- United States

- /

- Electrical

- /

- NasdaqGS:AMSC

Assessing American Superconductor’s (AMSC) Valuation After Analyst Upgrades and Strong Earnings Surprise

Reviewed by Simply Wall St

American Superconductor (AMSC) caught investors’ attention after a wave of analyst upgrades. These were sparked by earnings that surpassed consensus EPS expectations by over 33%. The upbeat recommendations have pushed sentiment higher and fueled a 3% move in the stock.

See our latest analysis for American Superconductor.

Even with the flurry of analyst upgrades and a recent presentation at the ROTH Technology Conference, American Superconductor’s share price has seen pronounced swings, soaring earlier this year and then giving back ground in recent weeks. Momentum has cooled off lately, but despite a sharp 49% one-month share price drop, the stock is still up 19% for the year-to-date, and its three-year total shareholder return stands at a staggering 618%.

If this kind of dramatic turnaround has you curious about broader opportunities, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still up impressively over three years yet down sharply in recent weeks, the debate is now whether American Superconductor remains undervalued with more upside ahead, or if the market has already priced in its promising growth story.

Most Popular Narrative: 51.8% Undervalued

The most widely followed narrative suggests American Superconductor could be worth far more than its last close, despite recent volatility in the share price. Enthusiasm for future growth and margin expansion sets the stage for some bold expectations from analysts.

Ongoing development and successful deployment of proprietary, higher-margin grid and materials technologies, including integration of recent acquisitions, are increasing content per project and supporting gross margin expansion and scalable earnings. High factory utilization and capacity expansion plans, combined with operational leverage from past and potential acquisitions, are driving improved efficiency and margin profile. There is potential for further net income growth as scale increases.

Curious about the specific projections fueling this target? The math behind the narrative relies on a striking ramp in earnings, aggressive revenue growth, and higher profit margins. Discover the bold forecasts and see which numbers drive this upsize potential.

Result: Fair Value of $63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should note that one-off order timing and reliance on cyclical end markets could lead to revenue volatility and weaker margins in the future.

Find out about the key risks to this American Superconductor narrative.

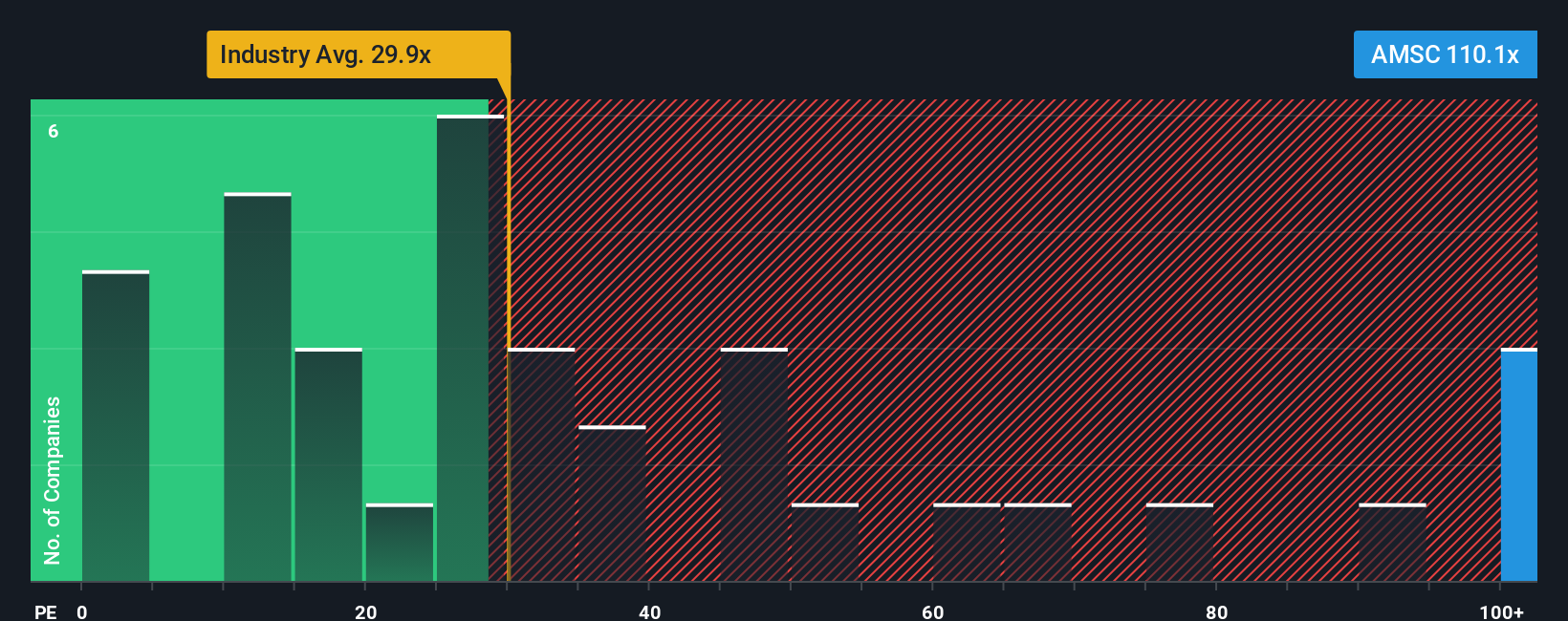

Another View: Price-to-Earnings Signals Caution

While analyst forecasts and discounted cash flow suggest upside for American Superconductor, its current price-to-earnings ratio stands at 90.6x, which is significantly higher than both industry peers (30.6x) and its own fair ratio estimate of 61x. This premium valuation suggests investors are paying a lot for expected growth, raising questions about whether the shares truly offer value or risk being overpriced if momentum fades. Could the market’s optimism outpace what the business delivers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Superconductor Narrative

If you think there’s another angle or want to dig deeper into the data yourself, you can craft your own narrative in just a few minutes, Do it your way

A great starting point for your American Superconductor research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t limit yourself to just one opportunity. Jump on the latest market themes and keep your portfolio fresh with new possibilities every week using the Simply Wall Street Screener.

- Capture strong yields and steady income by checking out these 16 dividend stocks with yields > 3% with proven 3% returns or more.

- Boost your growth prospects by scouting these 26 AI penny stocks leading breakthroughs in artificial intelligence, automation, and the future of tech.

- Ride the next financial revolution by jumping into these 81 cryptocurrency and blockchain stocks that leverage blockchain to transform payments, security, and business models.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMSC

American Superconductor

Provides megawatt-scale power resiliency solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives