- United States

- /

- Electrical

- /

- NasdaqGS:AMSC

American Superconductor (AMSC): Exploring Current Valuation After Recent Share Price Move

Reviewed by Simply Wall St

American Superconductor (AMSC) has caught some investor attention recently as its stock climbed 6% in the past day, even though it experienced a month of mild losses. This movement invites a closer look at what might be driving sentiment around the company now.

See our latest analysis for American Superconductor.

Momentum has clearly built for American Superconductor over the past year, with a share price that has more than doubled year-to-date and a stellar one-year total shareholder return of 107.62%. While recent weeks saw some turbulence, the bigger picture shows sustained growth enthusiasm, likely fueled by evolving growth expectations and shifting risk perceptions after a lengthy multi-year rally.

If you’re curious about where else this kind of momentum could surface, now’s a perfect time to broaden your horizons and check out fast growing stocks with high insider ownership

With shares on a remarkable run and recent volatility prompting fresh debate, the question is whether American Superconductor remains attractively priced for new investors or if market optimism has already accounted for the next leg of growth.

Most Popular Narrative: 10.9% Undervalued

Compared to the latest closing price, the most widely followed narrative suggests American Superconductor still trades below its estimated fair value. This reflects analyst optimism about future fundamentals. Here is a glimpse into the thesis powering this premium.

Elevated policy-driven focus on grid reliability and modernization, including increased government and utility spending on infrastructure and grid resilience, is likely to create a tailwind for grid solutions. This expansion of AMSC's addressable market and backlog could ultimately support recurring revenues and potentially higher net margins.

Ever wondered what financial assumptions could justify such a confident upside call? Analysts are betting on a rare combination of expanding sales, accelerating earnings, and improving profitability that rivals even the hottest growth stories. Curious what projections support these bullish expectations? The answer might surprise you.

Result: Fair Value of $66.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing dependence on cyclical semiconductor demand and elevated costs could dampen profitability if growth or market conditions suddenly reverse.

Find out about the key risks to this American Superconductor narrative.

Another View: The Multiples Perspective

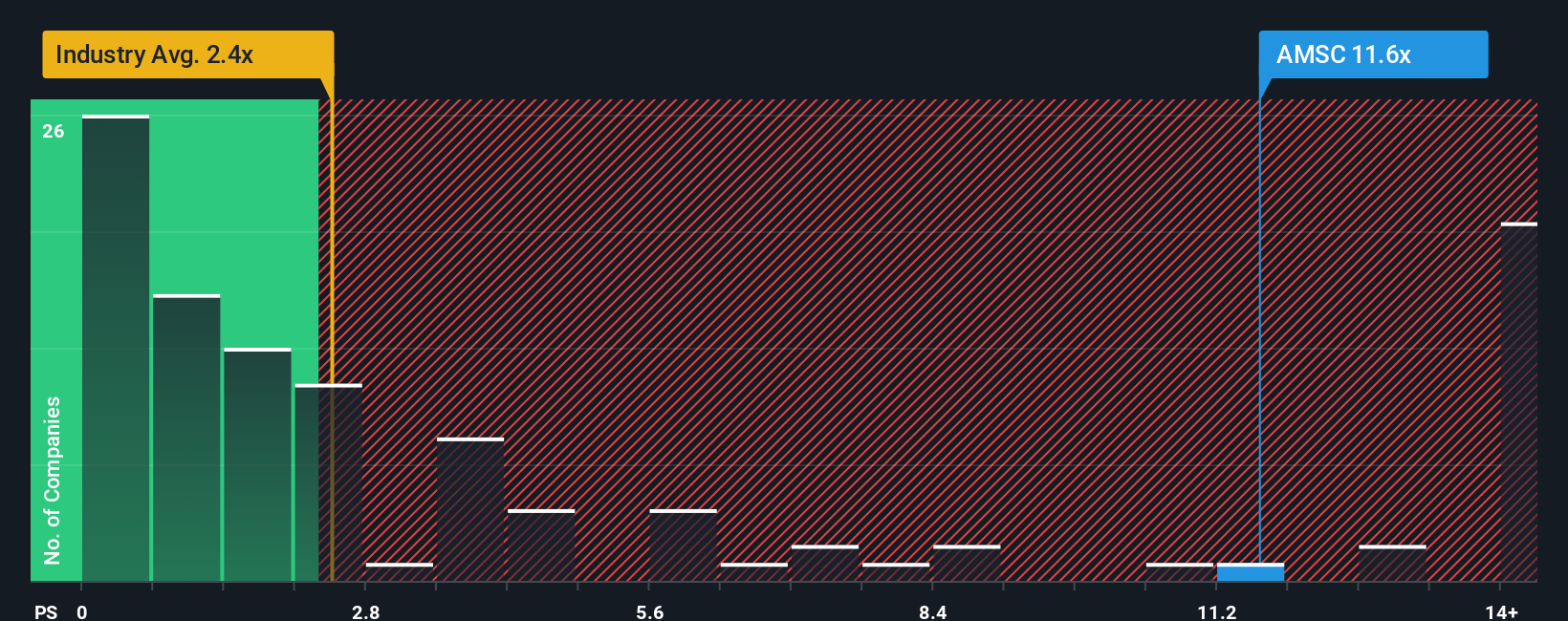

For those leaning on price-to-sales ratios, American Superconductor looks much more expensive than its industry peers and even above what the market's fair ratio could justify. At 10.5x sales, versus the industry’s 2.2x and a fair level at 2.3x, it raises questions about valuation risk. Could this premium really hold up if sentiment shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own American Superconductor Narrative

If you feel another perspective has been missed or want to run the numbers yourself, you can build a personalized outlook in just a few minutes, with Do it your way.

A great starting point for your American Superconductor research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next great opportunity slip by. Supercharge your investing approach, try new strategies, and spot trends before others catch on by exploring these hand-picked ideas:

- Spot undervalued gems and secure potential bargains early with these 849 undervalued stocks based on cash flows.

- Capitalize on rising demand in cutting-edge medicine by checking out these 33 healthcare AI stocks.

- Pursue regular income streams and robust yields with these 20 dividend stocks with yields > 3% to see which stocks stand out for dividend potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AMSC

American Superconductor

Provides megawatt-scale power resiliency solutions worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives