- United States

- /

- Banks

- /

- NYSE:NTB

Earnings Beat and Buybacks Might Change the Case For Investing In Bank of N.T. Butterfield & Son (NTB)

Reviewed by Sasha Jovanovic

- In late October 2025, Bank of N.T. Butterfield & Son Limited reported improved third quarter financial results, declared a US$0.50 per share quarterly dividend, and completed multiple share repurchase tranches totaling nearly US$30.3 million.

- Together, these actions reflect management's ongoing commitment to shareholder returns and highlight confidence in the bank's operational performance and capital position.

- We'll explore how the combination of rising earnings and steady buybacks shapes the company's investment outlook going forward.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Bank of N.T. Butterfield & Son Investment Narrative Recap

For shareholders, the core belief rests on Butterfield’s ability to provide stable income through disciplined capital returns and prudent risk management, despite international uncertainties affecting island economies and banking. The recent round of strong earnings, sustained dividend payouts, and continued buybacks reinforce the company's financial strength, though these updates do not materially lessen the primary near-term risk: the possibility of material deposit outflows related to large, non-core funds and volatile client balances.

Among the latest updates, the announcement of increased buyback activity, totaling US$30.3 million this quarter, stands out as most relevant, as it signals management’s continued focus on supporting per-share metrics and capital efficiency. While these repurchases are encouraging for holders, they do not directly change exposure to transient deposits, which remains a key concern when considering any earnings-driven catalyst.

On the other hand, investors should look closely at Butterfield’s concentration of potentially non-sticky deposits, as this is information that...

Read the full narrative on Bank of N.T. Butterfield & Son (it's free!)

Bank of N.T. Butterfield & Son is projected to reach $594.7 million in revenue and $194.4 million in earnings by 2028. This outlook assumes a 0.3% annual decline in revenue and a decrease in earnings of $25 million from the current $219.4 million.

Uncover how Bank of N.T. Butterfield & Son's forecasts yield a $51.50 fair value, a 13% upside to its current price.

Exploring Other Perspectives

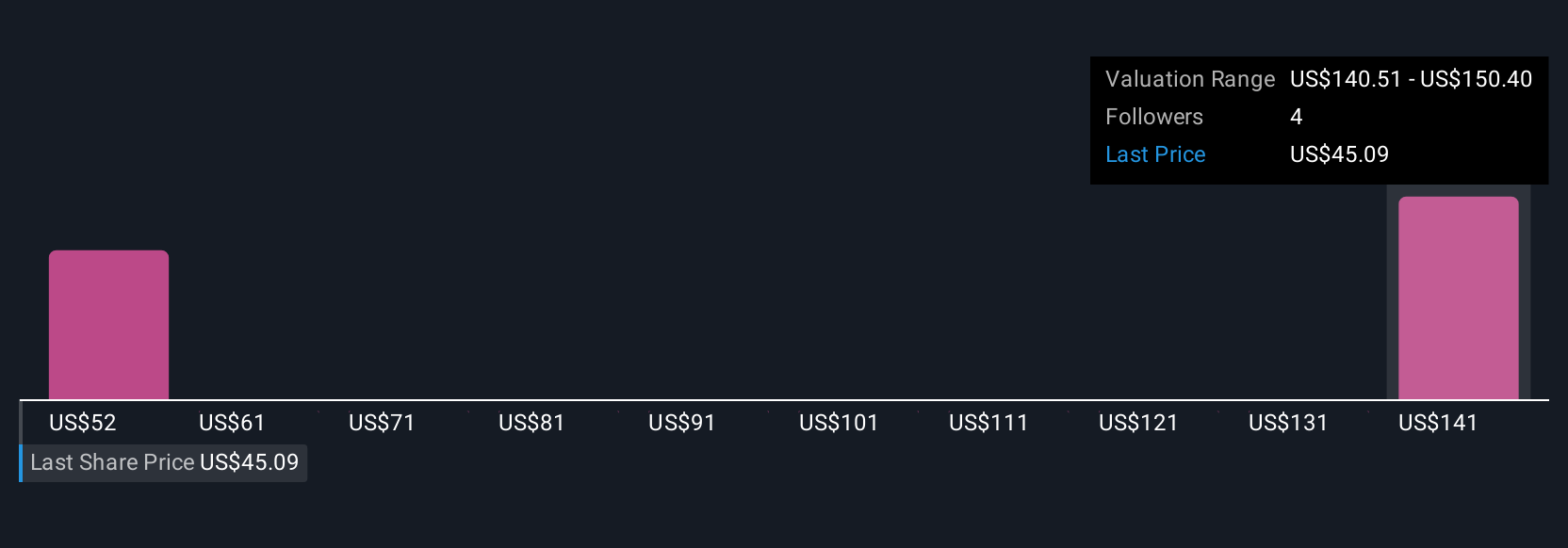

Three fair value estimates from the Simply Wall St Community span US$51.50 to US$156.34, with the lowest bucket not far from current market prices. Given Butterfield’s exposure to sizable, potentially unstable deposit balances, you can see how opinions diverge widely and why it’s important to compare multiple viewpoints.

Explore 3 other fair value estimates on Bank of N.T. Butterfield & Son - why the stock might be worth just $51.50!

Build Your Own Bank of N.T. Butterfield & Son Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bank of N.T. Butterfield & Son research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bank of N.T. Butterfield & Son research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bank of N.T. Butterfield & Son's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of N.T. Butterfield & Son might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NTB

Bank of N.T. Butterfield & Son

Provides a range of community, commercial, and private banking services to individuals and small to medium-sized businesses.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives