- United States

- /

- Electrical

- /

- NasdaqGS:AMSC

Why American Superconductor (AMSC) Is Up After Analyst Endorsements and Earnings Beat Despite Insider Sales

Reviewed by Sasha Jovanovic

- At the 14th Annual ROTH Technology Conference in New York, American Superconductor Corporation's CEO Daniel Patrick McGahn and Director of Communications Nicol Golez presented updates following the company's latest earnings announcement.

- An important takeaway was the boost in investor confidence driven by both an earnings beat and multiple positive analyst upgrades, even amid recent insider selling activity.

- We'll explore how the strong analyst endorsement after earnings could shape American Superconductor's investment outlook moving forward.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

American Superconductor Investment Narrative Recap

Owning shares of American Superconductor means believing in sustained demand for grid resiliency and materials solutions, underpinned by accelerating semiconductor and infrastructure investments. While recent earnings and analyst upgrades signal constructive short-term momentum, these events have not materially changed the central catalyst: the need for ongoing strong order flow from cyclical end-markets. Risks remain concentrated in order volatility and margin compression if demand from key sectors falters.

Among the company’s recent announcements, the multi-year $75 million defense contract stands out as potentially insulating against short-term cyclicality in semiconductor and energy-linked orders. This contract may offer some revenue stability and is relevant when considering how future catalysts could be influenced by changes in market demand.

Yet, in contrast to upbeat analyst sentiment, investors should remain attentive to the risk that order timing from large customers could create pronounced swings in future revenue and margin, especially as...

Read the full narrative on American Superconductor (it's free!)

American Superconductor's narrative projects $361.8 million revenue and $43.2 million earnings by 2028. This requires 12.4% yearly revenue growth and a $27.9 million earnings increase from $15.3 million today.

Uncover how American Superconductor's forecasts yield a $63.00 fair value, a 107% upside to its current price.

Exploring Other Perspectives

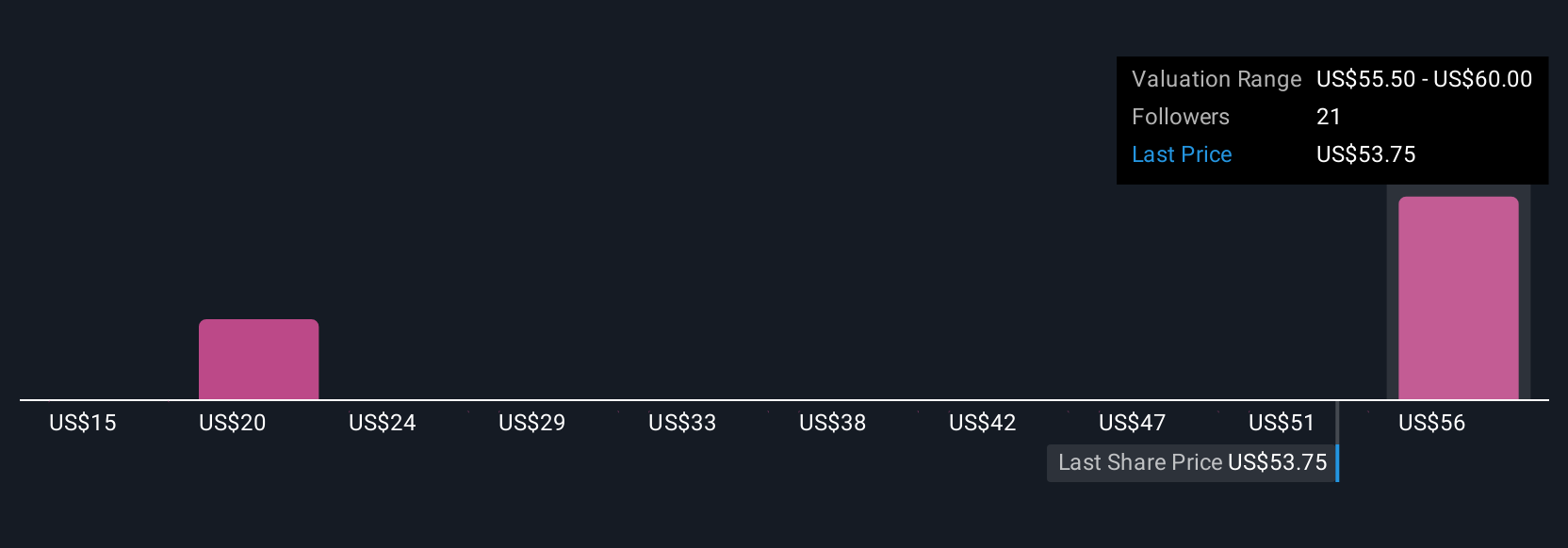

Simply Wall St Community members valued American Superconductor between US$43.74 and US$63, reflecting three distinct forecasts. This range stands in contrast to current market optimism fueled by strong analyst price targets and earnings beats, reminding you to consider different outlooks before making decisions.

Explore 3 other fair value estimates on American Superconductor - why the stock might be worth just $43.74!

Build Your Own American Superconductor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your American Superconductor research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free American Superconductor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate American Superconductor's overall financial health at a glance.

No Opportunity In American Superconductor?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMSC

American Superconductor

Provides megawatt-scale power resiliency solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives