- United States

- /

- Electrical

- /

- NasdaqGM:ARRY

Is It Time To Reassess Array Technologies (ARRY) After Recent Solar Sector Sentiment Shift

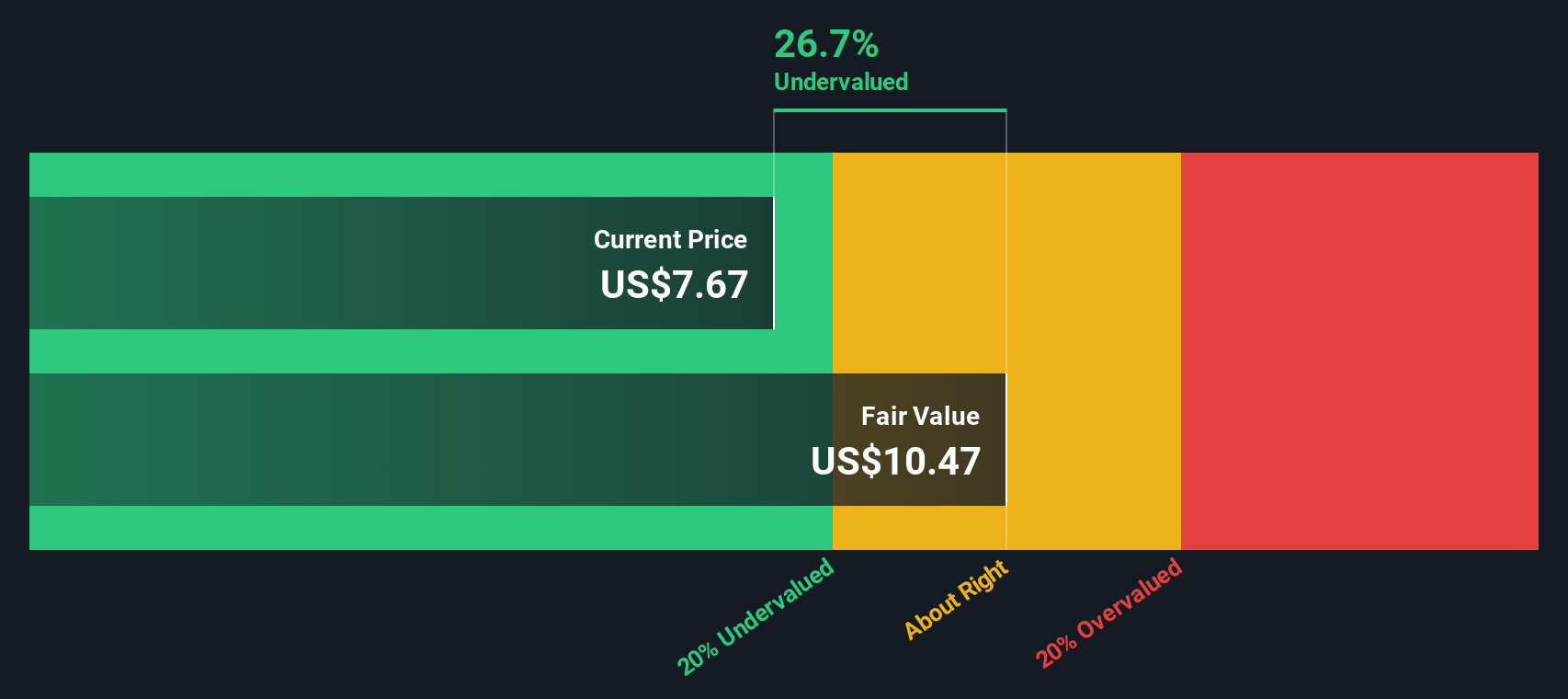

- If you are wondering whether Array Technologies stock still offers value at around US$10.00, the key question is how its current price lines up against what the business may be worth.

- The share price performance has been mixed, with returns of 5.3% over 7 days, 17.4% over 30 days, 3.3% year to date, a 48.1% gain over 1 year, and weaker returns over 3 and 5 years at 57.6% and 79.3% declines.

- Recent news coverage has focused on Array Technologies as investors reassess solar related names and sentiment around renewable infrastructure suppliers. This backdrop provides context for the recent moves in the share price and frames the question of whether current levels reflect opportunity or risk.

- On our checklist of six valuation tests, Array Technologies scores 4 out of 6, which highlights how different valuation methods judge the stock today and sets up a look at an even more useful way to think about value at the end of this article.

Approach 1: Array Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow, or DCF, model estimates what a company might be worth today by projecting its future cash flows and discounting them back to a present value.

For Array Technologies, the model used is a 2 Stage Free Cash Flow to Equity approach. The latest twelve month free cash flow is about $101.3 million. Analysts and internal estimates project free cash flow stepping up to around $132.6 million in 2026 and $162.7 million in 2027, with further projections out to $147.0 million in 2030, all expressed in dollars and then discounted back to today.

Adding these discounted cash flows together and including a longer term estimate gives an intrinsic value estimate of about $10.71 per share. With the stock recently trading around US$10.00, the model implies roughly a 6.6% discount to this DCF value, which is a relatively small gap.

Result: ABOUT RIGHT

Array Technologies is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

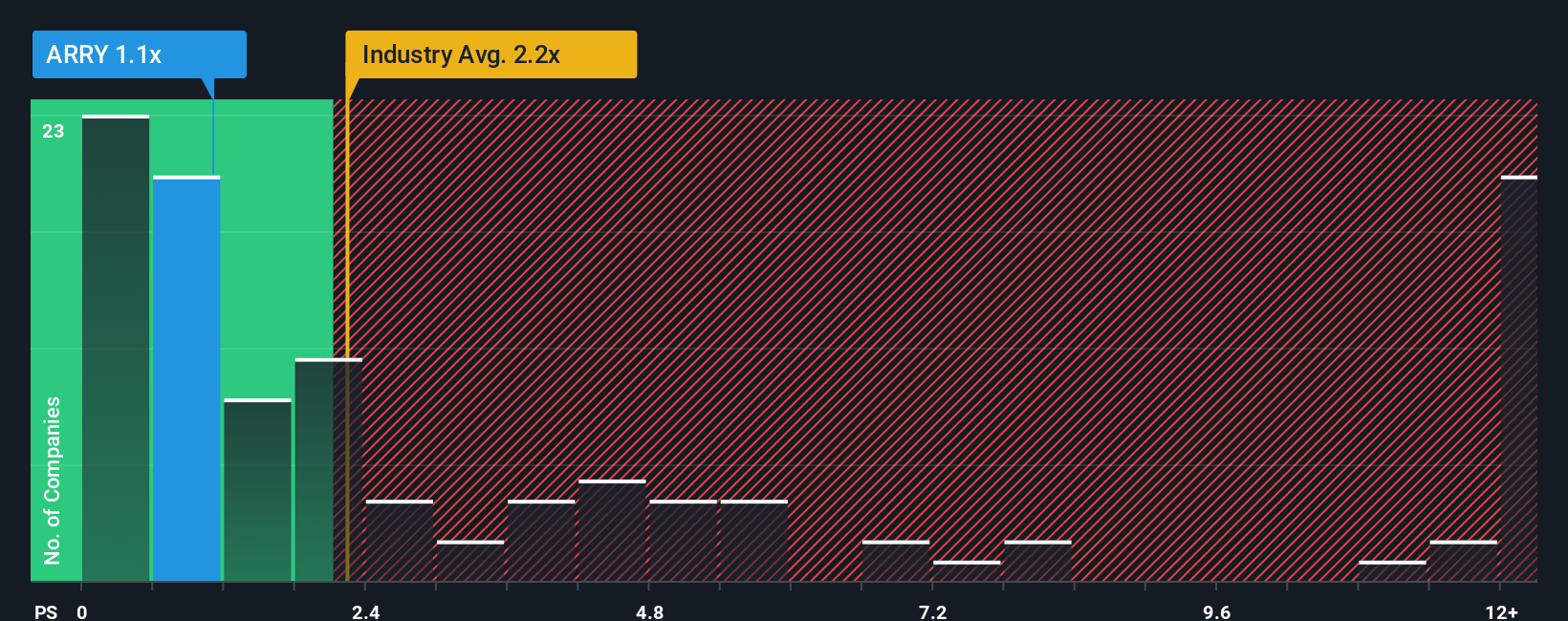

Approach 2: Array Technologies Price vs Sales

For a business like Array Technologies, where revenue is a key anchor for valuation, the P/S ratio is a practical way to think about what the market is paying for each dollar of sales. Investors generally accept a higher or lower P/S depending on what they expect for future growth and how much risk they see in the business, so there is no single "right" number.

Array Technologies currently trades on a P/S of 1.15x. That sits below the Electrical industry average P/S of 2.16x and the peer average of 2.24x, which suggests the stock is priced more cautiously than many of its peers. To go a step further, Simply Wall St calculates a proprietary "Fair Ratio" of 1.45x for Array Technologies. This metric aims to reflect the multiple that might make sense given factors such as earnings growth, profit margins, industry, market cap and specific risks, rather than just comparing to broad group averages.

Against this Fair Ratio of 1.45x, the current P/S of 1.15x is lower by about 0.30x, which points to the shares being priced below that modelled range.

Result: UNDERVALUED

P/S ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Array Technologies Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, which are simply your story about Array Technologies linked to a set of numbers like expected revenue, earnings, margins and a fair value. All of this is captured in an easy tool on Simply Wall St's Community page that helps you compare that fair value to today’s share price, react quickly as the Narrative auto updates with new news or earnings, and see how different investors can look at the same company in very different ways. For example, one investor might build a Narrative that lines up with a higher fair value around US$13.00 based on stronger execution and margin recovery. Another might build a more cautious Narrative closer to US$6.00 that gives more weight to policy risk and earnings volatility.

Do you think there's more to the story for Array Technologies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ARRY

Array Technologies

Engages in the manufacture and sale of solar tracking technology products in the United States, Spain, Brazil, Australia, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

Coca-Cola’s Enduring Moat in a Health-Conscious World: Steady Compounder Poised for 5-10% Annual Returns Through Emerging Market Dominance

Xero: Growth Was Priced In — Execution Is Not

Nu holdings will continue to disrupt the South American banking market

Recently Updated Narratives

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

Rocket Lab - Stock Narrative

Strong buy

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion