- United States

- /

- Electrical

- /

- NasdaqGM:ARRY

Array Technologies (ARRY) Soars 44% Over Last Month

Array Technologies (ARRY) announced the verification of its DuraTrack® and OmniTrack™ systems for 2,000-volt compatibility, reflecting its focus on enhancing solar efficiency and reducing costs. This announcement may have contributed to the company's impressive 44% price increase over the last month, supporting its leadership position in the solar sector. This price move occurred as the broader market indices hit all-time highs, with the S&P 500 and Nasdaq rising and inflation metrics ticking lower. While the general market trend was upward, Array's advancements in technology and alignment with industry standards likely added weight to its stock performance.

You should learn about the 1 weakness we've spotted with Array Technologies.

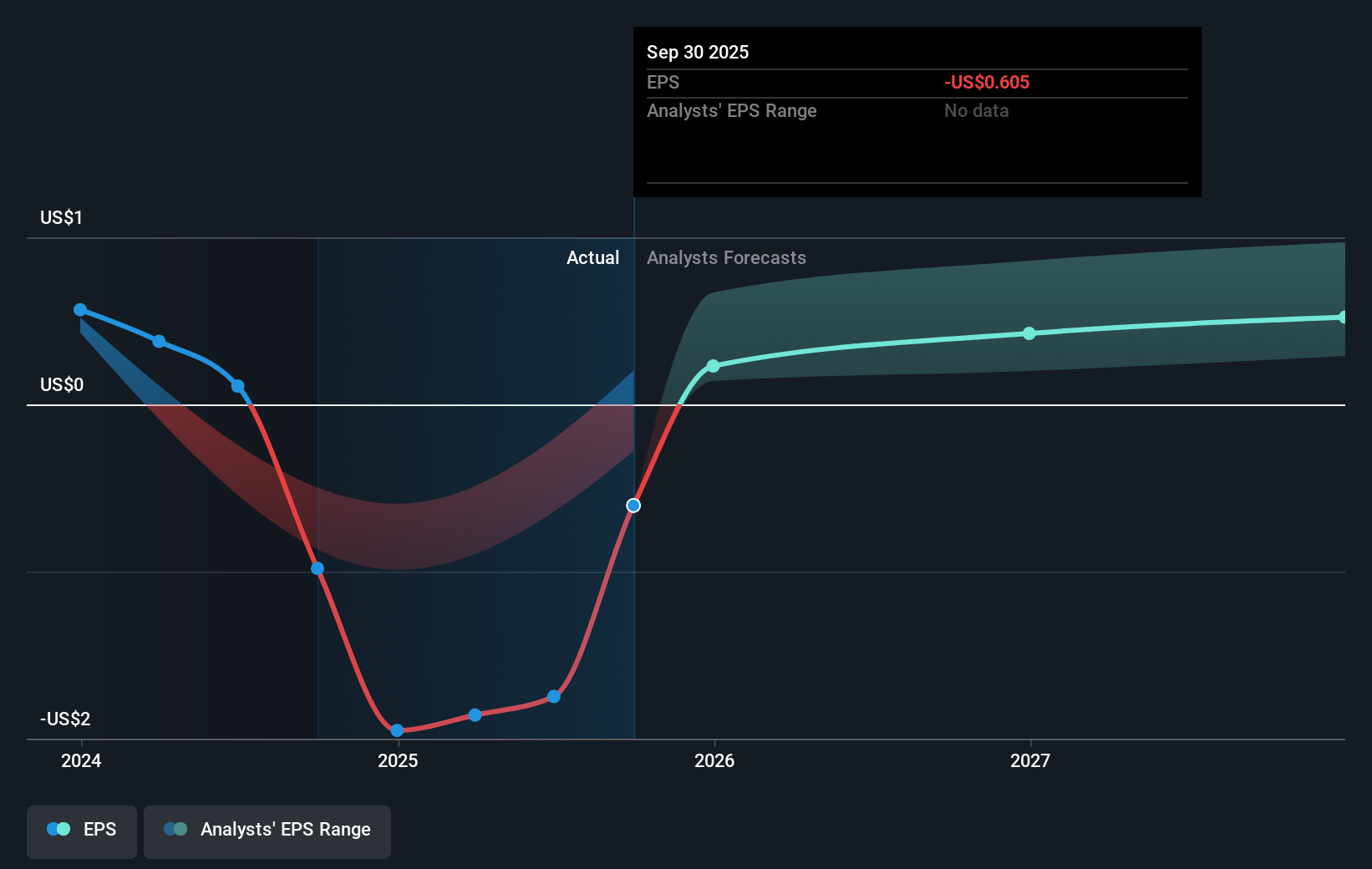

The recent verification of Array Technologies' DuraTrack and OmniTrack systems for 2,000-volt compatibility is a significant milestone that aligns well with the company's narrative of driving utility-scale solar growth through innovative products. This technological enhancement may bolster Array's competitive positioning and contribute positively to revenue and earnings forecasts. With analysts projecting an 8.6% annual revenue growth over three years, such innovations could further stabilize margins and enhance profitability projections, supporting the company's ongoing expansion and market share growth.

Over the past year, Array Technologies' total shareholder return was a substantial 39.19% driven by price movements rather than dividends. This performance trajectory contrasts with the previous 46.8% per year increase in losses over the past five years. Despite a challenging landscape, Array outperformed the overall US market, which returned 20.5%. However, it underperformed the US Electrical industry, which saw a 52% return.

Given the current share price of $7.92 and a consensus price target of approximately $9.30, the recent share price increase indicates confidence in the upcoming performance, although the difference from the price target remains modest. Investors are urged to consider these factors in their evaluations, especially in light of Array's ambitious international expansion and evolving product offerings, which could potentially reduce the share price discount to analyst targets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ARRY

Array Technologies

Manufactures and sells solar tracking technology products in the United States, Spain, Brazil, Australia, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Spotify - A Fundamental and Historical Valuation

Very Bullish

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.