- United States

- /

- Building

- /

- NasdaqGS:AAON

AAON (AAON): Assessing Valuation Following Recent Share Price Pullback

Reviewed by Simply Wall St

See our latest analysis for AAON.

AAON’s recent pullback comes after a string of strong longer-term gains. The share price has returned over 15% in the past 90 days alone, even though its 1-year total shareholder return sits at -14.4%. Momentum appears to be cooling a bit after stellar multi-year performance, but the growth story remains in focus as investors reassess valuation and future prospects.

If you’re looking to spot more emerging names or trends, now’s a good time to broaden your horizons and discover fast growing stocks with high insider ownership

This raises the question: with shares pulling back but still well above last year’s lows, is AAON undervalued at current levels, or is the market already factoring in the company’s projected growth and future prospects?

Most Popular Narrative: 7.1% Undervalued

AAON’s widely watched fair value estimate sits at $103.25, notably above the last close of $95.90. This suggests modest upside remains. The valuation factors in ambitious operating leverage and technological tailwinds, creating room for debate among investors.

Ongoing investments in new manufacturing capacity and automation (for example, the Memphis facility) are expected to nearly double BasX capacity by year-end. This would remove current operational constraints and shift from near-term cost drag to profit contribution by 2026 as orders ramp up, supporting long-term operating leverage.

Curious what earnings leap and margin expansion assumptions drive this premium? The narrative rests on bullish forecasts and industry-shaking financial projections. See which numbers could reset the market’s expectations and make or break AAON’s future.

Result: Fair Value of $103.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering operational disruptions or a slowdown in data center demand could quickly undermine AAON's expected growth and margin recovery narrative.

Find out about the key risks to this AAON narrative.

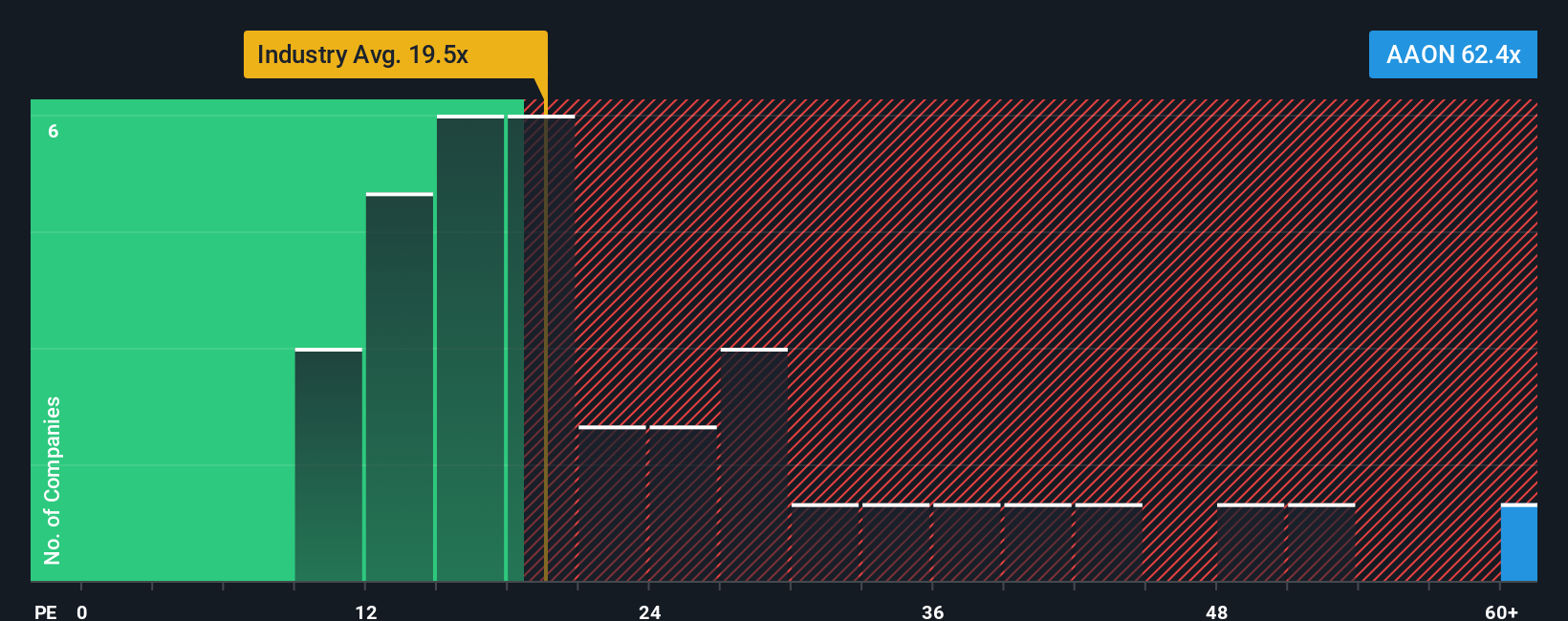

Another View: Industry Multiples Suggest Overvaluation

Yet, a look at AAON’s price-to-earnings ratio tells a different story. At 64x, it far exceeds the US Building industry average of 21.2x, its peer average of 26.9x, and even the estimated fair ratio of 45.8x. This wide gap suggests investors might be paying a substantial premium today. Could this premium be justified, or are expectations running too far ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AAON Narrative

If you see opportunity that others are missing, or want to chart your own course through the numbers, it’s quick and easy to build a personalized AAON story in just a few minutes. Do it your way

A great starting point for your AAON research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t sit on the sidelines when the next opportunity could be one click away. Use the Simply Wall Street Screener today and upgrade your strategy in minutes.

- Unlock hidden value by scanning through these 843 undervalued stocks based on cash flows for top picks trading below their intrinsic worth. This gives you a smarter edge with every investment.

- Build steady returns and protect your income with these 18 dividend stocks with yields > 3%, which highlights stocks paying yields over 3% to strengthen your portfolio’s cash flow.

- Step into tomorrow’s innovation and explore the AI revolution with these 26 AI penny stocks, featuring companies advancing artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AAON

AAON

Engages in engineering, manufacturing, marketing, and selling air conditioning and heating equipment in the United States and Canada.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives