- United States

- /

- Machinery

- /

- NasdaqGS:ASTE

Astec Industries (ASTE) Swings to Profit, One-Off Loss Clouds Narrative on Earnings Recovery

Reviewed by Simply Wall St

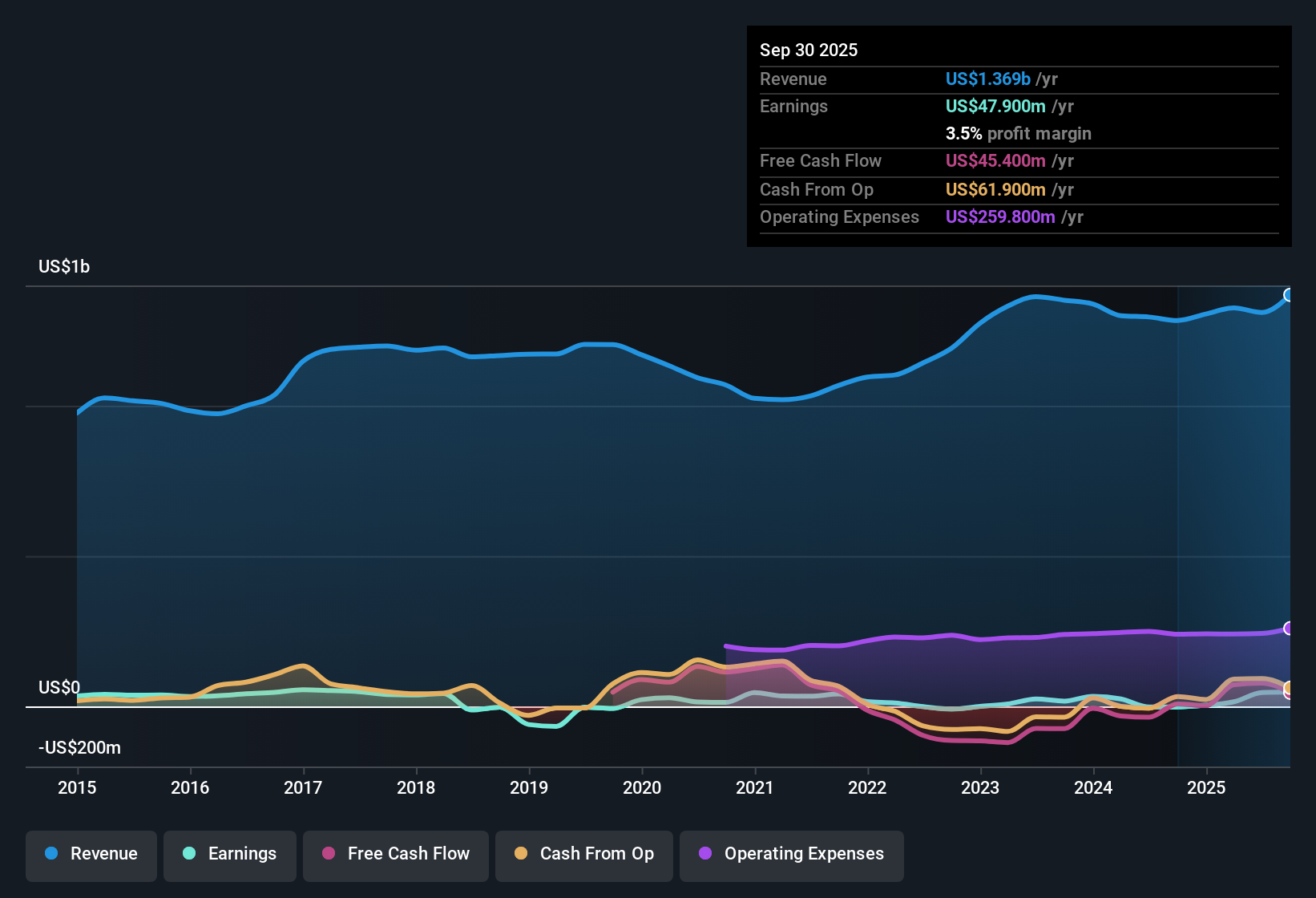

Astec Industries (ASTE) reported a major turnaround, achieving profitability for the period and breaking from a trend of 13.5% annual earnings declines over the past five years. While earnings are forecast to accelerate at 28.2% per year, well ahead of the US market's 16%, revenue growth is expected to be slower at 5.2% per year compared to the market’s 10.5%. Investors are weighing the positive earnings outlook against a recent one-off $38.7 million loss that clouds near-term profit clarity. However, the company’s favorable price-to-earnings ratio of 22.6x and shares trading below an estimated fair value of $50.24 add support to the bull case.

See our full analysis for Astec Industries.Next, we will see how these headline results compare with the most widely held narratives about Astec Industries. We will spot where the numbers support expectations and where they might surprise.

See what the community is saying about Astec Industries

Backlog Stays Strong Amidst Slower Top-Line Growth

- Analysts project Astec Industries will grow revenue by 7.4% each year for the next three years, even though current annual revenue growth is only expected to be 5.2% per year.

- According to the analysts' consensus view, momentum in infrastructure spending and large-scale project demand supports this robust backlog.

- The ongoing rollout of U.S. infrastructure bills and accelerating orders for both concrete and asphalt equipment are expected to drive a multi-year period of stable topline expansion.

- However, since growth is still slower than the US market average of 10.5% per year, analysts are alert to lingering risks from project timing, dealer caution, and Astec’s heavy U.S. exposure, which may cap upside compared to more diversified peers.

Consensus narrative suggests Astec’s future hinges on sustained U.S. infrastructure demand. See how narrative sentiment stacks up against these projections. 📊 Read the full Astec Industries Consensus Narrative.

Profit Margins Expected to Expand as Operational Improvements Take Hold

- Forecasts show net profit margin expanding from 3.5% now to 4.2% over three years, which extends a positive bottom-line trend even as revenue growth lags the market.

- Analysts' consensus view highlights two major drivers for this expected lift:

- Margin gains are likely to come from operational excellence initiatives, including manufacturing optimization and Lean practices, as well as the recently closed TerraSource acquisition, which delivers high-margin, recurring aftermarket parts revenue with an 80% gross margin.

- Still, analysts remind investors that macroeconomic and legislative headwinds, along with challenges in integrating new businesses, could limit the pace or scale of these improvements.

Valuation Advantage Anchored by Reasonable Multiples and Discount to DCF Fair Value

- The current share price of $45.37 trades below the DCF fair value of $50.24 and under the consensus analyst price target of $54.50, while Astec’s 22.6x price-to-earnings ratio is lower than the machinery industry’s 24.0x. This suggests a meaningful valuation cushion for new investors.

- Analysts' consensus sees this valuation discount as justified by solid expected earnings growth and margin gains.

- At the same time, they note that relying too heavily on U.S. market momentum and integrating new high-margin businesses carries enough execution risk to warrant caution.

- The small gap between today’s share price and both fair value and price target implies that much of the good news might already be reflected in the price, so the market may be waiting on clear progress before rerating the stock higher.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Astec Industries on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got another take on the latest figures? Share your perspective and craft your own narrative about Astec Industries in just a few minutes. Do it your way

A great starting point for your Astec Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Astec Industries’ reliance on U.S. infrastructure demand, along with its slower revenue growth compared to the broader market, signal a lack of consistent and stable expansion.

If you want companies with a proven history of steady revenue and earnings instead of cyclical uncertainty, check out stable growth stocks screener (2074 results) for investment ideas that stand the test of time.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ASTE

Astec Industries

Designs, engineers, manufactures, markets, and services equipment and components used primarily in road building and related construction activities worldwide.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives