- United States

- /

- Machinery

- /

- NasdaqGS:ASTE

Astec Industries, Inc. (NASDAQ:ASTE) Could Be Riskier Than It Looks

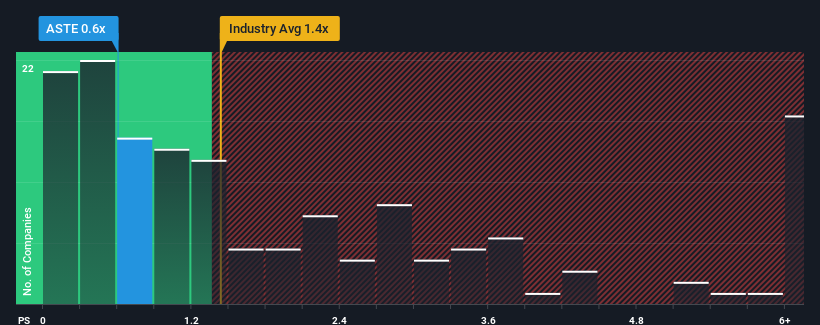

With a price-to-sales (or "P/S") ratio of 0.6x Astec Industries, Inc. (NASDAQ:ASTE) may be sending bullish signals at the moment, given that almost half of all the Machinery companies in the United States have P/S ratios greater than 1.4x and even P/S higher than 4x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Our free stock report includes 2 warning signs investors should be aware of before investing in Astec Industries. Read for free now.See our latest analysis for Astec Industries

What Does Astec Industries' Recent Performance Look Like?

Astec Industries' negative revenue growth of late has neither been better nor worse than most other companies. One possibility is that the P/S ratio is low because investors think the company's revenue may begin to slide even faster. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders may feel hopeful about the share price if the company's revenue continues tracking the industry.

Want the full picture on analyst estimates for the company? Then our free report on Astec Industries will help you uncover what's on the horizon.How Is Astec Industries' Revenue Growth Trending?

In order to justify its P/S ratio, Astec Industries would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 2.5%. Regardless, revenue has managed to lift by a handy 19% in aggregate from three years ago, thanks to the earlier period of growth. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth will show minor resilience over the next year growing only by 4.0%. Meanwhile, the broader industry is forecast to contract by 1.7%, which would indicate the company is doing better than the majority of its peers.

With this in consideration, we find it intriguing that Astec Industries' P/S falls short of its industry peers. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Astec Industries currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. When we see a superior revenue outlook with some actual growth, we can only assume investor uncertainty is what's been suppressing the P/S figures. Amidst challenging industry conditions, a key concern is whether the company can sustain its superior revenue growth trajectory. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Astec Industries that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ASTE

Astec Industries

Designs, engineers, manufactures, markets, and services equipment and components used primarily in road building and related construction activities worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives