- United States

- /

- Banks

- /

- NYSE:WFC

Will Wells Fargo’s (WFC) Prime Rate Cut and Expansion Efforts Shift Its Growth Narrative?

Reviewed by Sasha Jovanovic

- Wells Fargo recently reduced its prime rate from 7.25% to 7% in response to evolving financial conditions, while also announcing several new fixed-income offerings, completing capital raises, affirming its quarterly dividend, and opening a state-of-the-art campus in Las Colinas, Texas.

- These moves highlight the company’s multifaceted approach to adapting to economic trends and underscore an ongoing commitment to both operational growth and innovation in sustainability.

- We’ll explore how Wells Fargo’s prime rate reduction may influence the company’s growth narrative and positioning within the banking sector.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Wells Fargo Investment Narrative Recap

For investors considering Wells Fargo, the core belief centers on the bank’s ability to capitalize on a post-asset cap era, leveraging growth in digital banking and wealth management while managing costs and compliance. The recent reduction in the prime rate to 7% aligns with industry trends but is unlikely to materially change the most important near-term catalyst: margin improvement driven by loan growth and net interest income, nor does it substantially alter ongoing regulatory risks.

Among the latest announcements, the grand opening of Wells Fargo's Las Colinas campus stands out as a signal of long-term investment in operational scale and sustainability initiatives. While not an immediate driver of financial results, large-scale expansions like this can support both talent retention and the modernization needed to back future efficiency improvements, key considerations for sustaining net margin gains going forward.

However, investors should be aware that despite progress, persistent regulatory and compliance requirements remain a potential drag that could limit how quickly Wells Fargo can...

Read the full narrative on Wells Fargo (it's free!)

Wells Fargo's narrative projects $90.6 billion revenue and $22.1 billion earnings by 2028. This requires 5.3% yearly revenue growth and a $2.6 billion earnings increase from $19.5 billion.

Uncover how Wells Fargo's forecasts yield a $93.12 fair value, a 7% upside to its current price.

Exploring Other Perspectives

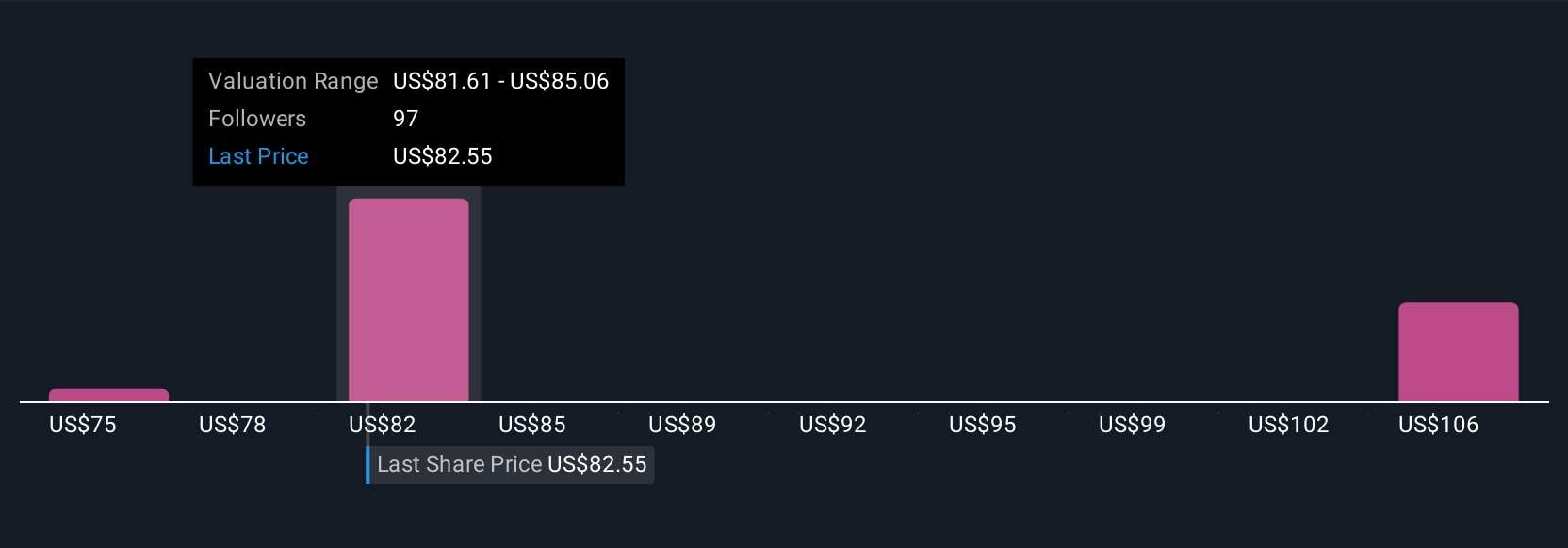

Five fair value estimates from the Simply Wall St Community range from US$74.70 to US$106.42 per share. Despite broad optimism about digital banking and operational growth, your perspective may differ, explore how these views stack up against your own expectations.

Explore 5 other fair value estimates on Wells Fargo - why the stock might be worth 14% less than the current price!

Build Your Own Wells Fargo Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Wells Fargo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Wells Fargo research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Wells Fargo's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wells Fargo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WFC

Wells Fargo

A financial services company, provides diversified banking, investment, mortgage, and consumer and commercial finance products and services in the United States and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives