assumptions, dive into the figures and build a custom AeroVironment story for yourself in just a few minutes. Do it your way

A great starting point for your AeroVironment research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for one story when they can seize the next big opportunity. Don’t let the market move on without you. See which stocks have strong upside potential.

- Unlock the potential of breakthrough AI with these 27 AI penny stocks, which are driving innovation across the market and helping shape tomorrow’s technologies.

- Power up your passive income strategy by tapping into these 20 dividend stocks with yields > 3%, offering reliable yields above 3% for your portfolio.

- Ride the wave of the digital revolution and access these 82 cryptocurrency and blockchain stocks, leading advances in secure payments and blockchain technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVAV

AeroVironment

Designs, develops, produces, delivers, and supports a portfolio of robotic systems and related services for government agencies and businesses in the United States and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives