- United States

- /

- Banks

- /

- OTCPK:SOMC

Southern Michigan Bancorp (SOMC) Profit Margin Rises, Reinforcing Bullish Value Narratives

Reviewed by Simply Wall St

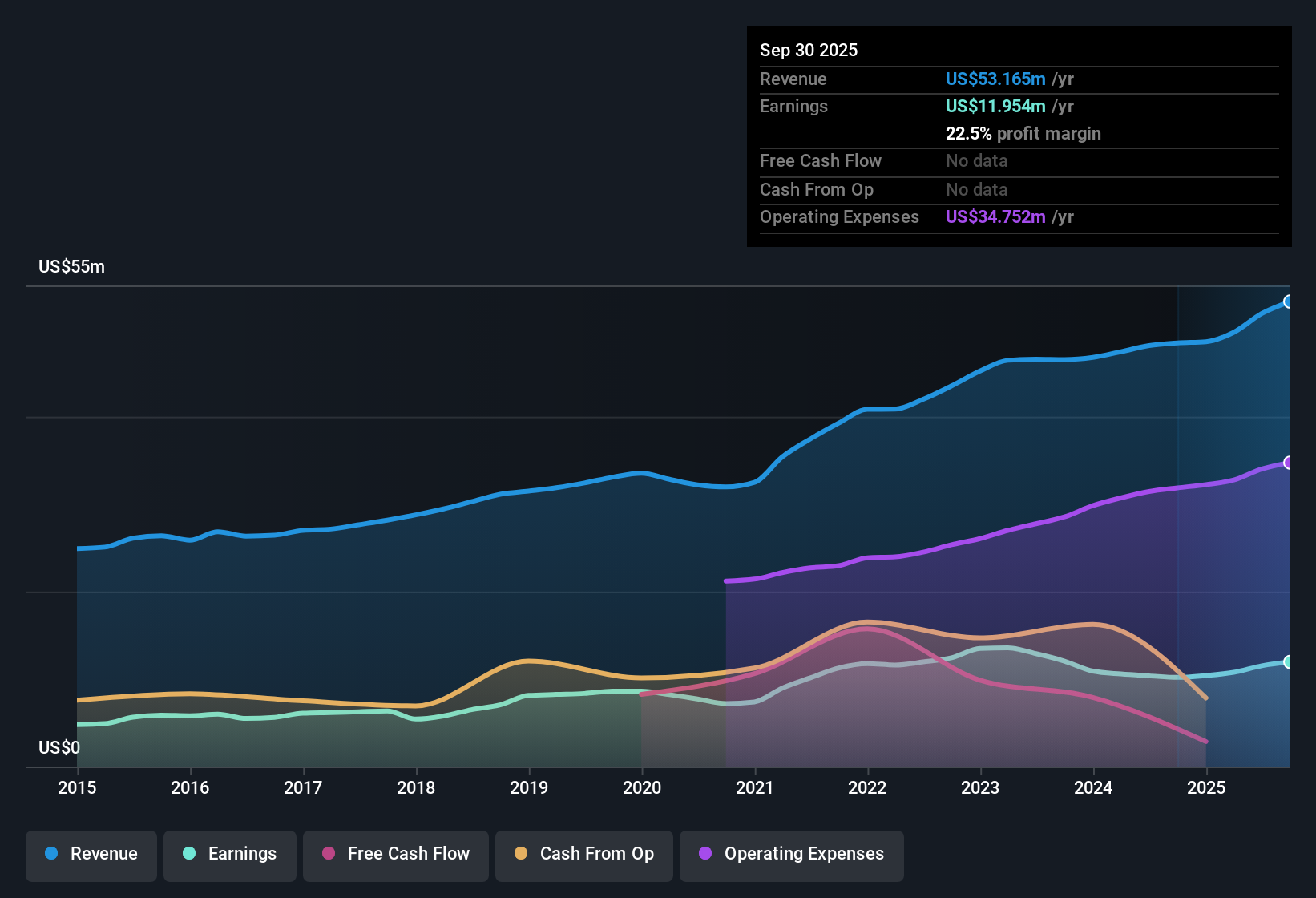

Southern Michigan Bancorp (SOMC) posted a net profit margin of 22.2%, up from 21.5% previously, which highlights a clear improvement in profitability. EPS grew steadily, with a year-over-year earnings growth rate of 11.1% that outpaces the company’s 5-year average growth of 3.8%. Earnings have compounded at 3.8% per year over the past five years. With the stock trading at $24.50, a discount to its estimated fair value and well below the industry’s average price-to-earnings ratio, SOMC’s results reflect high quality earnings amid some recent share price volatility.

See our full analysis for Southern Michigan Bancorp.Next, we will see how these headline results measure up against what the broader market is saying, comparing the numbers to narrative trends tracked by our community and analysts.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Climbs to 22.2%

- Net profit margin improved to 22.2%, up from 21.5% previously, indicating increasing profitability compared to industry peers and confirming a positive underlying operational trend.

- Improved margin strongly supports the case that Southern Michigan Bancorp is maintaining disciplined expense control, even as many sector peers struggle to defend profits in a challenging macro environment.

- The margin performance highlights one of the key positive narrative points: stable earnings resilience is perceived as a sign of quality and makes SOMC stand out as a strong option among regional banks.

- Notably, despite broader sector concerns, there is no mention of deteriorating asset quality or loan book risks, which reinforces the view that SOMC’s local focus is helping sustain these robust margins.

Share Price Volatility a Caution Flag

- The primary recorded risk is share price instability over the last three months, which contrasts with the company’s generally steady profit margins and earnings growth.

- This volatility raises concerns often discussed in bearish circles, where some argue that market confidence could be uncertain unless earnings growth soon translates into price stability.

- Since the fundamentals remain strong, there is a narrative tension around whether investor sentiment will turn if share price swings do not subside soon.

- This risk relates more to short-term market perception than to a change in operational health, but it remains a point of consistent bear-side attention.

Valuation Stands Out Versus Peers

- With a price-to-earnings ratio of 9.8x, lower than both the peer average of 12.4x and the industry average of 11x, and a current share price of $24.50 compared to a DCF fair value of $35.09, SOMC's stock is trading at a visible discount relative to fundamental benchmarks.

- The prevailing market view highlights how this discount heavily favors potential value investors and supports further upside if the company continues to deliver steady profitability and attractive dividends.

- Peer banks are not offering the same combination of below-average valuation and clear profit margin improvement, which sets SOMC apart for those looking for undervalued regional bank opportunities.

- Whether this gap to fair value will close depends on continued operational discipline, especially if volatility moderates and market sentiment improves.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Southern Michigan Bancorp's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite SOMC’s steady profit margins and attractive valuation, short-term share price swings have raised concerns about its consistency and market confidence.

If you value predictability and want companies that deliver stable results in all conditions, check out stable growth stocks screener (2112 results) and discover investments built for lasting consistency.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:SOMC

Southern Michigan Bancorp

Operates as the bank holding company for Southern Michigan Bank & Trust that provides a range of commercial banking services to individuals, businesses, institutions, and governmental agencies primarily in the southwest and south-central Michigan communities.

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives