- United States

- /

- Banks

- /

- OTCPK:TYFG

Tri-County Financial Group (TYFG) Net Margin Improves, Supporting Value-Income Narrative Despite Flat Growth Outlook

Reviewed by Simply Wall St

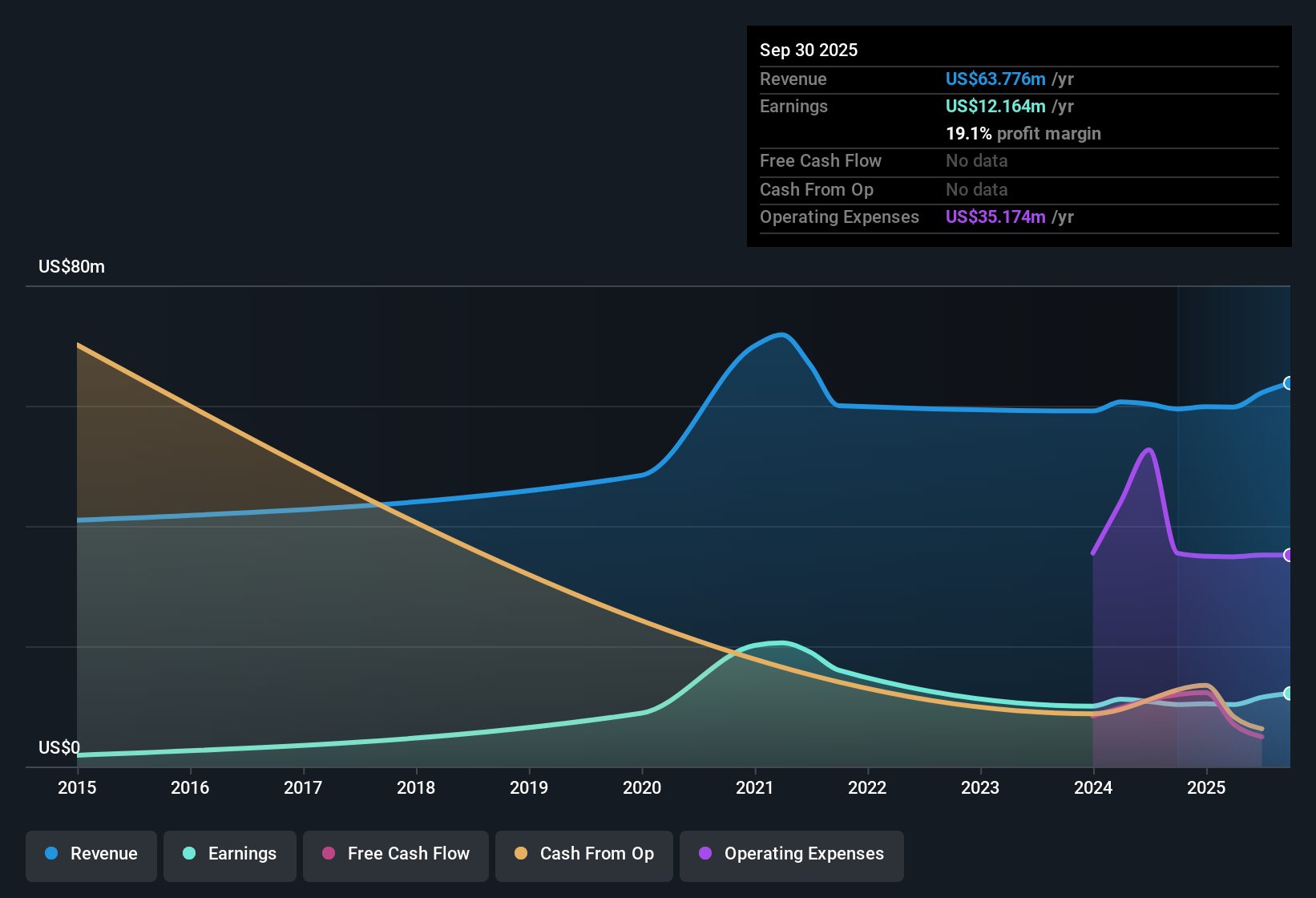

Tri-County Financial Group (TYFG) posted net profit margins of 18.5%, up from last year’s 17.9%. Earnings grew by 6.5% after several years of decline, and the Price-to-Earnings Ratio sits at 9.8x, which is well below the peer and US Banks industry averages. Management is credited with delivering high quality earnings, making the company’s attractive dividend and value-focused multiples especially notable for investors, despite recent share price volatility and muted growth forecasts.

See our full analysis for Tri-County Financial Group.The next section takes these headline numbers and compares them directly to the main narratives driving sentiment. This shows where investor views could be confirmed or upended.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Signal Resilient Profitability

- Net profit margin rose to 18.5% from 17.9% the prior year, bucking the five-year average of negative 17% annual earnings growth and demonstrating stronger performance than many regional peers.

- Improved profitability heavily supports the case that TYFG's high-quality earnings and conservative management approach can deliver stability even in a tough sector.

- The narrative points to dependable income for investors, as this margin expansion comes at a time when broader sector growth is muted.

- While mainstream outlooks are modest, management’s ability to turn around multi-year decline is cited as a key factor by market observers focused on yield and risk control.

Dividend Stands Out as Valuation Lifts

- The Price-to-Earnings Ratio is 9.8x, a substantial discount to the peer average of 15.8x and the broader US Banks sector at 11x. This makes the stock look notably undervalued based on multiples alone.

- The market’s prevailing logic argues TYFG appeals to value and income investors who prize attractive dividends and low entry prices more than rapid growth.

- Analysts highlight that the combination of discounted valuation and a stable, appealing dividend could help insulate investors from near-term volatility.

- Despite industry challenges, many see this value pricing and payout as a solid anchor for buyers with long-term horizons.

Muted Growth Outlook Tempers Enthusiasm

- Despite the recent turnaround in bottom-line performance, TYFG’s revenue and earnings are not forecast to grow, and the share price has shown volatility over the past three months.

- Skeptics emphasize that regardless of quality metrics, stalled top-line outlook keeps sentiment from turning decisively bullish.

- The lack of forecasted growth is a crucial factor for investors seeking upside or momentum, especially as the sector faces ongoing headwinds.

- Market commentators caution that investors may prefer to “hold for income” rather than expect strong capital gains in the near term.

Consensus analysis notes that while the stock’s margin and valuation strengths are compelling, flat growth expectations and recent price swings mean most investors see TYFG as a classic income play rather than a breakout story.

📊 Read the full Tri-County Financial Group Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Tri-County Financial Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

TYFG’s lack of growth forecasts and recent share price volatility limit excitement for those seeking consistent long-term expansion and reliability.

If you want steady financial results and fewer ups and downs, check out stable growth stocks screener (2110 results) to focus on companies delivering dependable growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tri-County Financial Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:TYFG

Tri-County Financial Group

Operates as a bank holding company for First State Bank, providing various banking and mortgage banking services and insurance services to individuals and businesses in the United States.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives