- United States

- /

- Building

- /

- NasdaqGS:AAON

AAON (AAON): Reassessing Valuation Following Market Shift After Strong Jobs Report

Reviewed by Simply Wall St

AAON (AAON) shares dipped this week after investors responded to a surprisingly strong jobs report. The report signaled that interest rate cuts may be delayed, prompting a rotation out of growth stocks like AAON.

See our latest analysis for AAON.

Despite some encouraging company milestones, including a fresh quarterly dividend declaration and ongoing innovations in thermal management, the broader market’s focus on macro risks has taken center stage for AAON. The stock’s 1-year total shareholder return stands at -33.13%, giving up some of the momentum built over the past few years. Its 3- and 5-year total returns of 76.88% and 113.31% highlight robust long-term compounding for steadfast holders. With a 6.44% share price return over the last 90 days, recent volatility suggests investors are recalibrating expectations as growth stocks fall out of favor. AAON’s strategic positioning may yet set the stage for renewed interest.

If you’re curious what else is catching the market’s attention beyond the usual favorites, this week is an ideal time to broaden your horizons and discover fast growing stocks with high insider ownership

With shares pulling back despite solid fundamentals and analyst optimism, investors are left to consider: is AAON now undervalued on near-term fears, or is the market wisely factoring in all the growth ahead already?

Most Popular Narrative: 20.6% Undervalued

AAON’s latest narrative points to a fair value of $115.25, a notable premium to its recent close at $91.52. This gap has investors weighing how future operational milestones could support further upside.

Ongoing investments in new manufacturing capacity and automation (for example, the Memphis facility) are expected to nearly double BasX capacity by year-end, removing current operational constraints and shifting from near-term cost drag to profit contribution by 2026 as orders ramp, supporting long-term operating leverage.

Want to know what ambitious projections justify that higher price target? The narrative hints at a financial transformation driven by surging demand, margin expansion, and a future profit benchmark more commonly seen in high-growth tech firms. Which underlying assumptions propel this optimistic fair value? Find out the numbers and catalysts fueling these bold forecasts.

Result: Fair Value of $115.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing operational disruptions and heavy capital spending could delay margin recovery. This may prompt investors to watch for setbacks that might challenge the current growth outlook.

Find out about the key risks to this AAON narrative.

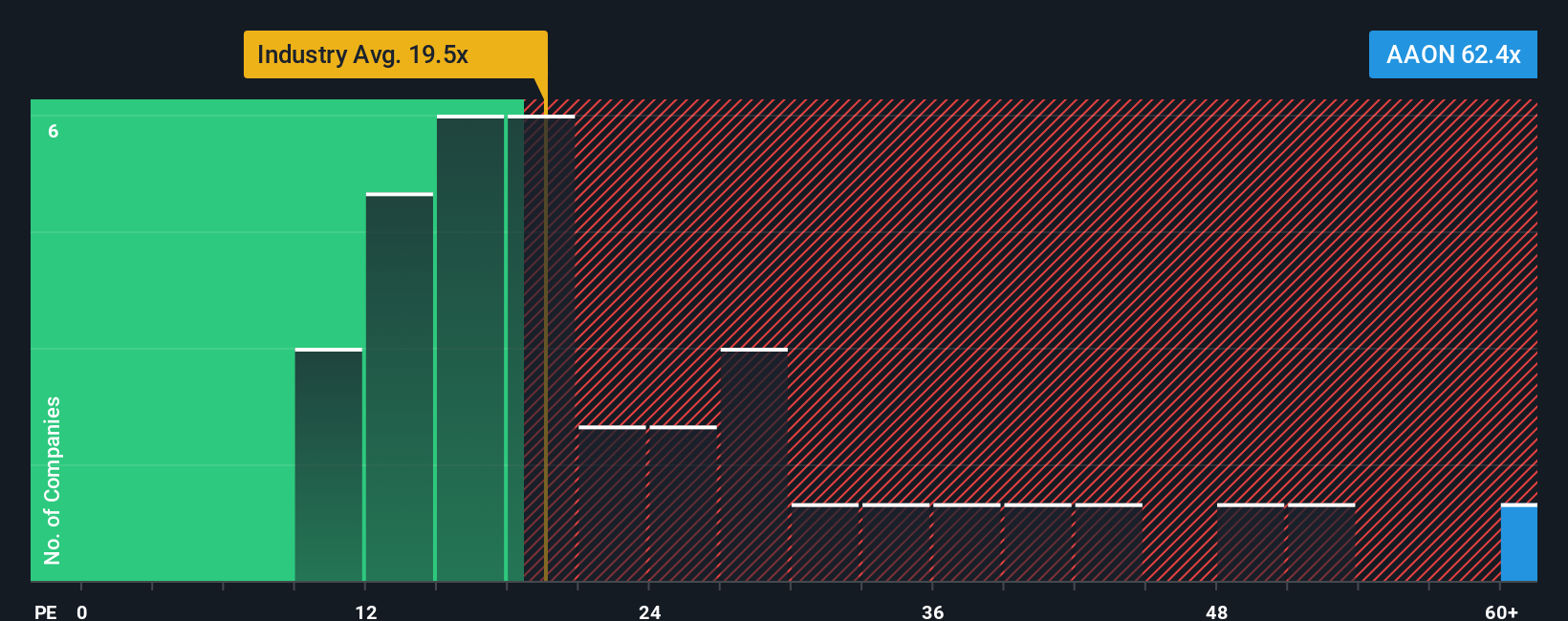

Another View: High Multiple Raises Questions

Looking at AAON from a different angle, its price-to-earnings ratio stands at 74.4x. This is far above the peer average of 26.1x, the industry average of 16.7x, and the fair ratio of 49.3x. This wide gap shows investors are paying a premium and signals greater valuation risk if future growth falls short. Will the company prove it deserves this lofty outlook?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AAON Narrative

If you want a different perspective or prefer hands-on analysis, take a few minutes to dive into the data and craft your own view. Do it your way

A great starting point for your AAON research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay ahead by researching fresh opportunities before they hit the spotlight. You could be first to spot a breakout trend, so don’t miss out.

- Unlock reliable income streams as you browse these 17 dividend stocks with yields > 3%, offering consistent yields above 3% for your portfolio.

- Get a jump on emerging tech by evaluating these 25 AI penny stocks, which stand at the forefront of artificial intelligence innovation and growth potential.

- Seize the chance to uncover real value in these 917 undervalued stocks based on cash flows, trading below their intrinsic cash flow estimates right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAON

AAON

Engages in engineering, manufacturing, marketing, and selling air conditioning and heating equipment in the United States and Canada.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives