- United States

- /

- Aerospace & Defense

- /

- NasdaqGS:ATRO

Astronics (ATRO): Losses Narrow by 46.7% Annually, Undervalued vs Peers Heading Into Earnings

Reviewed by Simply Wall St

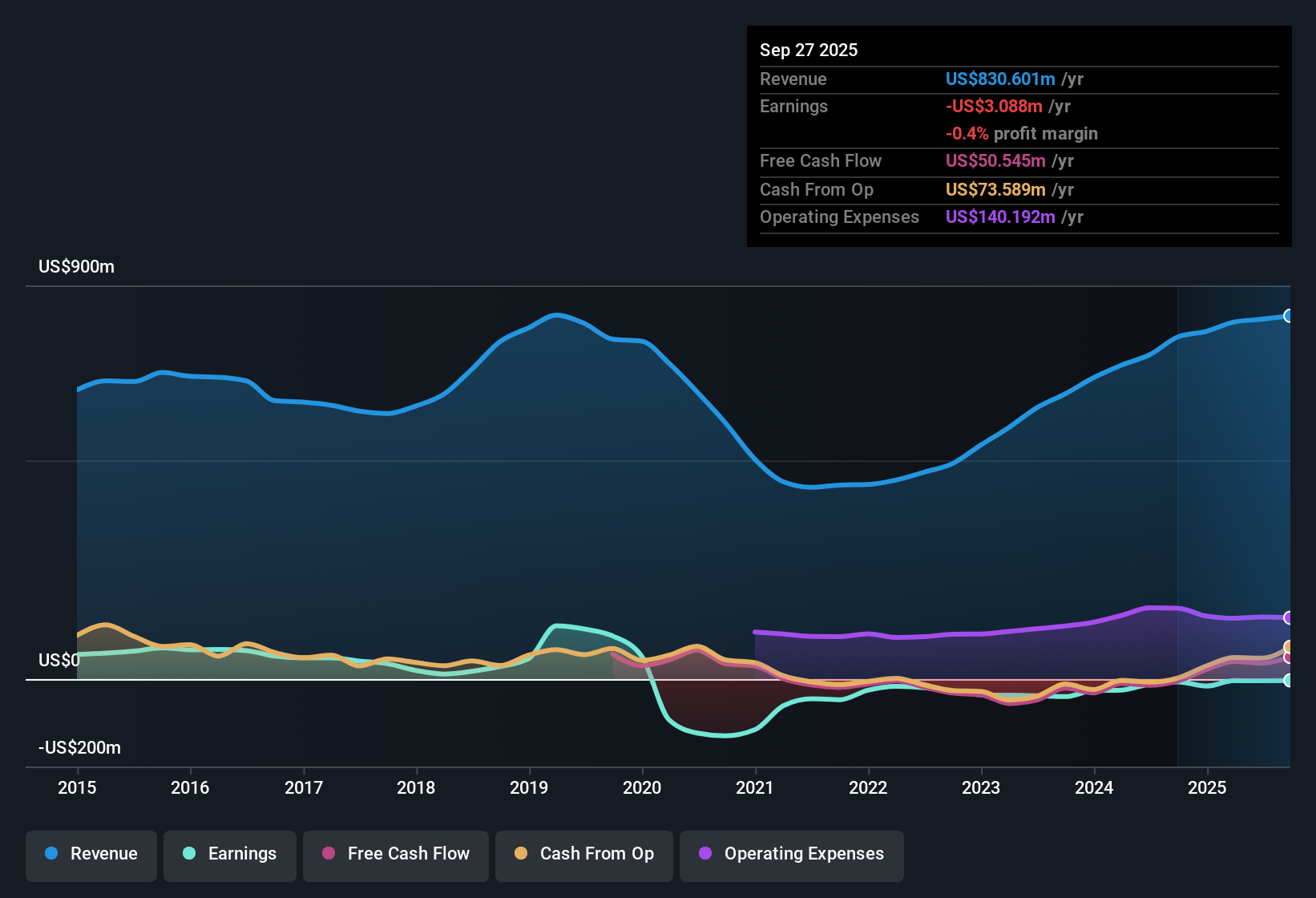

Astronics (ATRO) has cut its losses at a brisk pace, managing to shrink its net loss by an average of 46.7% per year over the past five years. Revenue is forecast to grow 7.1% annually, coming in below the broader US market's 10.5% per year outlook. With its stock price at $47.35, trading just under the estimated fair value of $47.49, the company’s 2x Price-To-Sales Ratio is noticeably lower than its industry and peer averages. While ATRO remains unprofitable, investors might find encouragement in its improving loss trajectory and favorable valuation multiples. However, caution will linger around its modest revenue expectations and ongoing profitability challenges.

See our full analysis for Astronics.The next section takes these numbers and compares them to the leading narratives among investors. It highlights where expectations hold true and where they might need a rethink.

See what the community is saying about Astronics

Margins Target a 9% Upswing

- Analysts project profit margins will climb from -0.5% today to 9.0% over the next three years, marking a significant improvement in Astronics' underlying profitability profile.

- The analysts' consensus view highlights strategic moves seen as margin drivers, such as:

- Portfolio optimization and focus on higher-margin aerospace segments, which are credited with supporting a lasting increase in net margins,

- Acquisition-driven gains like enhanced FAA certification capability that could translate into more recurring high-value contracts.

- Consensus analysts note that cost discipline and simplification initiatives are expected to deliver further margin expansion, even as the company moves beyond restructuring costs that previously compressed profitability.

- Despite this margin outlook, consensus also warns that portfolio realignment and restructuring actions, if managed poorly, could create near-term pressure. Margin recovery remains tightly tied to execution quality.

Consensus narrative links Astronics' margin rebound to its tighter business focus and improved certification wins. See how analyst views stack up in the deeper consensus case. 📊 Read the full Astronics Consensus Narrative.

Tariffs and Execution Risks Loom Large

- Major risk headwinds include new tariffs, which could add $15 to $20 million in additional annualized costs, and exposure to future losses in the Test segment following past execution missteps and UK patent litigation.

- Bears argue that sustained exposure to trade tariffs, program delays (especially in Boeing 737 and test programs), and ongoing restructuring could destabilize earnings, with:

- At least a quarter of tariffs difficult to migrate away from China, directly threatening net margins, and

- Recent infrastructure streamlining setting up near-term costs and possible interruptions to recurring revenue streams.

- Critics highlight the material adverse impact of IP litigation, as seen with a $21.6 million payout for a UK patent dispute, as a reminder that one-off legal costs can rapidly erode cash reserves and profitability.

- The consensus narrative further stresses that the company's heavy reliance on commercial aerospace cycles, estimated at 85 to 90 percent of total revenues, leaves results acutely vulnerable to industry shocks.

Valuation: DCF and Peer Discount

- Astronics trades at $47.35, almost exactly aligned with its DCF fair value estimate of $47.49, and carries a Price-To-Sales Ratio of 2x, which is below both industry and peer averages.

- Consensus analysts believe the current market price reflects fair value expectations, as the average analyst price target of 54.33 does not imply significant upside from current levels. Any outperformance would need delivery on margin expansion and risk mitigation targets, while underperformance could quickly expose valuation downside.

- Analysts point out that a future PE ratio of 19.7x (if 2028 earnings are achieved) would still see Astronics valued under the current industry average of 34.4x, suggesting room for rerating if margin and growth initiatives succeed.

- However, with consensus only 4.6 percent above today’s price, the market is pricing in cautious optimism rather than strong conviction.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Astronics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something else in the numbers? Turn your insight into a fresh perspective and craft your own narrative in just minutes. Do it your way

A great starting point for your Astronics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite a promising margin recovery, Astronics faces unpredictable profits, heavy reliance on commercial aerospace cycles, and risks from tariffs, litigation, and recent restructuring.

If recurring setbacks and volatile earnings make you hesitate, consider screening for steady performers with consistent growth and resilience using stable growth stocks screener (2073 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ATRO

Astronics

Through its subsidiaries, designs and manufactures products for the aerospace, defense, and electronics industries in the United States, rest of North America, Asia, Europe, South America, and internationally.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives